Attorney-Approved Family Member Lease Agreement Template

When navigating the complexities of housing arrangements, particularly within families, a Family Member Lease Agreement form serves as a crucial tool. This document outlines the terms and conditions under which one family member may lease property from another, ensuring clarity and mutual understanding. Key aspects of the agreement include the rental amount, payment schedule, and duration of the lease, which help to establish expectations and responsibilities. Additionally, the form typically addresses maintenance obligations, rules regarding pets, and procedures for terminating the lease, thereby minimizing potential conflicts. By formalizing the living arrangement, this agreement not only protects the rights of both parties but also fosters a sense of accountability. Ultimately, a well-structured Family Member Lease Agreement can contribute to harmonious family dynamics while providing legal safeguards for all involved.

Common mistakes

-

Not Including All Required Information: Many people forget to fill in all the necessary details. This includes names, addresses, and contact information for all parties involved.

-

Using Incorrect Dates: Some individuals mistakenly enter the wrong lease start and end dates. This can lead to confusion and potential disputes later on.

-

Failing to Specify Rent Amount: It's crucial to clearly state the rent amount. Omitting this detail can create misunderstandings about payment expectations.

-

Ignoring Maintenance Responsibilities: Not outlining who is responsible for maintenance can lead to issues. Both parties should know their obligations to avoid conflicts.

-

Overlooking Signatures: A common mistake is forgetting to sign the agreement. Without signatures, the lease is not legally binding.

-

Not Discussing Lease Terms: Failing to communicate about specific lease terms can cause problems. Both parties should be on the same page regarding rules and expectations.

-

Neglecting to Keep a Copy: After completing the form, some forget to keep a copy for themselves. Having a copy is essential for reference and record-keeping.

Example - Family Member Lease Agreement Form

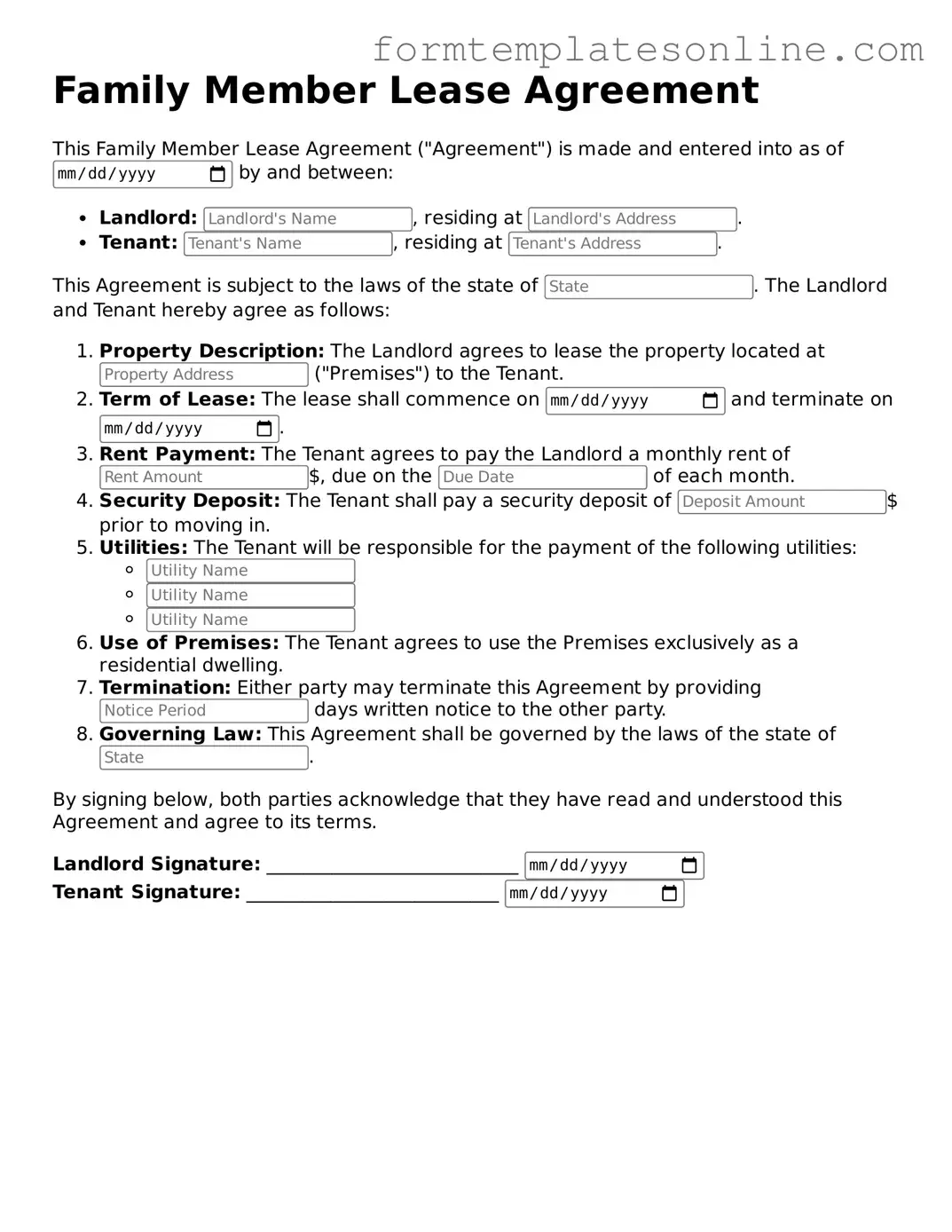

Family Member Lease Agreement

This Family Member Lease Agreement ("Agreement") is made and entered into as of by and between:

- Landlord: , residing at .

- Tenant: , residing at .

This Agreement is subject to the laws of the state of . The Landlord and Tenant hereby agree as follows:

- Property Description: The Landlord agrees to lease the property located at ("Premises") to the Tenant.

- Term of Lease: The lease shall commence on and terminate on .

- Rent Payment: The Tenant agrees to pay the Landlord a monthly rent of $, due on the of each month.

- Security Deposit: The Tenant shall pay a security deposit of $ prior to moving in.

- Utilities: The Tenant will be responsible for the payment of the following utilities:

- Use of Premises: The Tenant agrees to use the Premises exclusively as a residential dwelling.

- Termination: Either party may terminate this Agreement by providing days written notice to the other party.

- Governing Law: This Agreement shall be governed by the laws of the state of .

By signing below, both parties acknowledge that they have read and understood this Agreement and agree to its terms.

Landlord Signature: ___________________________

Tenant Signature: ___________________________

More About Family Member Lease Agreement

What is a Family Member Lease Agreement?

A Family Member Lease Agreement is a document that outlines the terms under which a family member can rent a property from another family member. It serves to clarify the responsibilities of both the landlord and the tenant, ensuring that everyone understands their rights and obligations in the rental arrangement.

Who should use a Family Member Lease Agreement?

This agreement is suitable for any family member who plans to rent a property from another family member. Whether it’s a parent renting to an adult child or siblings sharing a home, this document can help maintain clear communication and expectations.

What key elements should be included in the agreement?

The agreement should include the names of the landlord and tenant, the property address, the rental amount, payment due dates, lease duration, and any rules regarding property use. Additionally, it’s important to outline responsibilities for maintenance and repairs, as well as procedures for terminating the lease.

Is a Family Member Lease Agreement legally binding?

Yes, a Family Member Lease Agreement is legally binding as long as it meets the requirements of a valid contract. This includes mutual consent, a lawful purpose, and consideration (such as rent). However, it is always advisable to consult with a legal professional to ensure that the agreement complies with local laws.

Can the rental amount be below market value?

Yes, family members often agree to a rental amount that is lower than the market rate. However, it’s important to document this arrangement clearly in the lease agreement. This can help prevent misunderstandings and ensure that both parties are on the same page regarding expectations.

What happens if a family member wants to terminate the lease early?

The agreement should specify the process for early termination. It may include a notice period that the tenant must provide before moving out. Having this outlined in advance can help avoid conflicts later on.

Are there any tax implications for renting to a family member?

Yes, renting to a family member can have tax implications. The landlord may need to report rental income on their tax return, and the tenant may not be able to deduct rental expenses if the rent is significantly below market value. Consulting a tax professional is recommended to understand these implications fully.

Can the terms of the lease be modified later?

Yes, the terms of the lease can be modified, but any changes should be documented in writing and signed by both parties. This helps ensure that everyone agrees to the new terms and can prevent future disputes.

What should be done if there is a dispute between family members regarding the lease?

If a dispute arises, it’s best to try to resolve it through open communication. If that doesn’t work, mediation may be an option. In some cases, legal action might be necessary, but it is advisable to consider the impact on family relationships before pursuing this route.

Key takeaways

When filling out and using the Family Member Lease Agreement form, keep the following key points in mind:

- Understand the purpose: This agreement outlines the terms between family members regarding rental arrangements.

- Clearly define the parties: Include full names and addresses of both the landlord and tenant to avoid confusion.

- Specify the rental amount: Clearly state the monthly rent, due date, and acceptable payment methods.

- Outline the lease duration: Indicate whether the lease is for a fixed term or month-to-month, and include start and end dates if applicable.

- Include rules and responsibilities: Clearly state the expectations for maintenance, utilities, and any house rules to prevent misunderstandings.

- Document security deposits: If applicable, specify the amount of the security deposit and conditions for its return.

- Consider legal requirements: Ensure the agreement complies with local laws and regulations to protect both parties.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Family Member Lease Agreement form is designed to establish a rental arrangement between family members, ensuring clarity and legal protection for both parties involved. |

| Governing Laws | In the United States, lease agreements are generally governed by state laws. Specific regulations may vary, so it is essential to refer to the laws of the state where the property is located. |

| Key Elements | This form typically includes essential details such as the names of the parties, rental terms, payment amounts, and responsibilities of each party. |

| Importance of Written Agreement | Having a written Family Member Lease Agreement helps prevent misunderstandings and disputes by clearly outlining the expectations and obligations of both the landlord and tenant. |

More Family Member Lease Agreement Types:

Printable Simple Storage Agreement - The form often outlines any promotional or special offers applicable.

For those entering a rental agreement, understanding the nuances of a well-drafted Residential Lease Agreement template is crucial. This document not only delineates the obligations of both tenants and landlords but also serves as a safeguard against potential disputes during the lease term.

Dos and Don'ts

When filling out a Family Member Lease Agreement form, it's important to approach the process thoughtfully. Here are some guidelines to help you navigate this task effectively.

- Do read the entire agreement carefully before signing.

- Do ensure all names and details are accurately filled out.

- Do discuss the terms of the lease with your family member.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank; fill in all required information.

- Don't assume verbal agreements are sufficient; everything should be documented.

- Don't ignore local laws that may affect the lease agreement.

By following these guidelines, you can help ensure that the Family Member Lease Agreement is completed correctly and serves its intended purpose. Clear communication and attention to detail will make the process smoother for everyone involved.