Valid Promissory Note Form for California

In California, a Promissory Note serves as a crucial financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This form captures essential details such as the loan amount, interest rate, repayment schedule, and the consequences of default. By clearly stating the obligations of both parties, it minimizes misunderstandings and provides a legal framework for enforcing repayment. The document can be tailored to suit various types of loans, whether for personal use, business financing, or real estate transactions. Additionally, it may include provisions for prepayment, late fees, and collateral, ensuring that all aspects of the agreement are addressed. Understanding the significance of a Promissory Note in California is vital for anyone involved in lending or borrowing money, as it lays the foundation for a transparent and enforceable financial relationship.

Common mistakes

-

Not Clearly Identifying the Parties: One common mistake is failing to clearly identify the borrower and the lender. It’s essential to include full names and contact information. Without this clarity, it can lead to confusion about who is responsible for repayment.

-

Omitting Key Terms: Some individuals forget to include important terms such as the interest rate, payment schedule, and due dates. Leaving out these details can create misunderstandings later on, making it difficult to enforce the agreement.

-

Neglecting to Sign and Date: A significant error occurs when the parties do not sign or date the document. A promissory note is not legally binding without the signatures of both the borrower and the lender. Always double-check for signatures before finalizing the document.

-

Failing to Specify Default Terms: Another mistake is not outlining what happens in case of default. It’s important to include provisions for late payments or failure to repay. This information provides clarity and protects the lender's interests.

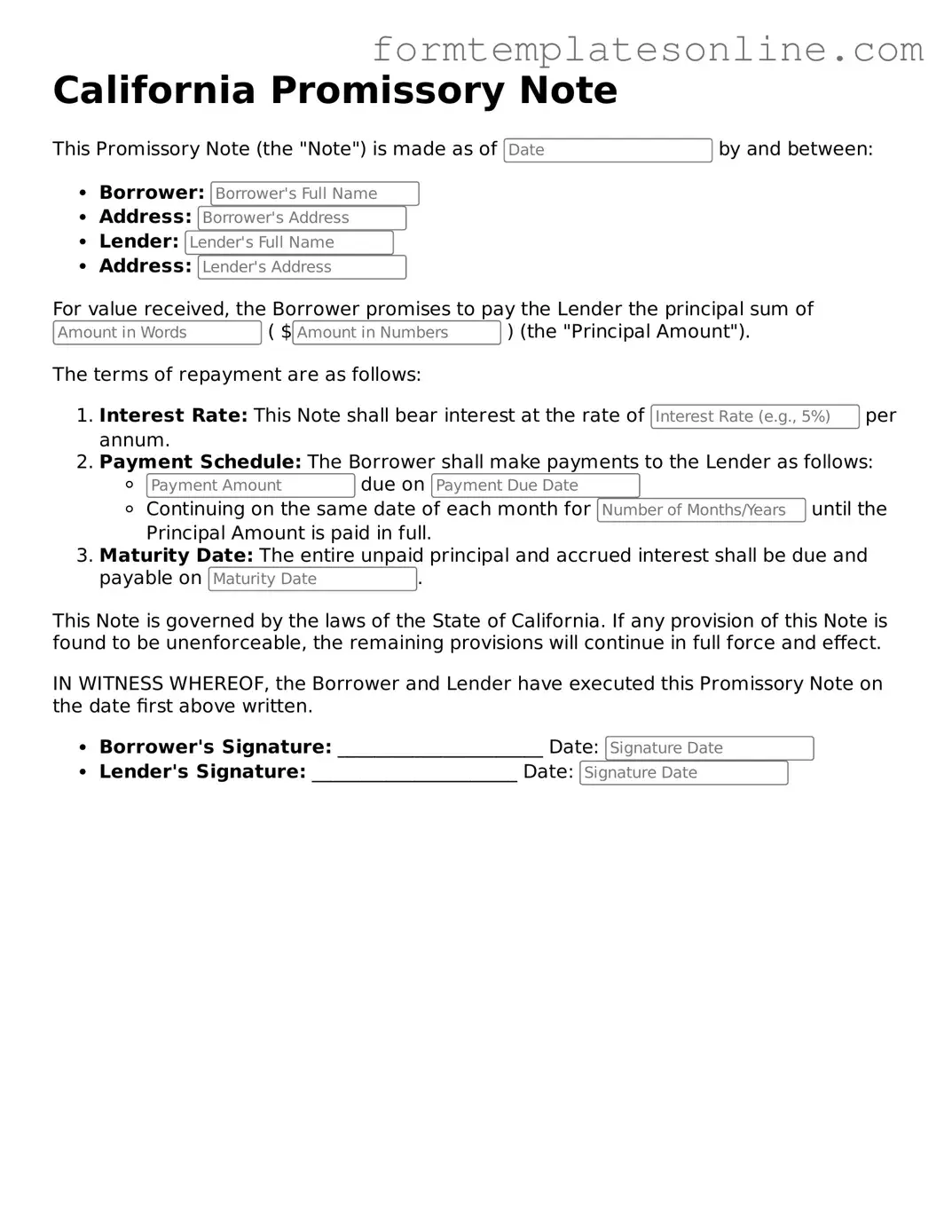

Example - California Promissory Note Form

California Promissory Note

This Promissory Note (the "Note") is made as of by and between:

- Borrower:

- Address:

- Lender:

- Address:

For value received, the Borrower promises to pay the Lender the principal sum of ( $ ) (the "Principal Amount").

The terms of repayment are as follows:

- Interest Rate: This Note shall bear interest at the rate of per annum.

- Payment Schedule: The Borrower shall make payments to the Lender as follows:

- due on

- Continuing on the same date of each month for until the Principal Amount is paid in full.

- Maturity Date: The entire unpaid principal and accrued interest shall be due and payable on .

This Note is governed by the laws of the State of California. If any provision of this Note is found to be unenforceable, the remaining provisions will continue in full force and effect.

IN WITNESS WHEREOF, the Borrower and Lender have executed this Promissory Note on the date first above written.

- Borrower's Signature: ______________________ Date:

- Lender's Signature: ______________________ Date:

More About California Promissory Note

What is a California Promissory Note?

A California Promissory Note is a written agreement in which one party promises to pay a specified amount of money to another party under agreed-upon terms. This document outlines the loan amount, interest rate, repayment schedule, and any penalties for late payment. It serves as a legal record of the debt and the obligations of both parties involved.

Who can use a Promissory Note in California?

Any individual or business can use a Promissory Note in California. It is commonly utilized between friends, family members, or business partners. However, it is essential that both parties understand the terms and conditions outlined in the note before signing.

What should be included in a California Promissory Note?

A complete California Promissory Note should include the following elements: the names and addresses of both the borrower and lender, the principal amount of the loan, the interest rate (if applicable), repayment terms (including due dates), and any penalties for late payments. Additionally, it should specify whether the note is secured or unsecured, and it is advisable to include a section for signatures and dates.

Is it necessary to notarize a Promissory Note in California?

Notarization is not required for a Promissory Note to be legally binding in California. However, having the document notarized can provide an extra layer of security and help prevent disputes about the authenticity of the signatures. It is often recommended for larger amounts or more formal agreements.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan according to the terms outlined in the Promissory Note, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. The lender may also be able to collect any accrued interest and fees as specified in the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps ensure clarity and prevents misunderstandings in the future.

Are there different types of Promissory Notes?

Yes, there are different types of Promissory Notes. Some common types include secured notes, which are backed by collateral, and unsecured notes, which are not. Additionally, notes can vary based on their terms, such as fixed-rate versus variable-rate interest, or short-term versus long-term repayment schedules.

Where can I obtain a California Promissory Note form?

You can obtain a California Promissory Note form from various sources, including legal stationery stores, online legal form providers, or through legal professionals. Ensure that the form you choose complies with California laws and is suitable for your specific situation.

Key takeaways

When dealing with a California Promissory Note, it is essential to understand the key elements involved in its completion and use. Below are important takeaways that can guide individuals through the process.

- Understand the Purpose: A promissory note is a legal document that outlines a borrower's promise to repay a loan to the lender under specified terms.

- Identify the Parties: Clearly state the names and contact information of both the borrower and the lender. This ensures that all parties are easily identifiable.

- Specify the Loan Amount: The total amount of money being borrowed must be clearly indicated. This figure should be accurate and agreed upon by both parties.

- Outline the Interest Rate: If applicable, include the interest rate that will be charged on the loan. This can be fixed or variable, but it must be clearly stated.

- Detail the Repayment Terms: Specify how and when the borrower will repay the loan. Include payment frequency, due dates, and any grace periods.

- Include Late Fees: If there are penalties for late payments, these should be clearly defined. This helps to protect the lender's interests.

- Address Prepayment: Indicate whether the borrower can pay off the loan early without penalties. This can be an attractive option for borrowers.

- Consider Collateral: If the loan is secured, describe the collateral involved. This provides the lender with a form of security in case of default.

- Sign and Date: Both parties must sign and date the document for it to be legally binding. Ensure that all signatures are witnessed if required.

- Keep Copies: Each party should retain a copy of the signed promissory note for their records. This serves as proof of the agreement.

Understanding these key aspects can help ensure that the promissory note is filled out correctly and serves its intended purpose effectively.

File Details

| Fact Name | Details |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The California Civil Code, particularly sections 3300 to 3400, governs promissory notes in California. |

| Types | There are various types of promissory notes, including secured and unsecured notes, and demand notes. |

| Interest Rates | The note may specify an interest rate, which must comply with California usury laws. |

| Signatures | To be valid, the note must be signed by the borrower; electronic signatures are acceptable under California law. |

| Enforceability | A promissory note is enforceable in court if it is clear, unambiguous, and meets legal requirements. |

| Default Consequences | If the borrower defaults, the lender may pursue legal remedies, including collection actions or foreclosure on collateral. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Friendly Loan Agreement Format - Promissory Notes can facilitate private funding by providing a tangible record of debt.

For anyone needing to delegate authority, the importance of a General Power of Attorney form cannot be overstated. This document enables individuals to ensure their preferences are honored, making it crucial for managing financial matters effectively. To learn more about this vital resource, visit the comprehensive guide on filling out a General Power of Attorney form.

Promissory Note Illinois - This document empowers individuals to enter into financial agreements with confidence.

Create a Promissory Note - The terms of the note can be negotiated between the parties involved.

Dos and Don'ts

When filling out the California Promissory Note form, following certain guidelines can help ensure accuracy and clarity. Here are ten important do's and don'ts:

- Do read the entire form carefully before starting.

- Do provide accurate information for all required fields.

- Do include the date when the note is signed.

- Do specify the loan amount clearly in numbers and words.

- Do outline the repayment terms in detail.

- Don't leave any fields blank unless instructed to do so.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to sign and date the form.

- Don't alter the form or use white-out; make corrections clearly.

- Don't ignore the importance of keeping a copy for your records.