Attorney-Approved Employee Loan Agreement Template

An Employee Loan Agreement form is a crucial document that outlines the terms and conditions under which an employer provides a loan to an employee. This form typically includes essential details such as the loan amount, repayment schedule, interest rate, and any applicable fees. It also specifies the purpose of the loan, ensuring both parties understand its intended use. Additionally, the agreement may address the consequences of default, including potential deductions from the employee's paycheck or other actions the employer may take. By clearly stating the rights and responsibilities of both the employer and the employee, this form serves to protect the interests of both parties while fostering transparency in the lending process. Understanding the components of this agreement is vital for employees considering a loan and employers looking to maintain clear financial relationships with their staff.

Common mistakes

-

Inaccurate Personal Information: One of the most common mistakes is providing incorrect or incomplete personal details. This includes misspellings of names, wrong addresses, or incorrect Social Security numbers. Such errors can lead to delays in processing the loan.

-

Failure to Specify Loan Amount: Another frequent oversight is not clearly stating the amount being requested. Without a specified figure, the agreement lacks clarity, which can create confusion later on.

-

Ignoring Repayment Terms: Some individuals neglect to read or understand the repayment terms. This includes the interest rate, repayment schedule, and any penalties for late payments. Failing to grasp these details can lead to financial difficulties down the line.

-

Not Providing Required Documentation: Many people forget to attach necessary documents, such as proof of income or identification. Incomplete submissions can result in automatic rejections or prolonged processing times.

-

Signing Without Reviewing: Rushing to sign the agreement without thoroughly reviewing its contents is a significant mistake. Important clauses may be overlooked, which could affect the borrower's rights and obligations.

-

Neglecting to Keep Copies: After submitting the form, some fail to keep a copy of the signed agreement for their records. This can lead to complications if disputes arise regarding the terms of the loan.

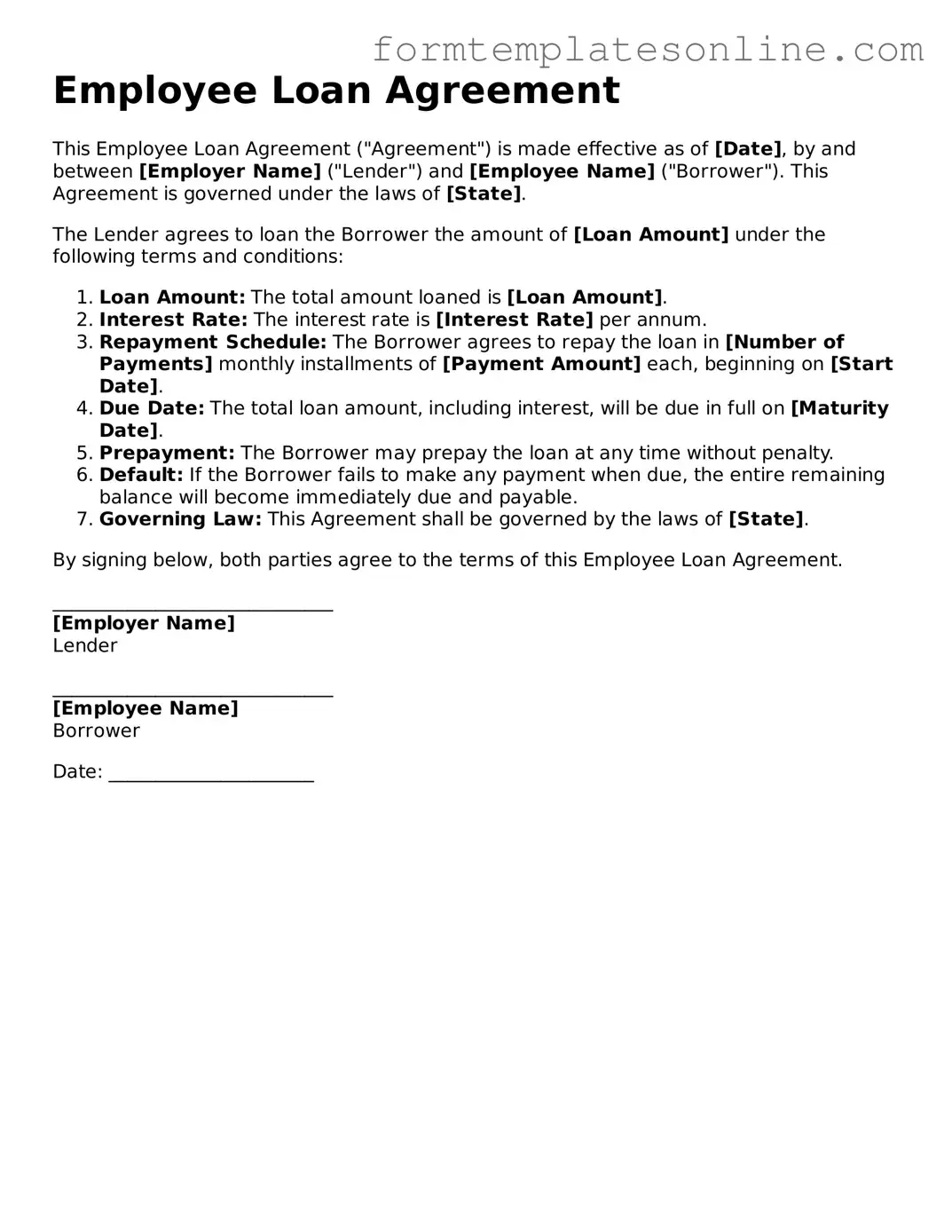

Example - Employee Loan Agreement Form

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made effective as of [Date], by and between [Employer Name] ("Lender") and [Employee Name] ("Borrower"). This Agreement is governed under the laws of [State].

The Lender agrees to loan the Borrower the amount of [Loan Amount] under the following terms and conditions:

- Loan Amount: The total amount loaned is [Loan Amount].

- Interest Rate: The interest rate is [Interest Rate] per annum.

- Repayment Schedule: The Borrower agrees to repay the loan in [Number of Payments] monthly installments of [Payment Amount] each, beginning on [Start Date].

- Due Date: The total loan amount, including interest, will be due in full on [Maturity Date].

- Prepayment: The Borrower may prepay the loan at any time without penalty.

- Default: If the Borrower fails to make any payment when due, the entire remaining balance will become immediately due and payable.

- Governing Law: This Agreement shall be governed by the laws of [State].

By signing below, both parties agree to the terms of this Employee Loan Agreement.

______________________________

[Employer Name]

Lender

______________________________

[Employee Name]

Borrower

Date: ______________________

More About Employee Loan Agreement

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement typically includes details such as the loan amount, repayment schedule, interest rates (if applicable), and any consequences for defaulting on the loan. It's designed to protect both the employer and the employee by clearly defining the expectations and responsibilities involved in the loan arrangement.

Why would an employer offer a loan to an employee?

Employers may offer loans to employees for several reasons. It can help employees manage unexpected expenses, such as medical bills or car repairs, without resorting to high-interest loans from other sources. Additionally, providing loans can foster goodwill, improve employee morale, and enhance loyalty. Employers may also use these agreements as a way to support employees in times of financial hardship, which can lead to increased productivity and retention.

What information should be included in the Employee Loan Agreement?

The Employee Loan Agreement should include essential details such as the total loan amount, the interest rate (if any), the repayment schedule, and the duration of the loan. It should also specify the purpose of the loan, any collateral involved, and the consequences of failing to repay. Both parties should sign the agreement to confirm their understanding and acceptance of the terms.

How is the repayment process structured?

Repayment terms can vary based on the agreement. Typically, repayments are made through payroll deductions, which ensures that payments are made consistently and on time. The agreement should outline the frequency of payments—whether weekly, bi-weekly, or monthly—and the total number of payments required. Clear communication about these terms helps prevent misunderstandings later on.

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan, the consequences should be clearly outlined in the agreement. This may include additional fees, a revised payment schedule, or even legal action in extreme cases. Employers often prefer to work with employees facing financial difficulties to find a solution that works for both parties. Open communication is key in these situations to avoid escalating issues.

Is the Employee Loan Agreement legally binding?

Yes, an Employee Loan Agreement is generally considered a legally binding contract, provided it meets the necessary requirements for contracts in your jurisdiction. This means that both parties are obligated to adhere to the terms outlined in the agreement. If either party fails to fulfill their obligations, the other party may have legal recourse. It’s advisable for both employers and employees to review the agreement carefully before signing to ensure they understand their rights and responsibilities.

Key takeaways

When filling out and using the Employee Loan Agreement form, keep these key takeaways in mind:

- Clear Terms: Ensure all loan terms are clearly defined. This includes the amount borrowed, interest rate, and repayment schedule.

- Documentation: Both parties should sign the agreement. This provides legal protection and clarity for both the employee and employer.

- Repayment Plan: Establish a realistic repayment plan. Consider the employee's financial situation to avoid undue hardship.

- Confidentiality: Keep the details of the loan confidential. This protects the employee's privacy and maintains trust within the workplace.

- Compliance: Ensure the agreement complies with local and federal laws. This helps avoid potential legal issues in the future.

File Details

| Fact Name | Description |

|---|---|

| Purpose | An Employee Loan Agreement form outlines the terms under which an employer provides a loan to an employee, ensuring clarity and mutual understanding. |

| Key Components | The form typically includes the loan amount, interest rate, repayment schedule, and any penalties for late payments. |

| Governing Laws | The agreement is subject to state laws, which may vary. For example, California's governing law for such agreements is the California Civil Code. |

| Employee Rights | Employees should understand their rights regarding loan agreements, including the right to seek clarification and the right to fair treatment in repayment terms. |

| Documentation | Both parties should keep a signed copy of the agreement for their records, as it serves as a legal document in case of disputes. |

Dos and Don'ts

When filling out an Employee Loan Agreement form, it's important to approach the process with care. Here are five essential dos and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check your calculations, especially if the loan involves interest.

- Do ask questions if any part of the agreement is unclear.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any required fields blank; incomplete forms can be rejected.

- Don't ignore the terms and conditions; they are crucial for understanding your obligations.

- Don't sign the agreement without fully understanding it.

- Don't forget to follow up if you do not receive confirmation of the loan approval.