Valid Lady Bird Deed Form for Florida

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This deed offers several advantages, including the ability to avoid probate, maintain eligibility for Medicaid, and ensure a smooth transition of property upon the owner’s death. By using this form, property owners can specify that they retain the right to live in and manage the property for as long as they wish, which provides peace of mind and flexibility. Additionally, the Lady Bird Deed automatically grants full ownership to the designated beneficiaries without the need for court intervention, simplifying the transfer process. This deed is particularly useful for individuals looking to pass on their property to family members while minimizing tax implications and administrative burdens. Understanding the key features and benefits of the Florida Lady Bird Deed is essential for anyone considering this estate planning option.

Common mistakes

-

Incorrect Property Description: Many individuals fail to accurately describe the property being transferred. This can lead to confusion or disputes later on. It’s essential to provide a clear and precise legal description of the property.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document. Ensure that everyone involved has signed before submitting the form.

-

Not Notarizing the Document: A Lady Bird Deed must be notarized to be legally valid. Skipping this step can cause issues when trying to enforce the deed.

-

Failing to Include a Remainder Beneficiary: Some people forget to name a beneficiary who will inherit the property after the original owner’s passing. This oversight can complicate matters for heirs.

-

Inaccurate or Missing Dates: Dates play a crucial role in legal documents. Not including the date of execution or providing incorrect dates can lead to problems in the future.

-

Not Understanding the Implications: Some individuals do not fully grasp the implications of a Lady Bird Deed. It’s important to understand how it affects property rights and tax obligations.

-

Improper Filing: Once completed, the deed must be filed with the appropriate county clerk’s office. Failing to file it properly can result in the deed being unenforceable.

Example - Florida Lady Bird Deed Form

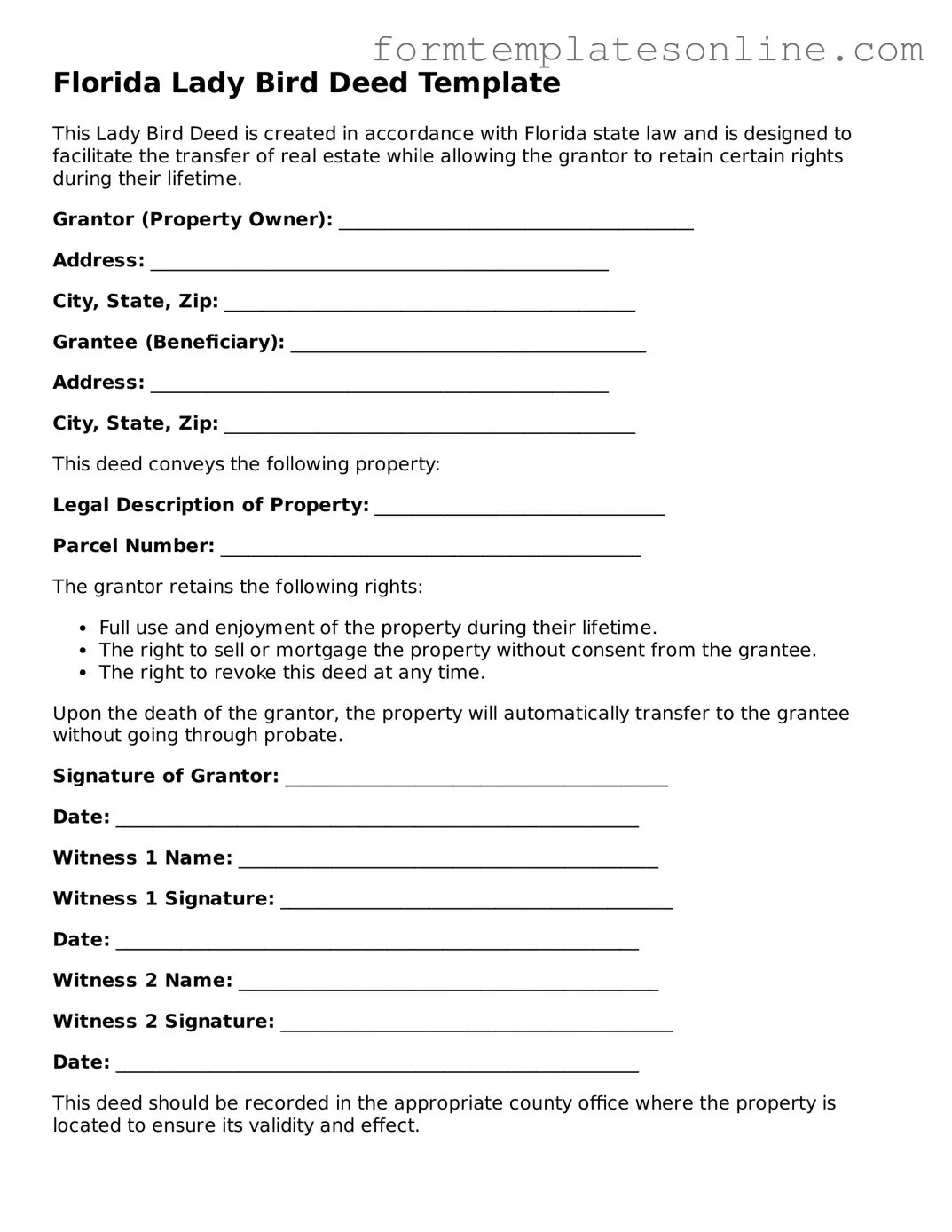

Florida Lady Bird Deed Template

This Lady Bird Deed is created in accordance with Florida state law and is designed to facilitate the transfer of real estate while allowing the grantor to retain certain rights during their lifetime.

Grantor (Property Owner): ______________________________________

Address: _________________________________________________

City, State, Zip: ____________________________________________

Grantee (Beneficiary): ______________________________________

Address: _________________________________________________

City, State, Zip: ____________________________________________

This deed conveys the following property:

Legal Description of Property: _______________________________

Parcel Number: _____________________________________________

The grantor retains the following rights:

- Full use and enjoyment of the property during their lifetime.

- The right to sell or mortgage the property without consent from the grantee.

- The right to revoke this deed at any time.

Upon the death of the grantor, the property will automatically transfer to the grantee without going through probate.

Signature of Grantor: _________________________________________

Date: ________________________________________________________

Witness 1 Name: _____________________________________________

Witness 1 Signature: __________________________________________

Date: ________________________________________________________

Witness 2 Name: _____________________________________________

Witness 2 Signature: __________________________________________

Date: ________________________________________________________

This deed should be recorded in the appropriate county office where the property is located to ensure its validity and effect.

For assistance, please consult a legal professional to confirm that this document meets your specific needs.

More About Florida Lady Bird Deed

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed is a legal document that allows property owners to transfer their property to their beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed is also known as an enhanced life estate deed. It helps avoid probate and can provide tax benefits for the beneficiaries.

What are the benefits of using a Lady Bird Deed?

One of the primary benefits of a Lady Bird Deed is that it allows the property owner to maintain control over the property during their lifetime. The owner can sell, mortgage, or change the beneficiaries without needing consent from them. Additionally, the property typically passes to the beneficiaries outside of probate, which can save time and costs associated with the probate process.

Who can use a Lady Bird Deed?

Any property owner in Florida can use a Lady Bird Deed to transfer their property. It is particularly beneficial for individuals who wish to pass on their home or real estate to family members while retaining the right to live in the property until their death.

How does a Lady Bird Deed affect Medicaid eligibility?

A Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility. Since the property owner retains control and the right to live in the home, it is not considered a countable asset for Medicaid purposes. However, it is essential to consult with a Medicaid planning expert to understand the specific implications.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or changed at any time during the property owner's lifetime. The property owner can execute a new deed or modify the existing one without needing the beneficiaries' consent. This flexibility allows the owner to adapt to changing circumstances.

What is the process for creating a Lady Bird Deed?

To create a Lady Bird Deed, the property owner must fill out the appropriate form, which includes details about the property and the beneficiaries. The deed must then be signed in the presence of a notary public and recorded with the county clerk's office where the property is located. It is advisable to seek legal assistance to ensure all requirements are met.

Is a Lady Bird Deed the same as a regular quitclaim deed?

No, a Lady Bird Deed is not the same as a quitclaim deed. A quitclaim deed transfers ownership of the property without any warranties or guarantees. In contrast, a Lady Bird Deed allows the property owner to retain certain rights and control over the property during their lifetime, making it a more complex legal instrument.

Can a Lady Bird Deed be used for all types of property?

A Lady Bird Deed can be used for most types of real property, including residential homes and vacant land. However, it may not be suitable for certain types of property, such as commercial real estate or properties held in a trust. Consulting with a legal professional can help determine the best approach for specific situations.

What happens to the property if the beneficiary predeceases the owner?

If a beneficiary named in a Lady Bird Deed predeceases the property owner, the property will not automatically go to the deceased beneficiary's heirs. Instead, the property owner may choose to update the deed to name a new beneficiary or allow the property to pass according to the owner's estate plan or state law.

Are there any tax implications associated with a Lady Bird Deed?

There can be tax implications when using a Lady Bird Deed. The property may receive a step-up in basis at the time of the owner's death, which can reduce capital gains tax for the beneficiaries if they sell the property. It is advisable to consult with a tax professional to understand the specific tax consequences related to the deed.

Key takeaways

- The Florida Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- This deed can help avoid probate, simplifying the transfer process upon the owner’s death.

- Filling out the form requires accurate identification of the property and the beneficiaries.

- It is essential to include the full legal description of the property, not just the address.

- Both the property owner and the beneficiaries must be clearly named to avoid confusion.

- Signing the deed in front of a notary public is necessary for it to be valid.

- Recording the deed with the county clerk is crucial for it to take effect legally.

- Consider consulting with a legal professional to ensure the deed meets all requirements.

- The Lady Bird Deed can provide tax benefits, such as avoiding capital gains tax for beneficiaries.

- It is important to review and update the deed if circumstances change, such as the addition of new beneficiaries.

File Details

| Fact Name | Description |

|---|---|

| Definition | The Florida Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically Section 732.4015. |

| Benefits | It helps avoid probate, ensuring a smoother transition of property upon the owner's death. |

| Retained Rights | The property owner maintains the right to sell, mortgage, or change the beneficiaries at any time. |

| Tax Implications | There are generally no immediate tax consequences for the property owner when creating a Lady Bird Deed. |

| Revocation | The deed can be revoked at any time by the property owner, providing flexibility in estate planning. |

Consider Some Other Lady Bird Deed Forms for US States

Lady Bird Deed San Antonio - A Lady Bird Deed can provide peace of mind knowing your property will go to your chosen heirs automatically.

For those navigating the complexities of legal decisions, understanding the significance of a General Power of Attorney is paramount. This essential form empowers individuals to designate a trusted person to handle their financial and legal affairs when they are unable to do so. Learn more about this important document through our guide on the General Power of Attorney options.

North Carolina Lady Bird Deed - Consulting with a legal professional about a Lady Bird Deed's implications is advisable.

Free Michigan Lady Bird Deed Pdf - Created by the state of Texas, it has gained popularity in various regions across the U.S.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's essential to approach the process with care and attention to detail. Here are five important dos and don'ts to keep in mind:

- Do ensure that the property description is accurate and complete. An incorrect description can lead to complications in the future.

- Do consult with an attorney if you have any questions about the implications of the deed. Legal advice can prevent costly mistakes.

- Do include the names of all intended beneficiaries clearly. This ensures that your wishes are honored after your passing.

- Don't rush through the form. Take your time to review each section thoroughly to avoid errors.

- Don't forget to sign the deed in the presence of a notary. A notarized signature is crucial for the deed to be valid.

Following these guidelines can help ensure that your Lady Bird Deed is filled out correctly, safeguarding your intentions regarding your property.