Valid Durable Power of Attorney Form for Florida

The Florida Durable Power of Attorney form is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf when they are unable to do so. This form grants the designated agent broad authority, which can include managing financial matters, handling real estate transactions, and making healthcare decisions. One of the key features of this document is its durability; it remains effective even if the principal becomes incapacitated. This means that the appointed agent can step in seamlessly, ensuring that the principal's affairs are managed according to their wishes. It is crucial to select a trustworthy agent, as they will have significant power over important decisions. Additionally, the form must be properly executed to be valid, which includes signing it in the presence of a notary public. Understanding the implications and responsibilities that come with this form can help individuals plan for the future with confidence.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. It’s important to be explicit about what decisions the agent can make on your behalf. This can include financial decisions, healthcare choices, or property management. Without clear specifications, there may be confusion or disputes later on.

-

Not Naming Alternate Agents: People often overlook the importance of naming an alternate agent. If the primary agent is unavailable or unable to perform their duties, having a backup ensures that your affairs can still be managed. This step can prevent complications and delays in decision-making.

-

Failure to Sign and Date: A Durable Power of Attorney form is not valid unless it is signed and dated. Some individuals forget this crucial step. Remember, without your signature, the document holds no legal weight. Make sure to review the entire form and sign it in the appropriate place.

-

Not Having Witnesses or Notarization: In Florida, certain requirements for witnesses or notarization must be met for the document to be valid. Some people neglect to have the necessary witnesses present or fail to get the document notarized. This oversight can lead to challenges in the future when the document is needed.

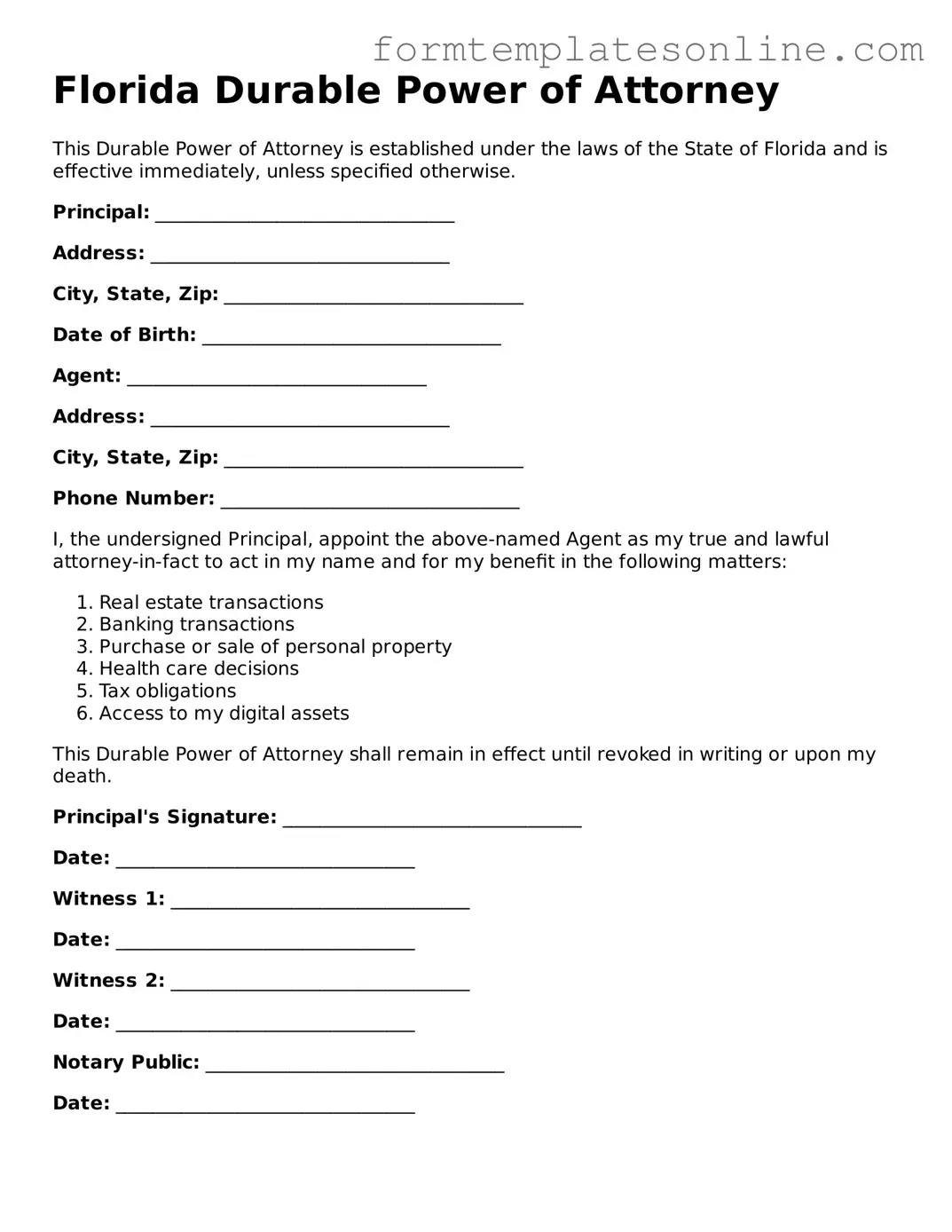

Example - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney

This Durable Power of Attorney is established under the laws of the State of Florida and is effective immediately, unless specified otherwise.

Principal: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

Date of Birth: ________________________________

Agent: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

Phone Number: ________________________________

I, the undersigned Principal, appoint the above-named Agent as my true and lawful attorney-in-fact to act in my name and for my benefit in the following matters:

- Real estate transactions

- Banking transactions

- Purchase or sale of personal property

- Health care decisions

- Tax obligations

- Access to my digital assets

This Durable Power of Attorney shall remain in effect until revoked in writing or upon my death.

Principal's Signature: ________________________________

Date: ________________________________

Witness 1: ________________________________

Date: ________________________________

Witness 2: ________________________________

Date: ________________________________

Notary Public: ________________________________

Date: ________________________________

More About Florida Durable Power of Attorney

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal matters can be managed without interruption.

What are the main benefits of having a Durable Power of Attorney in Florida?

Having a Durable Power of Attorney provides several advantages. It allows for the seamless management of financial affairs if the principal becomes unable to make decisions. This document can help avoid court intervention, which can be time-consuming and costly. It also gives the principal the ability to choose a trusted individual to handle their affairs, rather than leaving it to the court to appoint someone.

Who can be appointed as an agent under a Durable Power of Attorney?

In Florida, any competent adult can be appointed as an agent. This includes family members, friends, or trusted advisors. It is important to choose someone who is reliable and understands the principal's wishes, as the agent will have significant authority over financial and legal matters.

What powers can be granted to an agent in a Durable Power of Attorney?

The principal can grant a wide range of powers to the agent, including managing bank accounts, paying bills, buying or selling property, and making investment decisions. However, the principal can also limit the powers granted by specifying certain actions that the agent cannot take. It is crucial to clearly outline these powers in the document to ensure the agent acts within the principal's wishes.

Does a Durable Power of Attorney need to be notarized in Florida?

Yes, in Florida, a Durable Power of Attorney must be signed in the presence of a notary public. Additionally, it is advisable to have two witnesses present during the signing. This helps ensure the document's validity and provides a record of the principal's intent.

Can a Durable Power of Attorney be revoked?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the document, the principal should create a written revocation and notify the agent and any relevant financial institutions or parties that may have relied on the original document.

What happens if a Durable Power of Attorney is not in place when needed?

If a Durable Power of Attorney is not established and the principal becomes incapacitated, family members may have to go through a court process to obtain guardianship. This process can be lengthy, expensive, and may not reflect the principal's wishes. Having a Durable Power of Attorney in place can prevent these complications and ensure that the principal's preferences are honored.

Key takeaways

When considering a Florida Durable Power of Attorney, it’s important to understand the key aspects of this document. Here are some essential takeaways:

- Authority Granted: This document allows you to designate someone to make decisions on your behalf. The person you choose is known as your agent or attorney-in-fact.

- Durability: The power of attorney remains effective even if you become incapacitated. This ensures that your financial and legal matters can still be managed.

- Specific vs. General Powers: You can grant your agent specific powers, such as managing real estate or handling bank accounts, or you can give them broad authority over all your financial matters.

- Revocation: You have the right to revoke the Durable Power of Attorney at any time, as long as you are mentally competent. This can be done by creating a new document or by informing your agent in writing.

- Witnesses and Notarization: In Florida, the form must be signed in the presence of two witnesses and a notary public. This step is crucial to ensure the document’s validity.

- Review Regularly: It’s wise to review your Durable Power of Attorney periodically. Life changes, such as marriage or divorce, may necessitate updates to your agent or the powers granted.

Understanding these key points can help you make informed decisions about your Durable Power of Attorney. It’s a significant step in planning for your future and ensuring your wishes are respected.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Florida Durable Power of Attorney allows an individual (the principal) to designate another person (the agent) to manage their financial and legal affairs. |

| Durability | This form remains effective even if the principal becomes incapacitated, distinguishing it from a standard Power of Attorney. |

| Governing Law | The Florida Durable Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Agent Authority | The agent can perform a variety of tasks, including handling bank transactions, managing investments, and filing taxes. |

| Execution Requirements | The form must be signed by the principal in the presence of two witnesses and a notary public to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

| Limitations | Some actions, such as making medical decisions, require a separate document, like a Health Care Proxy. |

| Agent's Fiduciary Duty | The agent has a legal obligation to act in the best interests of the principal, managing their assets responsibly. |

| Notarization | Notarization is essential for the form to be recognized legally, ensuring authenticity and preventing fraud. |

| State-Specific Form | The Florida Durable Power of Attorney form is specific to Florida and may differ from forms used in other states. |

Consider Some Other Durable Power of Attorney Forms for US States

What Does a Durable Power of Attorney Allow You to Do - Prepares your loved ones for future uncertainties.

New York State Power of Attorney Form 2022 Pdf - A Durable Power of Attorney can help manage your financial obligations, preventing lapses in payments during periods of incapacity.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, it is essential to follow specific guidelines to ensure the document is valid and effective. Below are five things you should and shouldn't do:

- Do: Clearly identify the principal and the agent in the document.

- Do: Specify the powers granted to the agent, detailing what decisions they can make on behalf of the principal.

- Do: Sign the form in the presence of a notary public to validate it.

- Do: Keep a copy of the completed form in a safe place and provide copies to relevant parties.

- Do: Review the document periodically to ensure it still reflects the principal's wishes.

- Don't: Leave any sections of the form blank; this could lead to misunderstandings or disputes.

- Don't: Use vague language when describing the powers granted; clarity is crucial.

- Don't: Forget to date the form; an undated document may be considered invalid.

- Don't: Assume the agent will know the principal's wishes without clear instructions.

- Don't: Rely solely on verbal agreements; the form must be in writing to be enforceable.