Citibank Direct Deposit PDF Form

Managing your finances can be made easier with the right tools, and the Citibank Direct Deposit form is one such tool that simplifies the process of receiving your paycheck or benefits. This form allows you to authorize your employer or government agency to deposit your funds directly into your Citibank account, ensuring timely access to your money without the hassle of paper checks. Key elements of the form include your personal information, such as your name and account number, as well as your employer's details. Additionally, you'll find options to specify the amount of money to be deposited and whether you want to split deposits between multiple accounts. Completing this form accurately is crucial, as it guarantees that your funds reach the right place. With the Citibank Direct Deposit form, you can enjoy the convenience of automatic deposits, making your financial management smoother and more efficient.

Common mistakes

-

Failing to provide accurate personal information. It's essential to ensure that your name, address, and Social Security number are correct.

-

Not double-checking the bank account number. A simple typo can lead to funds being deposited into the wrong account.

-

Omitting the routing number. This number is crucial for directing the deposit to the correct bank.

-

Using an outdated form. Always ensure that you have the most current version of the Direct Deposit form.

-

Not signing the form. A signature is often required to authorize the direct deposit.

-

Failing to specify the type of account. Indicating whether the account is checking or savings is necessary for proper processing.

-

Neglecting to provide employer information. Including your employer’s name and address can help expedite the process.

-

Overlooking the need for a voided check. Some banks require a voided check to verify the account details.

-

Not keeping a copy of the completed form. Retaining a copy can be helpful for future reference or if issues arise.

-

Assuming the process is instantaneous. It can take time for the direct deposit to be set up, so patience is necessary.

Example - Citibank Direct Deposit Form

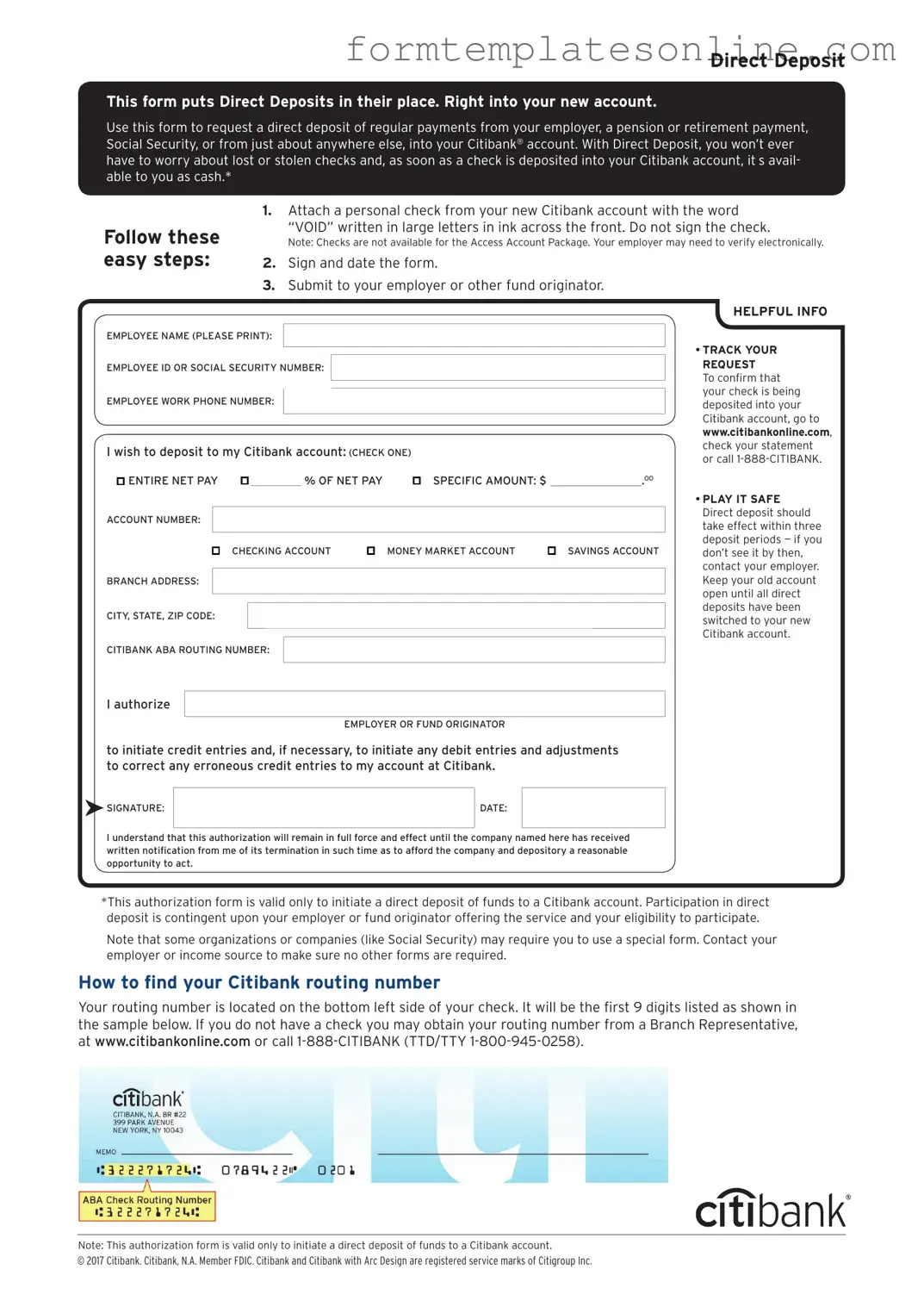

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

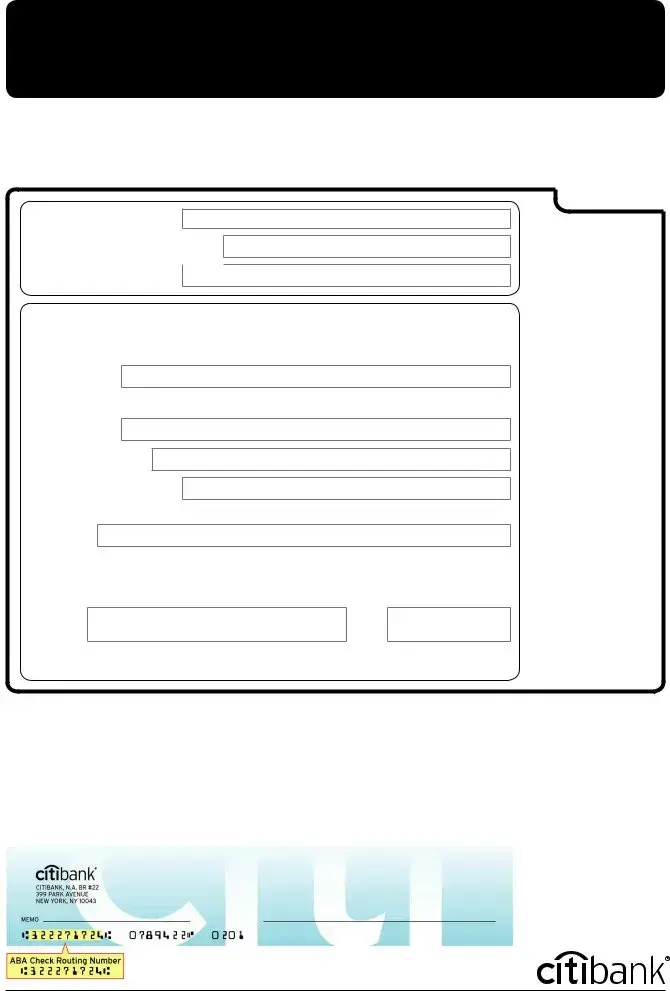

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

More About Citibank Direct Deposit

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows individuals to authorize their employers or other payers to deposit funds directly into their Citibank accounts. This process eliminates the need for physical checks, providing a faster and more secure way to receive payments such as salaries, pensions, or government benefits.

How do I obtain the Citibank Direct Deposit form?

You can obtain the Citibank Direct Deposit form by visiting a local Citibank branch or downloading it from the Citibank website. The form is typically available in the banking services section, where you can find various account-related forms and documents.

What information do I need to fill out the form?

To complete the Citibank Direct Deposit form, you will need to provide your personal information, including your name, address, and Social Security number. Additionally, you must include your Citibank account number and the routing number for your bank. This information ensures that funds are deposited accurately into your account.

How do I submit the completed form?

You can submit the completed Citibank Direct Deposit form in several ways. You may take it to your employer’s payroll department or the relevant organization that will be making the deposits. Alternatively, some employers may allow you to submit the form electronically through their payroll systems.

How long does it take for direct deposits to start?

The time it takes for direct deposits to begin can vary. Generally, it may take one to two pay cycles for the changes to take effect after the form has been submitted. It is advisable to check with your employer or the organization making the payments for specific timelines.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. To do this, you will need to fill out a new Citibank Direct Deposit form with your updated account details and submit it to your employer or payer. Make sure to allow sufficient time for the changes to take effect.

What should I do if I encounter issues with my direct deposit?

If you experience issues with your direct deposit, such as missing payments or incorrect amounts, first check with your employer or the organization responsible for the payment. They can verify whether the deposit was processed correctly. If the issue persists, contact Citibank customer service for assistance.

Is there a fee for using direct deposit with Citibank?

Generally, there are no fees associated with receiving direct deposits into your Citibank account. However, it is advisable to review your account terms and conditions or contact Citibank directly to confirm any potential fees that may apply to your specific account type.

Key takeaways

When filling out and using the Citibank Direct Deposit form, keep the following key takeaways in mind:

- Ensure that you have your Citibank account number handy. This number is essential for directing your funds accurately.

- Provide the correct routing number for Citibank. This number helps identify your bank in the transaction process.

- Double-check all entries on the form. Mistakes can lead to delays or misdirected deposits.

- Sign and date the form where indicated. An unsigned form may not be processed.

- Submit the completed form to your employer or the entity responsible for processing your payments.

- Keep a copy of the submitted form for your records. This can help resolve any issues that may arise later.

- Monitor your bank account after submitting the form. Ensure that your deposits are being made correctly and on time.

- Be aware of any processing times. It may take one or two pay cycles for the direct deposit to take effect.

- Contact Citibank customer service if you have questions about your account or the direct deposit process.

- Consider setting up online banking to track your deposits and account activity easily.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form allows individuals to set up automatic deposits into their Citibank accounts. |

| Eligibility | Most individuals with a Citibank account can use this form for direct deposits from employers or government benefits. |

| Required Information | Users must provide their account number, routing number, and personal identification details. |

| Submission Method | The completed form can be submitted electronically or printed and sent to the employer or benefits provider. |

| Processing Time | Direct deposits typically take one to two pay cycles to begin after the form is submitted. |

| State-Specific Forms | Some states may require specific forms or additional documentation based on local laws. |

| Governing Laws | Federal laws, such as the Electronic Fund Transfer Act, govern direct deposits across the U.S. |

| Security Measures | Citibank employs various security measures to protect personal and financial information on the form. |

| Contact Information | For questions, customers can contact Citibank’s customer service for assistance with the form. |

Other PDF Forms

Spanish Job Application - Engaging with the application process shows your interest and commitment to joining the team.

A Florida Non-disclosure Agreement form is a legal document that businesses in Florida use to safeguard their confidential information. It ensures that the recipient of this information does not disclose it to anyone outside of the agreement. This form plays a crucial role in protecting trade secrets and maintaining competitive advantages, and you can find more information about it at onlinelawdocs.com.

Indiana Odometer Statement - The form can be printed and filled out in advance for convenience.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, attention to detail is crucial. Below is a list of essential dos and don'ts to ensure a smooth process.

- Do double-check your account number for accuracy to avoid delays in deposits.

- Do provide your employer with the completed form promptly to ensure timely processing.

- Do include your routing number, as it is necessary for the bank to direct funds correctly.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank, as this can lead to processing errors.

- Don't forget to sign and date the form, as an unsigned document may be rejected.

By adhering to these guidelines, you can help facilitate a seamless direct deposit setup with Citibank.