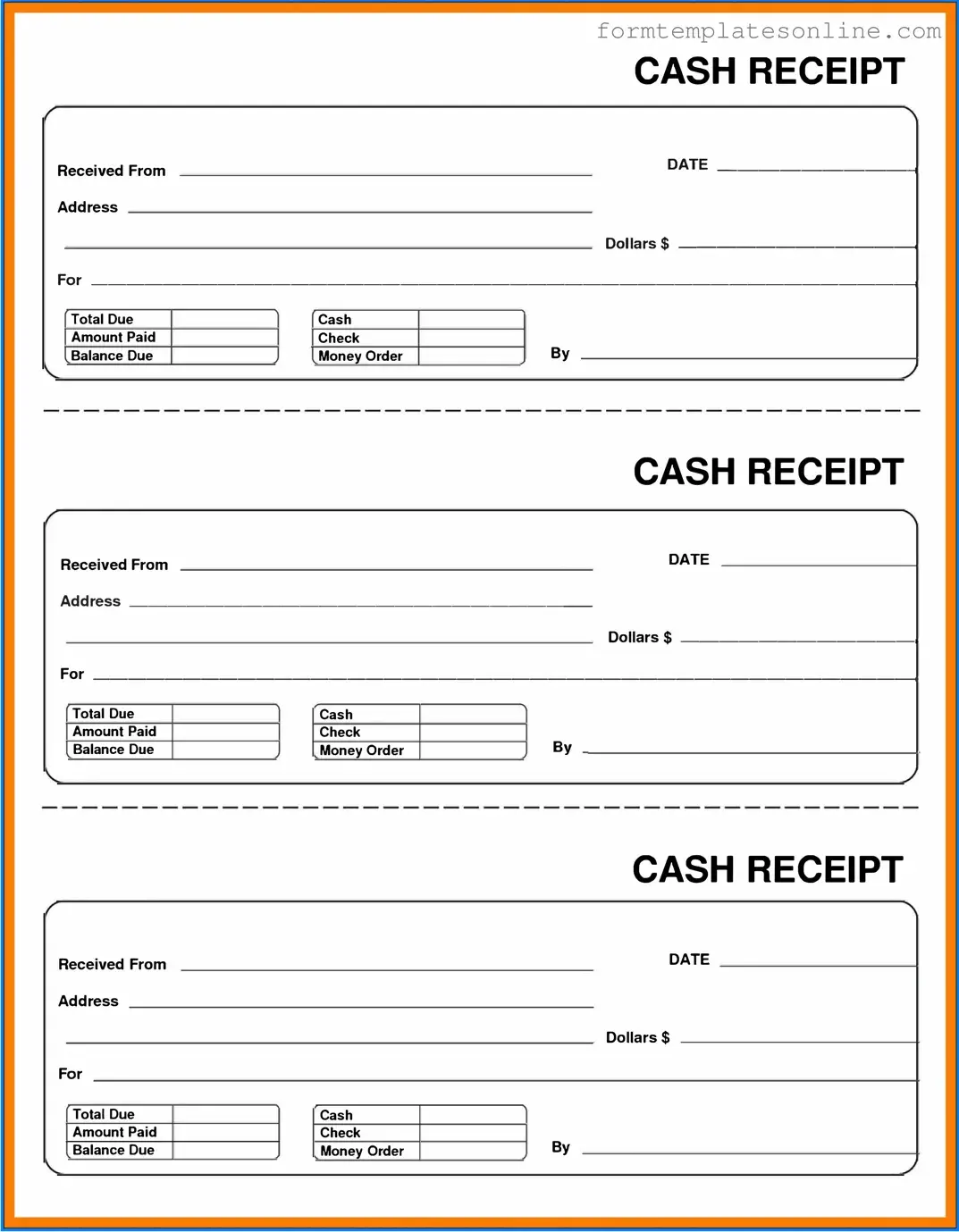

Cash Receipt PDF Form

When managing finances, clarity and organization are key. The Cash Receipt form serves as an essential tool for documenting cash transactions, ensuring that every payment is accurately recorded. This form typically includes important details such as the date of the transaction, the amount received, and the name of the individual or entity making the payment. Additionally, it often features a unique receipt number for easy tracking and reference. By providing a clear record, the Cash Receipt form helps prevent discrepancies and supports effective financial management. Whether used by businesses, non-profits, or individuals, this form plays a crucial role in maintaining transparency and accountability in cash handling.

Common mistakes

-

Missing Date: One common mistake is failing to write the date on the form. Without a date, it can be difficult to track when the payment was received.

-

Incorrect Amount: People sometimes write the wrong payment amount. Double-checking the figures can prevent confusion later.

-

Omitting Payer Information: Not including the name or contact details of the payer can lead to issues in the future, especially if there are questions about the payment.

-

Neglecting Purpose of Payment: Failing to specify what the payment is for can create misunderstandings. Clearly stating the purpose helps maintain accurate records.

-

Not Signing the Form: Some individuals forget to sign the receipt. A signature adds authenticity and confirms that the transaction has been acknowledged.

-

Using Unclear Language: Vague descriptions can lead to confusion. It’s important to be specific and clear about the transaction details.

-

Ignoring Payment Method: Not indicating how the payment was made, whether by cash, check, or credit card, can complicate record-keeping.

-

Failing to Keep a Copy: Some people forget to make a copy of the receipt for their records. Keeping a copy is essential for tracking finances and for future reference.

Example - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

More About Cash Receipt

What is a Cash Receipt form?

A Cash Receipt form is a document used to record the receipt of cash payments. It serves as proof of payment for transactions and is essential for maintaining accurate financial records. This form typically includes details such as the date of the transaction, the amount received, the purpose of the payment, and the name of the payer.

Why is it important to use a Cash Receipt form?

Using a Cash Receipt form is crucial for several reasons. It provides a clear record of cash transactions, which helps in tracking income and managing finances. Additionally, it can protect both the payer and the receiver by serving as a formal acknowledgment of payment. This documentation can be vital during audits or financial reviews.

Who should complete the Cash Receipt form?

The Cash Receipt form should be completed by the person or department receiving the cash payment. This could be a cashier, an accounts receivable clerk, or any authorized personnel responsible for handling cash transactions. Ensuring that the form is filled out accurately is essential for maintaining proper records.

What information is required on the Cash Receipt form?

Essential information on the Cash Receipt form includes the date of the transaction, the name of the payer, the amount received, the method of payment (cash, check, credit card, etc.), and a description of the purpose of the payment. Some forms may also require a signature from the person receiving the cash.

How should I store completed Cash Receipt forms?

Completed Cash Receipt forms should be stored securely to protect sensitive financial information. It is advisable to keep both physical copies and digital records, if possible. Organizing these forms by date or transaction type can make it easier to retrieve them when needed for reference or audits.

Can a Cash Receipt form be modified after it is completed?

Once a Cash Receipt form is completed and signed, it should not be altered. If a mistake is made, it is best to create a new form and indicate that it replaces the previous one. This approach maintains the integrity of the records and provides a clear audit trail.

What should I do if I lose a Cash Receipt form?

If a Cash Receipt form is lost, it is important to document the situation. Notify your supervisor or the appropriate department immediately. Depending on your organization’s policies, you may need to create a replacement form, noting that it is a duplicate and explaining the circumstances of the loss.

Are there any legal implications associated with Cash Receipt forms?

Yes, Cash Receipt forms can have legal implications. They serve as official documentation of financial transactions, which can be important in case of disputes or audits. Maintaining accurate and complete records helps protect against potential legal issues and ensures compliance with financial regulations.

Key takeaways

When dealing with a Cash Receipt form, understanding its purpose and proper usage is crucial. Here are some key takeaways to keep in mind:

- Purpose: The Cash Receipt form serves as a record of cash transactions. It documents the receipt of cash payments for goods or services.

- Accuracy: Ensure all details are filled out accurately. Mistakes can lead to confusion and potential financial discrepancies.

- Date of Transaction: Always include the date when the cash was received. This helps in maintaining a clear timeline of transactions.

- Payment Details: Clearly state the amount received and the purpose of the payment. This provides clarity for both the payer and the receiver.

- Signature: A signature from the person receiving the cash adds authenticity to the transaction and serves as proof of receipt.

- Record Keeping: Keep a copy of the Cash Receipt form for your records. This is important for tracking income and for tax purposes.

- Distribution: Provide a copy to the payer as a receipt. This not only confirms their payment but also serves as a reference for future inquiries.

Using the Cash Receipt form correctly can streamline your financial processes and enhance accountability.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document cash transactions received by a business or organization. |

| Record Keeping | This form serves as an important record for accounting and auditing purposes. |

| Receipt Number | Each Cash Receipt form should have a unique receipt number for tracking. |

| Date of Transaction | The date when the cash was received must be clearly indicated on the form. |

| Amount Received | The total amount of cash received must be accurately recorded. |

| Payer Information | Details about the payer, such as name and contact information, should be included. |

| Purpose of Payment | The form should specify the reason for the cash payment, providing clarity for both parties. |

| Authorized Signatures | Signatures from authorized personnel validate the transaction and ensure accountability. |

| State-Specific Requirements | Some states may have specific laws governing cash transactions and receipt documentation. |

| Retention Period | Businesses should retain Cash Receipt forms for a minimum period, often dictated by tax regulations. |

Other PDF Forms

How to Fill Out Disability Forms - It requires information about your medical condition and work history.

For those seeking an informative resource, the complete guide to Golf Cart Bill of Sale essentials provides valuable insights into the documentation needed for a smooth transaction.

How to File a Trespassing Order - Notify individuals in writing that they must not enter your property under any circumstances.

Dos and Don'ts

When filling out the Cash Receipt form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here’s a helpful list of dos and don’ts:

- Do double-check all amounts before submitting the form to avoid errors.

- Do ensure that all required fields are completed, including date, amount, and payer information.

- Do keep a copy of the completed form for your records.

- Do use clear and legible handwriting or type the information to prevent misunderstandings.

- Don’t leave any fields blank; missing information can lead to processing delays.

- Don’t use correction fluid or tape on the form; it’s better to start over if a mistake is made.

- Don’t forget to sign the form if a signature is required; this step is crucial for validation.

- Don’t submit the form without reviewing it thoroughly for accuracy.