Valid Tractor Bill of Sale Form for California

In the bustling world of agriculture and machinery, the California Tractor Bill of Sale form serves as a crucial document for anyone involved in the buying or selling of tractors. This form not only facilitates a smooth transaction but also provides essential protection for both the buyer and the seller. It captures vital information such as the names and addresses of both parties, the tractor's make, model, year, and identification number, ensuring that all details are accurately recorded. Additionally, the form outlines the sale price, any warranties or guarantees, and the date of the transaction, which helps establish a clear understanding of the agreement. By formalizing the sale with this document, individuals can safeguard their interests and maintain a transparent record of ownership transfer, thus avoiding potential disputes in the future. Whether you are a seasoned farmer or a first-time buyer, understanding the intricacies of this form can significantly ease the process of acquiring or selling a tractor in California.

Common mistakes

-

Failing to include the date of sale. This is crucial for establishing the timeline of ownership.

-

Not providing complete seller information. Ensure that the full name and contact details are accurate to avoid future disputes.

-

Overlooking the buyer information. Just like the seller, the buyer's details must be correctly filled out to ensure proper transfer of ownership.

-

Neglecting to include the tractor identification number (VIN). This unique number is essential for identifying the specific tractor being sold.

-

Not specifying the purchase price. Clearly stating the amount paid is important for tax purposes and future reference.

-

Using vague descriptions of the tractor. Providing a detailed description helps avoid confusion and ensures both parties are on the same page.

-

Failing to sign the document. Both the seller and buyer must sign the bill of sale to validate the transaction.

-

Not including any conditions of sale. If there are specific terms or conditions, they should be clearly outlined to prevent misunderstandings.

-

Forgetting to keep a copy of the bill of sale. Retaining a copy for personal records is essential for both parties in case of future inquiries.

-

Not checking for errors before submission. A simple mistake can lead to complications, so reviewing the form thoroughly is advisable.

Example - California Tractor Bill of Sale Form

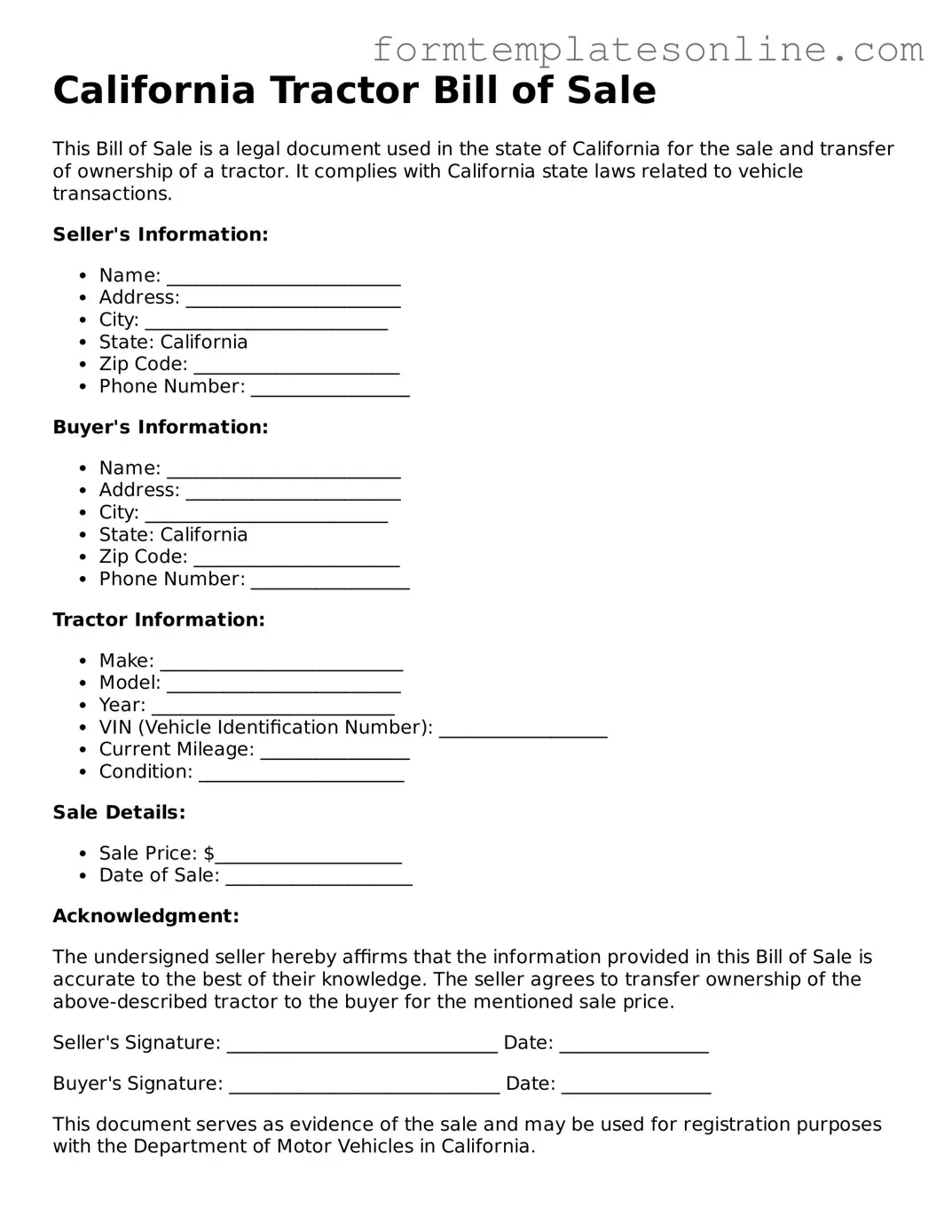

California Tractor Bill of Sale

This Bill of Sale is a legal document used in the state of California for the sale and transfer of ownership of a tractor. It complies with California state laws related to vehicle transactions.

Seller's Information:

- Name: _________________________

- Address: _______________________

- City: __________________________

- State: California

- Zip Code: ______________________

- Phone Number: _________________

Buyer's Information:

- Name: _________________________

- Address: _______________________

- City: __________________________

- State: California

- Zip Code: ______________________

- Phone Number: _________________

Tractor Information:

- Make: __________________________

- Model: _________________________

- Year: __________________________

- VIN (Vehicle Identification Number): __________________

- Current Mileage: ________________

- Condition: ______________________

Sale Details:

- Sale Price: $____________________

- Date of Sale: ____________________

Acknowledgment:

The undersigned seller hereby affirms that the information provided in this Bill of Sale is accurate to the best of their knowledge. The seller agrees to transfer ownership of the above-described tractor to the buyer for the mentioned sale price.

Seller's Signature: _____________________________ Date: ________________

Buyer's Signature: _____________________________ Date: ________________

This document serves as evidence of the sale and may be used for registration purposes with the Department of Motor Vehicles in California.

More About California Tractor Bill of Sale

What is a California Tractor Bill of Sale form?

The California Tractor Bill of Sale form is a legal document used to record the sale of a tractor between a buyer and a seller. This form serves as proof of the transaction and includes essential details such as the make, model, year, and identification number of the tractor. It also outlines the sale price and the names and addresses of both parties involved. Having this document helps protect both the buyer and seller by providing clear evidence of the transaction.

Why is it important to have a Bill of Sale for a tractor?

A Bill of Sale is crucial for several reasons. First, it acts as a receipt for the buyer, confirming that they have purchased the tractor. Second, it protects the seller by documenting that they have transferred ownership. In California, having a Bill of Sale can also be necessary for registering the tractor with the Department of Motor Vehicles (DMV) or for tax purposes. Without this document, disputes can arise over ownership, and it may complicate future transactions.

What information is typically included in the Tractor Bill of Sale?

The Tractor Bill of Sale typically includes several key pieces of information. This includes the date of the sale, the names and addresses of both the buyer and seller, a detailed description of the tractor (including make, model, year, and VIN), and the sale price. Additionally, there may be sections for signatures from both parties, which serve to validate the document. Some forms may also include a statement regarding the condition of the tractor at the time of sale.

Is a Bill of Sale required by law in California?

Can I create my own Tractor Bill of Sale?

Yes, you can create your own Tractor Bill of Sale. However, it is important to ensure that it includes all necessary information to be valid and useful. Many templates are available online, which can guide you in drafting the document. Make sure to include all relevant details such as the description of the tractor, sale price, and both parties’ information. Additionally, both the buyer and seller should sign the document to make it legally binding.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer may need to present this document when registering the tractor with the DMV or for any tax-related purposes. If applicable, the seller should also ensure that the title is transferred properly to the buyer. This may involve submitting additional paperwork to the DMV, depending on the specific circumstances of the sale.

Key takeaways

Filling out and using the California Tractor Bill of Sale form is essential for both buyers and sellers. Here are some key takeaways to keep in mind:

- Complete Information: Ensure that all fields are filled out accurately, including the names and addresses of both the buyer and seller.

- Tractor Details: Include specific details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN).

- Sale Price: Clearly state the sale price of the tractor. This helps in establishing the value of the transaction.

- Signatures Required: Both the buyer and seller must sign the form to make it legally binding.

- Date of Sale: Include the date when the sale takes place. This is important for record-keeping.

- As-Is Condition: If the tractor is sold "as-is," make sure to note that on the form to clarify the terms of the sale.

- Notarization: While not always required, having the bill of sale notarized can add an extra layer of security.

- Keep Copies: Both parties should keep a copy of the completed bill of sale for their records.

- Transfer of Title: Remember that the bill of sale is not a title transfer; ensure you complete the title transfer process separately.

- Consult Local Laws: Check any local regulations that may apply to the sale of agricultural equipment in your area.

By following these guidelines, you can ensure a smooth transaction when buying or selling a tractor in California.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The California Tractor Bill of Sale form is used to document the sale of a tractor in California. |

| Governing Law | This form is governed by California Vehicle Code § 5901 and related regulations. |

| Parties Involved | The form requires information about both the seller and the buyer. |

| Vehicle Information | Details about the tractor, including make, model, year, and VIN, must be included. |

| Sales Price | The agreed-upon sales price for the tractor needs to be clearly stated. |

| Signatures | Both the seller and the buyer must sign the form to validate the transaction. |

| Date of Sale | The date when the sale occurs should be indicated on the form. |

| Witness Requirement | While not mandatory, having a witness sign can add an extra layer of protection. |

| Record Keeping | It is advisable for both parties to keep a copy of the completed bill of sale for their records. |

| Transfer of Ownership | The bill of sale serves as proof of ownership transfer, which may be necessary for registration. |

Consider Some Other Tractor Bill of Sale Forms for US States

Georgia Bill of Sale for Car - Records the sale date and transfer of ownership.

The use of a Georgia Non-disclosure Agreement (NDA) is crucial for individuals and organizations looking to protect their confidential information. By entering into this legal document, parties commit to safeguarding sensitive data from unauthorized sharing, which is essential in today's competitive landscape. To create and finalize such agreements, resources like OnlineLawDocs.com can provide valuable guidance and templates.

Bill of Sale Truck - Helps simplify the process for non-professionals selling tractors.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to do and avoid:

- Do provide accurate information about the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- Do include the full names and addresses of both the buyer and seller.

- Do clearly state the sale price of the tractor.

- Do sign and date the form to validate the transaction.

- Don't leave any required fields blank; incomplete information can lead to delays.

- Don't use outdated forms; always check for the most current version.

- Don't forget to keep a copy of the completed form for your records.