Attorney-Approved Deed in Lieu of Foreclosure Template

When homeowners face financial difficulties and struggle to keep up with mortgage payments, they often seek alternatives to foreclosure. One such option is the Deed in Lieu of Foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, effectively settling the mortgage debt without going through the lengthy and costly foreclosure process. By signing this deed, the homeowner can avoid the negative consequences of foreclosure on their credit report. The lender, in turn, gains possession of the property more quickly and with less hassle. It's important to understand that this process typically requires the homeowner to be in default on their mortgage, and the lender must agree to accept the deed. Additionally, the Deed in Lieu of Foreclosure may include specific terms regarding any remaining debt and the homeowner's rights after the transfer. Overall, this option can provide a more amicable solution for both parties, but it is essential to consider all implications before proceeding.

State-specific Deed in Lieu of Foreclosure Documents

Common mistakes

-

Failing to provide accurate property information. It is crucial to include the correct address, legal description, and any identifying numbers associated with the property. Inaccuracies can lead to complications or delays in processing the deed.

-

Not signing the form in the correct locations. Each party involved must sign where indicated. Missing signatures can invalidate the document, causing further issues in the foreclosure process.

-

Overlooking the need for notarization. Many jurisdictions require the deed to be notarized to ensure its legality. Without a notary’s seal, the deed may not be accepted by the lender.

-

Neglecting to include all necessary parties. If there are multiple owners or lienholders, all must be included in the deed. Failing to do so can lead to disputes or claims after the deed is executed.

-

Ignoring the lender's specific requirements. Each lender may have different guidelines for the deed in lieu of foreclosure process. Not adhering to these can result in rejection of the deed.

-

Not understanding the implications of the deed. A deed in lieu of foreclosure can have significant effects on credit scores and future borrowing capabilities. It is essential to comprehend these consequences before proceeding.

-

Forgetting to retain copies of the submitted form. Keeping a copy for personal records is important. This ensures that you have documentation of what was submitted in case of future disputes.

-

Submitting the form without consulting a professional. Seeking advice from a real estate attorney or a qualified professional can help avoid mistakes and ensure that all legal requirements are met.

-

Rushing through the process. Taking time to carefully review the form and gather all necessary documentation is vital. Hasty submissions often lead to errors that can complicate the situation.

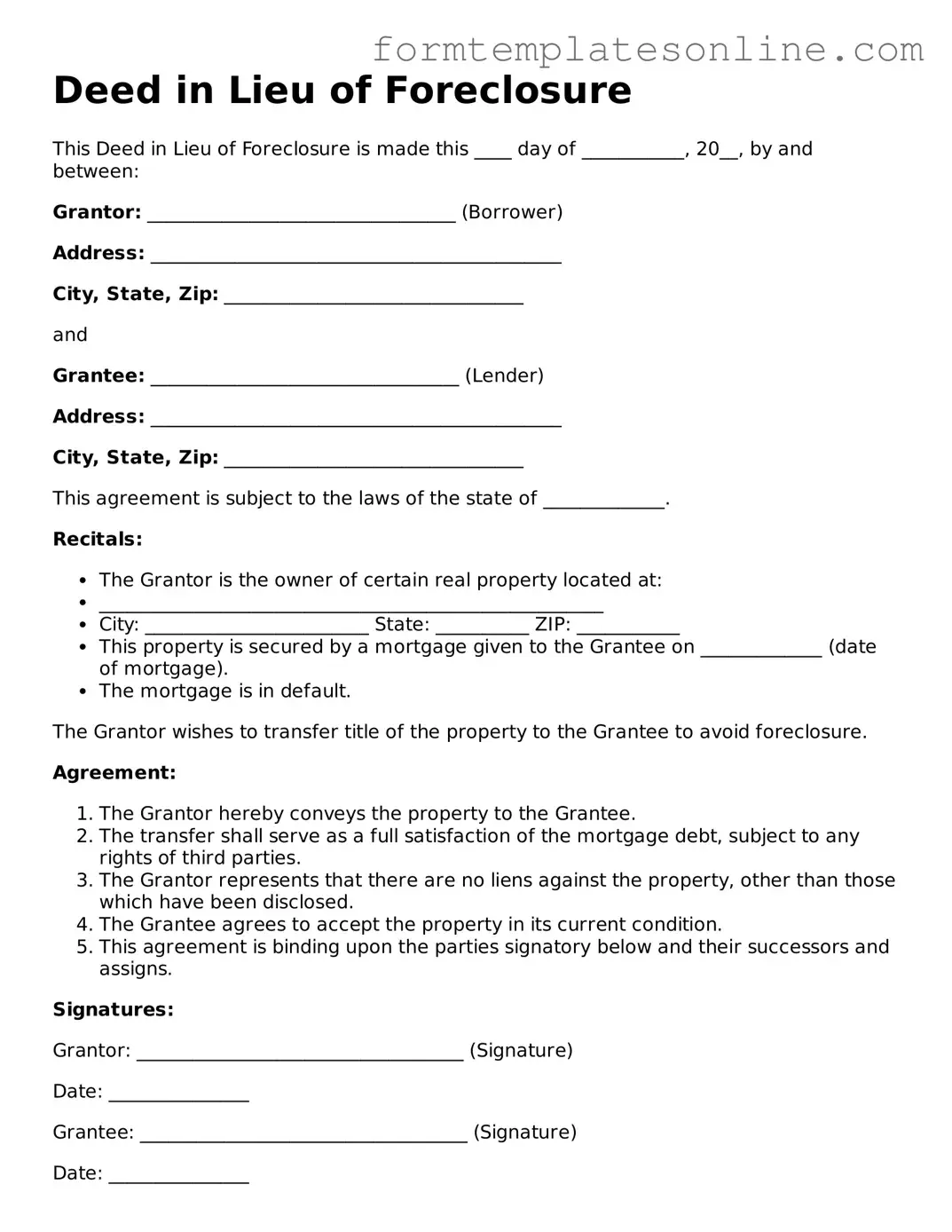

Example - Deed in Lieu of Foreclosure Form

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ____ day of ___________, 20__, by and between:

Grantor: _________________________________ (Borrower)

Address: ____________________________________________

City, State, Zip: ________________________________

and

Grantee: _________________________________ (Lender)

Address: ____________________________________________

City, State, Zip: ________________________________

This agreement is subject to the laws of the state of _____________.

Recitals:

- The Grantor is the owner of certain real property located at:

- ______________________________________________________

- City: ________________________ State: __________ ZIP: ___________

- This property is secured by a mortgage given to the Grantee on _____________ (date of mortgage).

- The mortgage is in default.

The Grantor wishes to transfer title of the property to the Grantee to avoid foreclosure.

Agreement:

- The Grantor hereby conveys the property to the Grantee.

- The transfer shall serve as a full satisfaction of the mortgage debt, subject to any rights of third parties.

- The Grantor represents that there are no liens against the property, other than those which have been disclosed.

- The Grantee agrees to accept the property in its current condition.

- This agreement is binding upon the parties signatory below and their successors and assigns.

Signatures:

Grantor: ___________________________________ (Signature)

Date: _______________

Grantee: ___________________________________ (Signature)

Date: _______________

Witness: ___________________________________ (Signature)

Date: _______________

Notary Public:

State of ________________

County of _______________

On this ____ day of ___________, 20__, before me, a Notary Public, personally appeared __________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to this instrument and acknowledged that he/she/they executed it.

Notary Signature: ________________________________

My Commission Expires: ______________________

More About Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This arrangement allows the homeowner to settle their mortgage debt without going through the lengthy and often stressful foreclosure process. It can be a beneficial option for those facing financial difficulties and seeking to minimize the impact on their credit score.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure typically depends on the lender's policies. Generally, homeowners who are struggling to make mortgage payments and are at risk of foreclosure may qualify. However, the homeowner must demonstrate financial hardship and show that they have exhausted other options, such as loan modification or short sale. Lenders will also assess the property's condition and market value before approving the deed transfer.

What are the benefits of a Deed in Lieu of Foreclosure?

One significant benefit is that it can help homeowners avoid the negative consequences of foreclosure. This process is usually quicker and less costly than foreclosure. Additionally, homeowners may be able to negotiate a release from the mortgage debt, which can provide a fresh start. Furthermore, a Deed in Lieu of Foreclosure may have a less damaging effect on credit scores compared to a foreclosure, allowing individuals to rebuild their credit more quickly.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks to consider. Homeowners may lose any equity they have built up in the property. Additionally, lenders may impose tax consequences on the forgiven debt, which could lead to unexpected financial burdens. It is crucial to consult with a tax advisor or attorney to understand the implications fully. Lastly, not all lenders accept Deeds in Lieu of Foreclosure, which could limit options for some homeowners.

How does the process of obtaining a Deed in Lieu of Foreclosure work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will require documentation of the homeowner's financial situation, including income, expenses, and the status of the mortgage. After reviewing this information, the lender will determine whether to accept the deed transfer. If approved, the homeowner will sign the necessary documents, and the lender will take ownership of the property, releasing the homeowner from further obligations under the mortgage.

Can a Deed in Lieu of Foreclosure affect my ability to purchase a new home in the future?

A Deed in Lieu of Foreclosure can impact future home purchases, but the effects may be less severe than those of a foreclosure. Lenders typically look at credit history and the time elapsed since the deed transfer. Homeowners may need to wait a few years before qualifying for a new mortgage, but this timeline can vary based on individual circumstances and lender policies. It is advisable to work on rebuilding credit and saving for a down payment during this period to improve future home buying prospects.

Key takeaways

Filling out and using a Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure proceedings.

- Eligibility Requirements: Not all homeowners qualify for this option. Lenders typically require that the property is free of other liens and that the homeowner is in default on their mortgage.

- Impact on Credit Score: While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively affect your credit score. It's essential to understand the long-term implications.

- Negotiating Terms: Homeowners should feel empowered to negotiate terms with the lender, such as the possibility of being released from further liability on the mortgage debt.

- Legal and Financial Advice: Consulting with a legal or financial advisor is crucial. They can provide guidance tailored to your specific situation and help you understand your rights.

- Documenting the Process: Keep thorough records of all communications and documents related to the Deed in Lieu of Foreclosure. This documentation can be invaluable for future reference.

Taking these steps can help ensure that you are making informed decisions during a challenging time. Remember, you are not alone in this process, and there are resources available to support you.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, protect their credit score, and may allow for a smoother transition to a new living situation. |

| State-Specific Forms | Different states have their own forms and requirements. For example, California requires adherence to Civil Code Section 2943. |

| Negotiation | Borrowers often have the opportunity to negotiate terms with the lender, including potential forgiveness of remaining debt or relocation assistance. |

| Legal Advice | It's advisable for borrowers to seek legal counsel before signing a Deed in Lieu of Foreclosure to understand all implications and ensure their rights are protected. |

More Deed in Lieu of Foreclosure Types:

Where Can I Get a Quit Claim Deed Form - Using a Quitclaim Deed can expedite the property transfer process significantly.

What Is a Gift Deed in Real Estate - Properly executed, a Gift Deed can make gifting properties much less stressful for everyone involved.

For anyone considering borrowing funds, it's essential to understand the importance of a Loan Agreement. This legally binding document protects both the borrower and the lender by clearly defining the loan amount, interest rates, repayment terms, and potential repercussions for non-repayment. A well-drafted agreement, such as those available at OnlineLawDocs.com, ensures that all parties are aware of their rights and responsibilities, reducing the risk of misunderstandings.

Title Companies and Transfer on Death Deeds - Although it is called a deed, it does not transfer ownership during the owner's lifetime.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, there are important steps to follow to ensure the process goes smoothly. Here’s a list of what to do and what to avoid:

- Do: Review the form carefully before filling it out.

- Do: Provide accurate and complete information to avoid delays.

- Do: Seek legal advice if you have questions about the process.

- Do: Sign and date the form in the appropriate sections.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank; this can cause complications.

- Don't: Ignore instructions provided with the form.

- Don't: Forget to keep a copy of the completed form for your records.