Childcare Receipt PDF Form

The Childcare Receipt form serves as an essential document for both parents and childcare providers, ensuring clarity and accountability in financial transactions related to childcare services. This form captures critical information, including the date of service, the amount paid, and the name of the individual or entity receiving the payment. It also specifies the names of the children for whom care was provided, which helps in maintaining accurate records. Additionally, the form outlines the duration of the childcare services, indicating the start and end dates. A signature from the childcare provider authenticates the receipt, confirming that the transaction has been completed. By utilizing this form, parents can keep track of their childcare expenses, which may be beneficial for budgeting or tax purposes. Overall, the Childcare Receipt form is a straightforward yet vital tool in the realm of childcare services.

Common mistakes

-

Leaving the date blank: It is important to fill in the date of the service. Without this information, the receipt may be considered incomplete.

-

Not including the amount paid: Ensure that the amount for the childcare services is clearly stated. Omitting this detail can lead to confusion later.

-

Forgetting to write the name of the child(ren): Always include the names of the children receiving care. This helps in identifying the services provided.

-

Neglecting the provider’s signature: The signature of the childcare provider is essential. Without it, the receipt may not be valid.

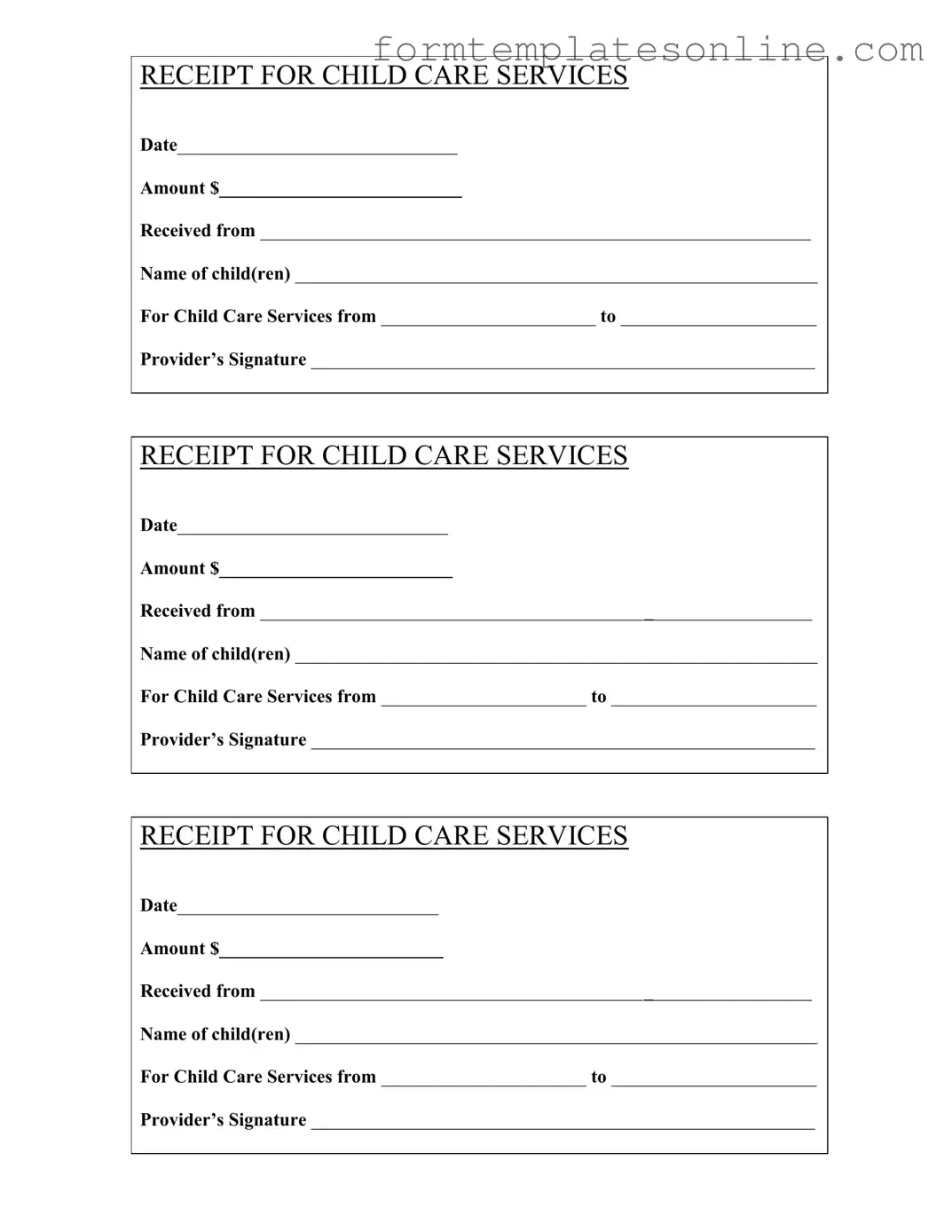

Example - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

More About Childcare Receipt

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a record of payment for childcare services. It provides essential details such as the date of service, amount paid, and the names of the children receiving care. This documentation is useful for both parents and childcare providers for tracking payments and may also be needed for tax purposes.

What information do I need to fill out on the form?

You will need to provide several key pieces of information. This includes the date of payment, the amount paid, the name of the person making the payment, the names of the children receiving care, the period during which the childcare services were provided, and the signature of the childcare provider. Each of these elements is crucial for creating a valid receipt.

How do I use the Childcare Receipt form for tax deductions?

If you are eligible for tax deductions related to childcare expenses, the receipt can be an important document. When filing your taxes, you may need to provide proof of payment for childcare services. Ensure that the form is filled out correctly and keep it with your tax records to substantiate your claims.

Can I request a Childcare Receipt if I paid in cash?

Yes, you can and should request a Childcare Receipt even if you paid in cash. It is essential to have a formal record of the transaction. The receipt not only confirms that you made the payment but also provides details that may be necessary for your records or tax filings.

Is the Childcare Receipt form the same for all childcare providers?

While the basic structure of the Childcare Receipt form may be similar, individual childcare providers may have their own variations. Some may include additional information or specific terms. Always check with your provider to ensure you are using the correct form for their services.

What if I lose the Childcare Receipt?

If you lose the receipt, it is advisable to contact your childcare provider to request a duplicate. They should have a record of the payment and can issue a new receipt. Keeping a digital copy of important documents can help prevent issues in the future.

Do I need to provide my Social Security number on the form?

Generally, you do not need to provide your Social Security number on the Childcare Receipt form. However, some childcare providers may ask for it for their records. It’s best to check with your provider about their specific requirements.

How can I ensure that the Childcare Receipt is valid?

To ensure the receipt is valid, make sure all required information is filled out completely and accurately. The provider's signature is also crucial, as it verifies that the receipt is legitimate. If you have any doubts, confirm with the provider that the receipt is authentic.

Can I use the Childcare Receipt form for multiple children?

Yes, the Childcare Receipt form can accommodate multiple children. You can list all the names of the children receiving care on the same receipt, making it easier to track payments for siblings. Just ensure that the service dates and payment details apply to all listed children.

What should I do if there is an error on the receipt?

If you notice an error on the receipt, such as an incorrect amount or name, contact your childcare provider immediately. They can issue a corrected receipt. It’s important to have accurate documentation, especially for financial records or tax purposes.

Key takeaways

When filling out and using the Childcare Receipt form, consider the following key takeaways:

- Date: Always include the date on which the payment was made. This helps in maintaining accurate records.

- Amount: Clearly state the total amount received for childcare services. This figure should match the payment made.

- Received From: Fill in the name of the individual or organization making the payment. Accurate identification is crucial for record-keeping.

- Name of Child(ren): List the names of all children for whom childcare services were provided. This ensures clarity in the services rendered.

- Service Dates: Specify the start and end dates of the childcare services. This information is vital for both providers and parents.

- Provider’s Signature: The childcare provider must sign the receipt. This signature confirms the legitimacy of the transaction.

- Keep Copies: Always retain a copy of the completed receipt for your records. This can be useful for tax purposes or disputes.

- Use Consistently: Use this form consistently for all transactions to maintain uniformity in record-keeping.

- Review for Accuracy: Before finalizing, double-check all entries for accuracy. Errors can lead to confusion or disputes later.

- Understand Tax Implications: Be aware that childcare receipts can be used for tax deductions. Ensure that all information is correct to maximize benefits.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form serves as proof of payment for childcare services rendered. |

| Date Requirement | The form must include the date when the childcare services were provided. |

| Amount | The total amount paid for childcare services must be clearly stated on the form. |

| Recipient Information | The name of the individual or entity receiving the childcare services must be included. |

| Child's Name | The names of the child or children receiving care should be listed on the form. |

| Provider's Signature | A signature from the childcare provider is required to validate the receipt. |

Other PDF Forms

Cg 2010 Form 07/04 - Each additional insured must be carefully identified within the policy schedule.

For those seeking to prepare this essential document, resources such as OnlineLawDocs.com provide valuable guidance on how to properly execute a New York Durable Power of Attorney, ensuring clarity and legal compliance in the process of appointing an agent for financial management.

How to Tell If You Had a Miscarriage - It serves as a formal notice regarding the option to register a fetal death in the state.

Abn for Medicare - The form encourages proactive financial planning for individuals relying on Medicare for healthcare expenses.

Dos and Don'ts

When filling out the Childcare Receipt form, there are several important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do write the date clearly.

- Do include the exact amount paid.

- Do ensure the recipient's name is spelled correctly.

- Do list the names of all children receiving care.

- Do specify the dates of service accurately.

- Do sign the form to validate the receipt.

- Don't leave any sections blank.

- Don't use abbreviations that could cause confusion.

- Don't forget to keep a copy for your records.

- Don't alter any information after it has been filled out.