Valid Deed in Lieu of Foreclosure Form for Florida

In the state of Florida, homeowners facing the possibility of foreclosure have an alternative option that may provide a more favorable resolution to their financial difficulties: the Deed in Lieu of Foreclosure. This legal instrument allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. By utilizing this process, individuals can avoid the lengthy and often stressful foreclosure proceedings, while also mitigating the impact on their credit scores. The form itself typically requires essential information, such as the names of the parties involved, a description of the property, and the circumstances leading to the transfer. It also outlines any additional agreements between the homeowner and the lender, including potential relocation assistance or debt forgiveness. Understanding the implications of this form is crucial for homeowners considering this route, as it can significantly influence their financial future and overall well-being.

Common mistakes

-

Not Understanding the Implications: Many individuals do not fully grasp what a deed in lieu of foreclosure entails. This can lead to unexpected consequences regarding credit scores and future home ownership.

-

Incorrect Property Description: Failing to accurately describe the property can result in legal complications. Ensure that the address and legal description are correct and match official records.

-

Missing Signatures: It is essential to have all necessary parties sign the document. Omitting a signature can invalidate the deed and prolong the foreclosure process.

-

Not Consulting a Professional: Some people attempt to fill out the form without seeking legal advice. This can lead to mistakes that might have been avoided with proper guidance.

-

Failing to Notify All Parties: It's crucial to inform all relevant parties about the deed in lieu of foreclosure. Not doing so can create confusion and potential disputes later on.

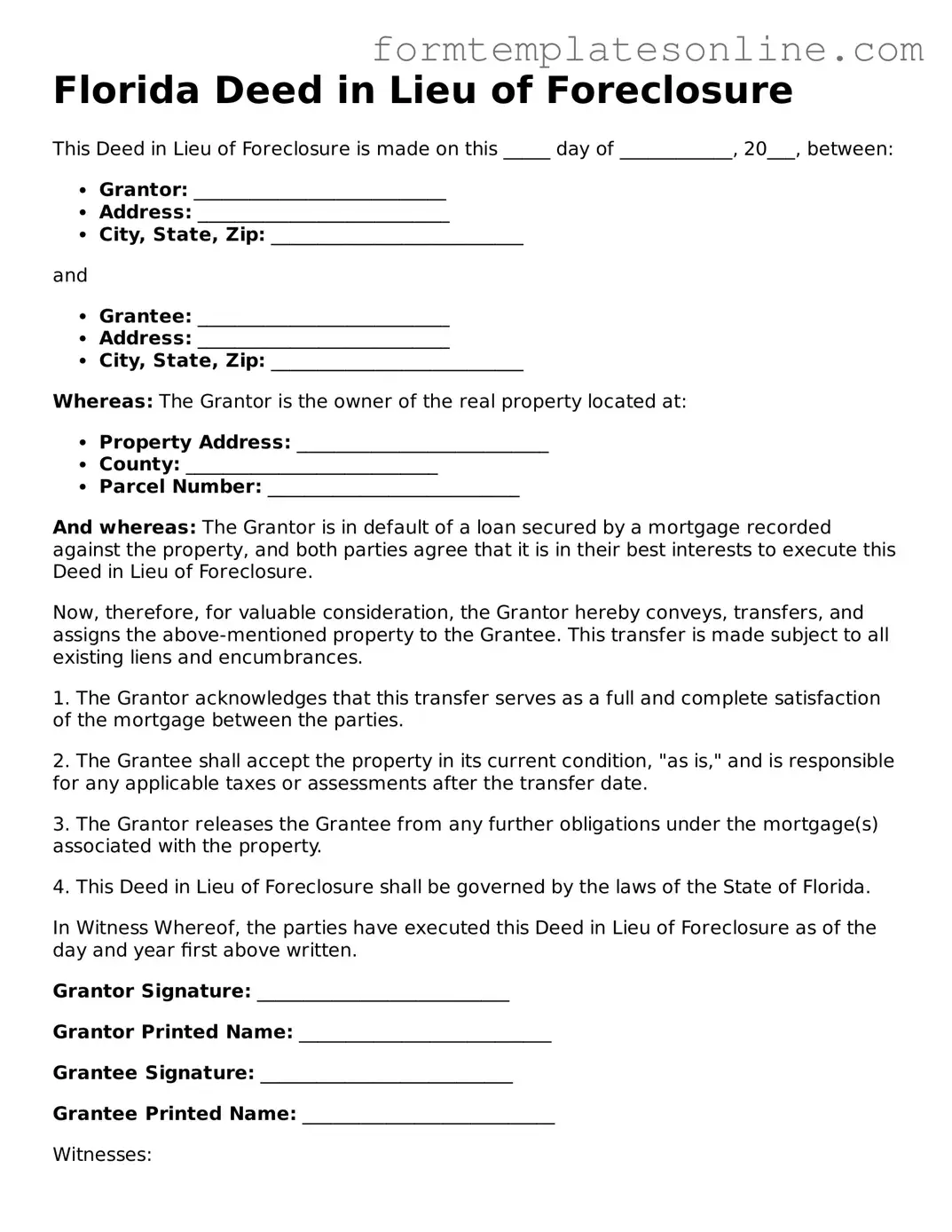

Example - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made on this _____ day of ____________, 20___, between:

- Grantor: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

and

- Grantee: ___________________________

- Address: ___________________________

- City, State, Zip: ___________________________

Whereas: The Grantor is the owner of the real property located at:

- Property Address: ___________________________

- County: ___________________________

- Parcel Number: ___________________________

And whereas: The Grantor is in default of a loan secured by a mortgage recorded against the property, and both parties agree that it is in their best interests to execute this Deed in Lieu of Foreclosure.

Now, therefore, for valuable consideration, the Grantor hereby conveys, transfers, and assigns the above-mentioned property to the Grantee. This transfer is made subject to all existing liens and encumbrances.

1. The Grantor acknowledges that this transfer serves as a full and complete satisfaction of the mortgage between the parties.

2. The Grantee shall accept the property in its current condition, "as is," and is responsible for any applicable taxes or assessments after the transfer date.

3. The Grantor releases the Grantee from any further obligations under the mortgage(s) associated with the property.

4. This Deed in Lieu of Foreclosure shall be governed by the laws of the State of Florida.

In Witness Whereof, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: ___________________________

Grantor Printed Name: ___________________________

Grantee Signature: ___________________________

Grantee Printed Name: ___________________________

Witnesses:

Witness 1 Signature: ___________________________

Witness 1 Printed Name: ___________________________

Witness 2 Signature: ___________________________

Witness 2 Printed Name: ___________________________

Notary Public:

Notary Signature: ___________________________

Notary Printed Name: ___________________________

My Commission Expires: ___________________________

More About Florida Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer the ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This option can help avoid the lengthy and often stressful foreclosure process.

Who can use a Deed in Lieu of Foreclosure?

Homeowners facing financial difficulties and unable to keep up with mortgage payments may consider a Deed in Lieu of Foreclosure. It is typically available to those who have fallen behind on their mortgage and are looking for a way to resolve their financial obligations without going through foreclosure.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to this option. First, it can help homeowners avoid the negative impact of foreclosure on their credit score. Second, the process is usually quicker and less costly than foreclosure. Lastly, it can provide a sense of closure and allow the homeowner to move on more quickly.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are some potential drawbacks. Homeowners may still face tax implications, as forgiven debt could be considered taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and homeowners may need to meet certain criteria to qualify.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and property details. If approved, the homeowner will sign the deed, transferring ownership to the lender, and the mortgage debt will be canceled.

What documents are required for a Deed in Lieu of Foreclosure?

Homeowners will need to provide various documents, including proof of income, financial statements, and a hardship letter explaining their situation. The lender may also require a title search and other legal documents to ensure a smooth transfer of ownership.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, homeowners can negotiate terms with their lender. This may include discussing the possibility of a cash incentive or other arrangements that could make the transition easier. Open communication with the lender is key to finding a mutually agreeable solution.

Will a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively impact your credit score. The extent of the impact will depend on your overall credit history and the specifics of your situation. However, it is generally viewed more favorably than a foreclosure.

How long does the process take?

The timeline for a Deed in Lieu of Foreclosure can vary. Generally, it can take anywhere from a few weeks to several months, depending on the lender’s procedures and the complexity of the homeowner's financial situation. Homeowners should be prepared for some back-and-forth communication during this time.

What should I do if my lender denies my request for a Deed in Lieu of Foreclosure?

If a lender denies the request, homeowners can explore other options, such as loan modification, short sale, or even bankruptcy. It’s important to seek advice from a financial advisor or housing counselor to determine the best path forward based on individual circumstances.

Key takeaways

When dealing with a Florida Deed in Lieu of Foreclosure, it’s essential to understand the process and implications. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer their property to the lender to avoid foreclosure.

- Eligibility Criteria: Not all homeowners qualify. Lenders typically require proof of financial hardship and an inability to continue making mortgage payments.

- Impact on Credit Score: While it may be less damaging than a foreclosure, a deed in lieu can still negatively affect your credit score.

- Property Condition: The property must be in good condition. Lenders may refuse the deed if the property has significant damage or issues.

- Consult with Professionals: It’s wise to speak with a real estate attorney or financial advisor before proceeding to ensure you understand all implications.

- Obtain Written Agreement: Ensure that you receive a written agreement from the lender stating that the deed in lieu will satisfy your mortgage debt.

- Tax Consequences: Be aware of potential tax implications. The IRS may consider the forgiven debt as taxable income, so consulting a tax professional is advisable.

By keeping these points in mind, you can navigate the process of a Deed in Lieu of Foreclosure more effectively and make informed decisions about your property and financial future.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Laws | In Florida, the deed in lieu of foreclosure is governed by the Florida Statutes, specifically Chapter 697, which covers mortgages and deeds. |

| Benefits | This process can be less damaging to a borrower's credit score compared to a foreclosure and may allow for a more amicable resolution between the borrower and lender. |

| Considerations | Borrowers should be aware that a deed in lieu of foreclosure may still have tax implications and should consult with a tax advisor before proceeding. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

California Property Surrender Deed - This deed transfers both the property title and the responsibilities that come with ownership back to the lender.

When engaging in a vehicle transaction, it is essential to have a comprehensive understanding of the Georgia Motor Vehicle Bill of Sale, as it not only formalizes the sale but also safeguards both the buyer and seller. This document is key to ensuring the legal transfer of ownership and is often available for download at resources like OnlineLawDocs.com, which provides a straightforward way to obtain the form necessary for the registration and titling of the vehicle in Georgia.

Will I Owe Money After a Deed in Lieu of Foreclosure - This form indicates a mutual agreement to end the mortgage contract amicably.

Deed in Lieu Vs Foreclosure - Completion of a Deed in Lieu can expedite the transferring of property ownership without legal battles.

Foreclosure Vs Deed in Lieu - Signing a Deed in Lieu means the homeowner is surrendering ownership in exchange for settling the mortgage debt.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it is important to approach the process carefully. Here are ten things to consider, including both actions to take and pitfalls to avoid.

- Do ensure that you understand the implications of signing the deed in lieu of foreclosure.

- Do consult with a legal professional to guide you through the process.

- Do provide accurate and complete information on the form.

- Do keep copies of all documents for your records.

- Do check for any outstanding liens or obligations on the property before signing.

- Don't rush through the form; take your time to review each section carefully.

- Don't sign the document without fully understanding your rights and responsibilities.

- Don't ignore any specific requirements set forth by your lender.

- Don't forget to notify any co-owners or interested parties about the process.

- Don't assume that the deed in lieu of foreclosure will be the best option for your situation without exploring alternatives.