Cash Drawer Count Sheet PDF Form

The Cash Drawer Count Sheet form is an essential tool for businesses that handle cash transactions. This form serves multiple purposes, primarily aiding in the accurate tracking of cash flow and ensuring that all financial records align. By documenting the cash on hand at the beginning and end of a shift, it provides a clear overview of daily cash activity. Each entry on the sheet typically includes the date, the name of the employee responsible for the cash drawer, and a detailed breakdown of the cash denominations present. Additionally, discrepancies between the expected cash total and the actual amount can be recorded, which helps in identifying potential errors or theft. This structured approach not only promotes accountability among staff but also enhances overall financial management. Ultimately, the Cash Drawer Count Sheet is a vital component in maintaining transparency and accuracy in cash handling processes.

Common mistakes

-

Inaccurate Totals: One common mistake is failing to double-check the math. When adding up cash, coins, and checks, errors can easily occur. A simple miscalculation can lead to discrepancies that may complicate accounting processes.

-

Omitting Details: Some individuals forget to include all necessary information. Each cash drawer count should document not just the total, but also the breakdown of bills and coins. Missing this information can hinder the reconciliation process.

-

Not Recording Changes: If any adjustments are made to the cash drawer during the shift, they must be noted. Failing to record these changes can create confusion later on, especially if discrepancies arise.

-

Neglecting Signatures: A signature is often required to validate the count. Skipping this step can lead to questions about accountability and may complicate audits or reviews of the cash drawer.

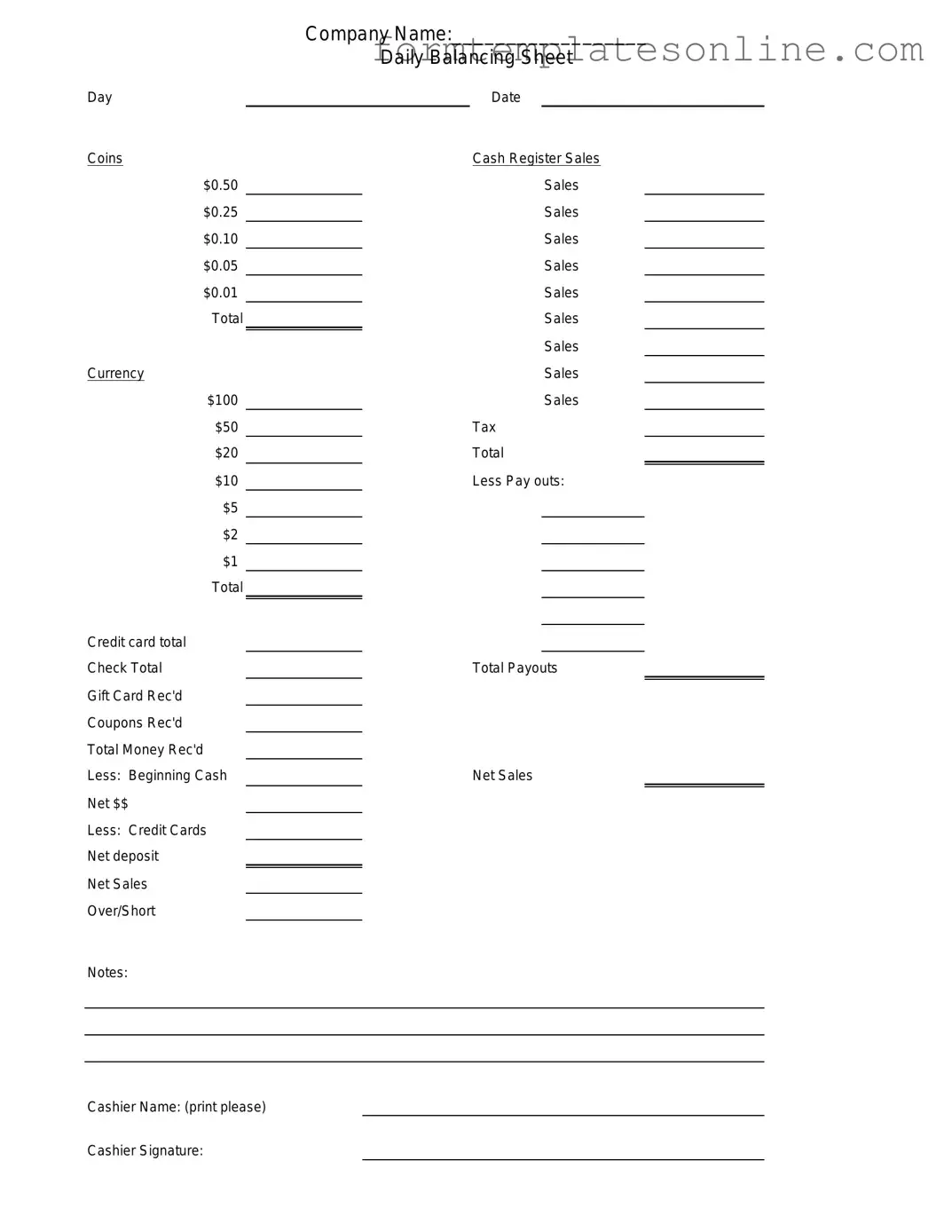

Example - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

More About Cash Drawer Count Sheet

What is a Cash Drawer Count Sheet?

A Cash Drawer Count Sheet is a document used by businesses to track the amount of cash in their cash drawers at the end of a shift or business day. It helps ensure that the cash on hand matches the sales recorded during that time. This form is essential for maintaining accurate financial records and can assist in identifying discrepancies if they arise.

Why is it important to use a Cash Drawer Count Sheet?

Using a Cash Drawer Count Sheet is crucial for several reasons. First, it promotes accountability among cash handlers. By documenting cash counts, businesses can reduce the risk of theft or errors. Second, it helps in reconciling cash sales with the cash on hand, ensuring that all transactions are accounted for. This practice also aids in preparing for audits and maintaining compliance with financial regulations.

How do I fill out a Cash Drawer Count Sheet?

Filling out a Cash Drawer Count Sheet involves several steps. Begin by entering the date and the name of the person completing the count. Next, count the cash in the drawer, including bills and coins, and record each denomination in the appropriate section of the form. Finally, total the amounts to provide a final cash count. It’s important to double-check your figures to ensure accuracy.

What should I do if there is a discrepancy in the cash count?

If you find a discrepancy between the cash count and the recorded sales, it’s important to investigate promptly. Review the sales transactions to ensure all sales were entered correctly. Check for any voids or refunds that may not have been accounted for. If the discrepancy remains unresolved, report it to a supervisor or manager for further review. Documenting the issue is essential for future reference.

Can I use a Cash Drawer Count Sheet for multiple cash drawers?

Yes, a Cash Drawer Count Sheet can be used for multiple cash drawers. If your business operates with several registers or cash drawers, it may be helpful to have a separate count sheet for each one. This way, you can maintain clear records for each location. Just ensure that each sheet is filled out accurately and stored properly for future reference.

Key takeaways

When filling out and utilizing the Cash Drawer Count Sheet form, several important aspects should be considered to ensure accuracy and accountability. Below are key takeaways to keep in mind:

- Accuracy is crucial. Double-check all entries to avoid discrepancies in cash counts.

- Record starting and ending amounts. Clearly note the cash amount at the beginning and end of each shift.

- Document any discrepancies. If there is a difference between expected and actual cash, make a note of it.

- Use clear handwriting. Ensure that all information is legible to prevent misunderstandings.

- Include date and time. Record when the count was performed for reference and tracking purposes.

- Have a designated person responsible. Assign a specific individual to complete the form to maintain accountability.

- Store the form securely. Keep completed Cash Drawer Count Sheets in a safe location for future audits.

- Review regularly. Periodic reviews of the count sheets can help identify trends or issues early.

- Train staff on proper procedures. Ensure all employees understand how to fill out the form correctly to maintain consistency.

By following these guidelines, businesses can better manage their cash handling processes and reduce the risk of errors or theft.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track cash transactions and ensure accountability in cash handling. |

| Components | The form typically includes fields for cash amounts, checks, credit card transactions, and discrepancies. |

| Frequency of Use | It is often completed at the end of each shift or business day to reconcile cash on hand. |

| Record Keeping | Businesses are required to keep these records for a specified period for auditing purposes. |

| Signature Requirement | Managers or cashiers usually must sign the form to verify the accuracy of the cash count. |

| State Regulations | In some states, specific laws govern cash handling and record-keeping practices for businesses. |

| Template Availability | Many businesses use standardized templates for consistency in cash reporting. |

| Training | Employees handling cash should receive training on how to properly fill out the Cash Drawer Count Sheet. |

| Discrepancy Reporting | Any discrepancies noted on the form must be reported to management immediately for further investigation. |

Other PDF Forms

W9 Form 2022 - Companies often update their vendor files with current W-9s to reflect accurate information.

Understanding the importance of a New York Durable Power of Attorney form is essential for ensuring that your financial affairs are managed according to your wishes, especially in times of illness or incapacity. By designating an agent through this legal document, you can have peace of mind knowing that decisions will be made on your behalf. For more information on this important legal tool, visit OnlineLawDocs.com.

J30 Form - Essential for companies to manage their stockholder relationships.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some things to keep in mind:

- Do: Double-check your calculations before submitting the form. Accurate numbers prevent discrepancies.

- Do: Use a pen with blue or black ink. This makes the document clear and professional.

- Do: Sign and date the form after completing it. This adds accountability to the process.

- Do: Keep a copy of the completed form for your records. This can be helpful for future reference.

- Don't: Leave any sections blank. Fill in all required fields to avoid confusion.

- Don't: Use pencil or erasable ink. Changes can lead to misunderstandings.

- Don't: Rush through the process. Take your time to ensure everything is accurate.

- Don't: Forget to notify a supervisor if you find any discrepancies. Transparency is key.