Valid Transfer-on-Death Deed Form for California

The California Transfer-on-Death Deed form serves as a vital tool for property owners looking to streamline the transfer of real estate upon their passing. This legal instrument allows individuals to designate beneficiaries who will inherit their property without the need for probate, simplifying the process significantly. By completing this form, property owners can ensure that their wishes are honored while also potentially reducing the financial burden on their heirs. It is essential to understand the requirements for executing the deed, including the necessity for it to be notarized and recorded with the county recorder's office. Additionally, the form provides flexibility, allowing for the designation of multiple beneficiaries or the ability to revoke the deed if circumstances change. As California continues to evolve its estate planning laws, the Transfer-on-Death Deed remains a practical option for those seeking to maintain control over their assets while providing for their loved ones in the future.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to confusion or disputes. Ensure the legal description matches the title deed.

-

Not Including All Owners: If the property has multiple owners, all must be listed. Omitting an owner can invalidate the deed.

-

Improper Signatures: All owners must sign the deed. If one owner does not sign, the transfer may not be recognized.

-

Missing Witnesses: California law requires the deed to be witnessed. Failing to have the correct number of witnesses can render the deed ineffective.

-

Not Recording the Deed: After filling out the form, it must be recorded with the county recorder's office. Neglecting this step means the deed may not be enforceable.

-

Failure to Understand Revocation: A Transfer-on-Death Deed can be revoked. Not knowing how to properly revoke it can lead to unintended transfers.

Example - California Transfer-on-Death Deed Form

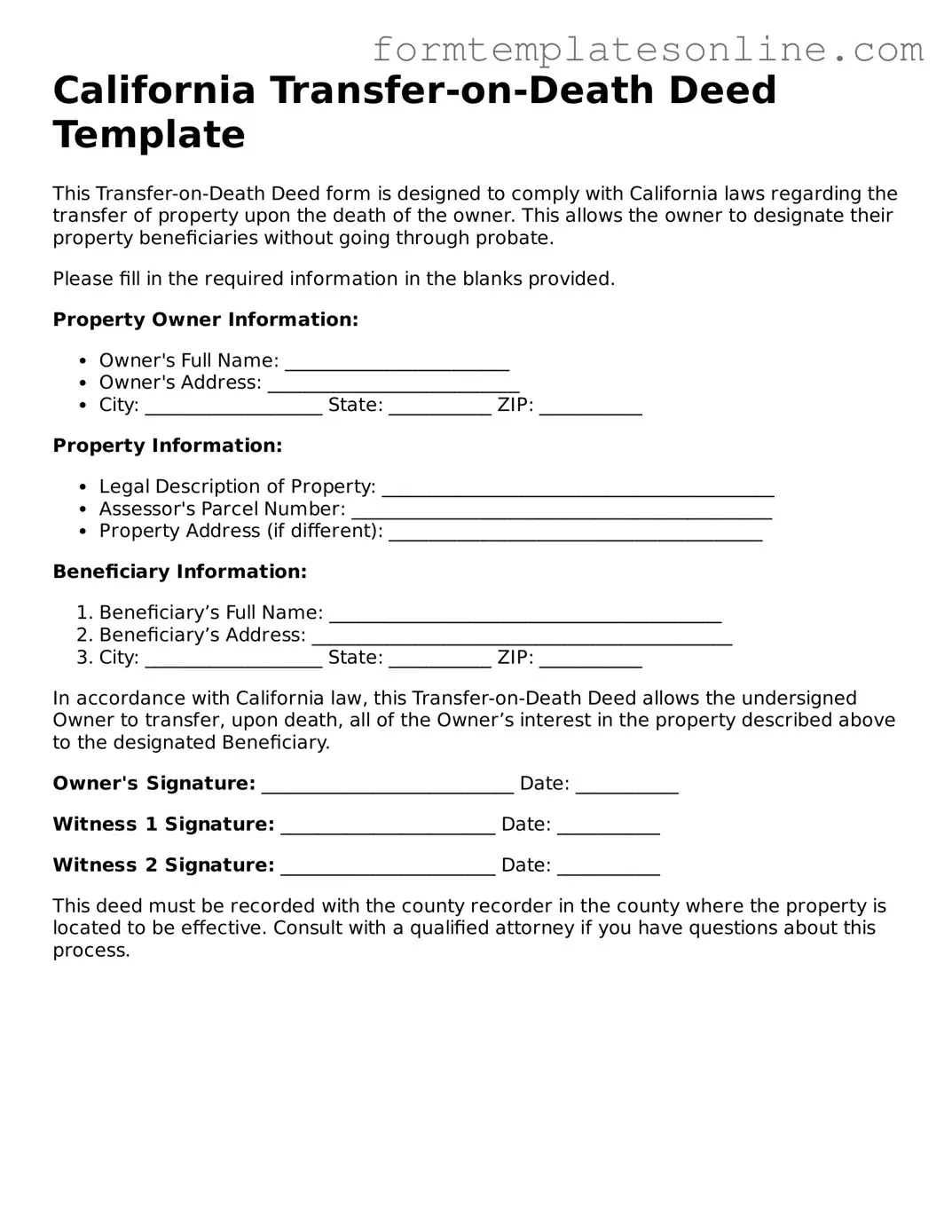

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed form is designed to comply with California laws regarding the transfer of property upon the death of the owner. This allows the owner to designate their property beneficiaries without going through probate.

Please fill in the required information in the blanks provided.

Property Owner Information:

- Owner's Full Name: ________________________

- Owner's Address: ___________________________

- City: ___________________ State: ___________ ZIP: ___________

Property Information:

- Legal Description of Property: __________________________________________

- Assessor's Parcel Number: _____________________________________________

- Property Address (if different): ________________________________________

Beneficiary Information:

- Beneficiary’s Full Name: __________________________________________

- Beneficiary’s Address: _____________________________________________

- City: ___________________ State: ___________ ZIP: ___________

In accordance with California law, this Transfer-on-Death Deed allows the undersigned Owner to transfer, upon death, all of the Owner’s interest in the property described above to the designated Beneficiary.

Owner's Signature: ___________________________ Date: ___________

Witness 1 Signature: _______________________ Date: ___________

Witness 2 Signature: _______________________ Date: ___________

This deed must be recorded with the county recorder in the county where the property is located to be effective. Consult with a qualified attorney if you have questions about this process.

More About California Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in California to transfer their real estate to a designated beneficiary upon their death. This deed helps avoid probate, making the transfer process simpler and faster for heirs.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in California can utilize a Transfer-on-Death Deed. This includes homeowners, co-owners, and those holding property in a trust. However, it is important to ensure that the property is not subject to any restrictions that may prevent the use of a TODD.

How do I create a Transfer-on-Death Deed?

To create a TODD, you must complete the appropriate form, which is available through the California government website or local county recorder's office. After filling out the form, you need to sign it in front of a notary public and then record it with the county where the property is located.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the property owner's death. To revoke it, you must complete a revocation form, sign it, and record it with the county recorder's office where the original TODD was filed.

What happens if I do not name a beneficiary in the Transfer-on-Death Deed?

If you do not name a beneficiary, the property will not transfer upon your death. Instead, it will become part of your estate and will be subject to probate. It is crucial to designate at least one beneficiary to ensure a smooth transfer of ownership.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when executing a Transfer-on-Death Deed. However, beneficiaries may be subject to property taxes and potential capital gains taxes when they sell the property. It’s advisable to consult a tax professional for specific guidance.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for residential real estate in California. It does not apply to personal property, commercial real estate, or properties held in certain types of trusts. Always check the specific details of your property before proceeding.

What if my beneficiary predeceases me?

If your designated beneficiary passes away before you, the property will not automatically transfer to their heirs. Instead, it will revert to your estate and go through probate. To avoid complications, consider naming an alternate beneficiary in your TODD.

Is legal assistance necessary to complete a Transfer-on-Death Deed?

While legal assistance is not required to complete a TODD, it can be beneficial. A legal professional can help ensure that the deed is filled out correctly and meets all legal requirements, reducing the risk of future disputes or complications.

How does a Transfer-on-Death Deed affect my mortgage?

A Transfer-on-Death Deed does not affect your existing mortgage. The mortgage remains in your name, and the beneficiary will inherit the property subject to any outstanding mortgage obligations. It’s important to inform your lender about your plans to use a TODD.

Key takeaways

When considering the California Transfer-on-Death Deed, it is essential to understand its implications and proper usage. Below are key takeaways that can guide you through the process.

- Purpose of the Deed: The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the probate process.

- Eligibility: Any individual who owns real property in California can create a Transfer-on-Death Deed. However, it must be executed while the owner is alive.

- Filling Out the Form: The form requires specific information, including the property description and the names of the beneficiaries. Accuracy is crucial.

- Recording the Deed: To be effective, the completed Transfer-on-Death Deed must be recorded with the county recorder's office where the property is located.

- Revocation: The deed can be revoked at any time before the owner's death. This can be done by recording a new deed or a revocation form.

- Consulting an Attorney: While the form is straightforward, consulting a legal professional can provide clarity and ensure that all requirements are met.

Understanding these aspects can empower property owners to make informed decisions about their estate planning. Properly executed, a Transfer-on-Death Deed can simplify the transfer of property and provide peace of mind for both the owner and their beneficiaries.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD Deed is governed by California Probate Code Section 5600-5695. |

| Eligibility | Any individual who owns real property in California can create a TOD Deed, as long as they are of sound mind. |

| Beneficiary Designation | Property owners can name one or more beneficiaries to receive the property upon their death. |

| Revocability | The Transfer-on-Death Deed can be revoked or modified at any time before the owner's death. |

| No Immediate Transfer | Property ownership does not transfer until the death of the owner, allowing them to retain full control during their lifetime. |

| Exclusions | Transfer-on-Death Deeds cannot be used for certain types of property, such as joint tenancy or community property with right of survivorship. |

| Filing Requirements | The TOD Deed must be recorded with the county recorder's office where the property is located to be effective. |

| Tax Implications | There may be tax implications for beneficiaries, including property tax reassessment, so consulting a tax professional is advisable. |

| Form Availability | California provides a standard form for the Transfer-on-Death Deed, which can be accessed online or through legal resources. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Free Printable Transfer on Death Deed Form Florida - The Transfer-on-Death Deed is not effective until the owner passes away, giving them full control during their lifetime.

A West Virginia Promissory Note serves as a legally binding agreement between parties, detailing the conditions of a loan, including interest rates and payment schedules. For those looking to ensure a clear understanding and protection in their lending arrangements, it is essential to utilize the correct documentation. If you're ready to formalize a loan agreement, consider filling out the Promissory Note form to streamline the process.

Texas Life Estate Deed Form - This form can facilitate a smoother transition for property ownership and reduce administrative burdens on survivors.

Where Can I Get a Tod Form - This deed can help you avoid potential family conflicts regarding property ownership after your passing.

How to Avoid Probate in Pa - The deed can help to ensure that specific wishes are honored regarding property distribution.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of things you should and shouldn’t do:

- Do ensure you understand the purpose of the Transfer-on-Death Deed.

- Do provide accurate property descriptions.

- Do include the names and information of all beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do file the deed with the county recorder’s office promptly.

- Don't use vague or unclear language in the deed.

- Don't forget to check for any outstanding liens on the property.

- Don't neglect to inform beneficiaries about the deed.

- Don't attempt to fill out the form without proper guidance if needed.

- Don't overlook the importance of keeping a copy of the filed deed.