Valid Loan Agreement Form for California

The California Loan Agreement form serves as a crucial document in the realm of lending and borrowing, outlining the terms and conditions that govern a loan transaction between a lender and a borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It also specifies the rights and responsibilities of both parties, ensuring clarity and mutual understanding. Furthermore, the agreement may address potential fees, late payment penalties, and default conditions, which are vital for protecting the interests of both the lender and the borrower. By providing a structured framework for the loan arrangement, this form helps to minimize misunderstandings and disputes, fostering a more secure and transparent lending environment in California.

Common mistakes

-

Incorrect Borrower Information: Many individuals fail to provide accurate personal information. This includes names, addresses, and social security numbers. Errors in this section can lead to significant delays in processing the loan.

-

Missing Signatures: It is crucial to ensure that all required parties sign the agreement. Omitting a signature can render the document invalid, causing complications down the line.

-

Improper Loan Amount: Borrowers often miscalculate the total loan amount needed. This can result in insufficient funds for the intended purpose, leading to financial strain.

-

Neglecting Terms and Conditions: Some individuals overlook the importance of thoroughly reading the terms and conditions. This oversight can lead to misunderstandings regarding repayment schedules and interest rates.

Example - California Loan Agreement Form

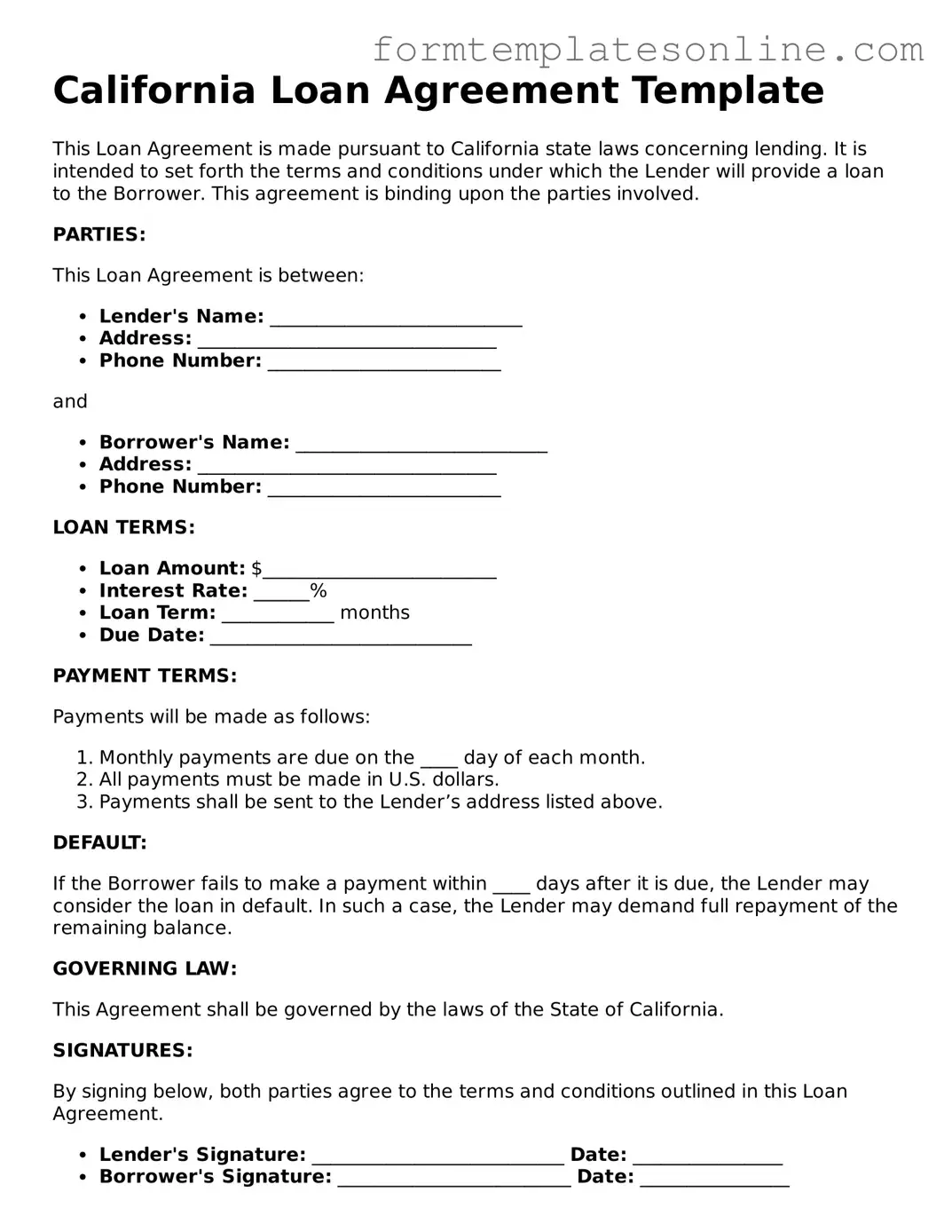

California Loan Agreement Template

This Loan Agreement is made pursuant to California state laws concerning lending. It is intended to set forth the terms and conditions under which the Lender will provide a loan to the Borrower. This agreement is binding upon the parties involved.

PARTIES:

This Loan Agreement is between:

- Lender's Name: ___________________________

- Address: ________________________________

- Phone Number: _________________________

and

- Borrower's Name: ___________________________

- Address: ________________________________

- Phone Number: _________________________

LOAN TERMS:

- Loan Amount: $_________________________

- Interest Rate: ______%

- Loan Term: ____________ months

- Due Date: ____________________________

PAYMENT TERMS:

Payments will be made as follows:

- Monthly payments are due on the ____ day of each month.

- All payments must be made in U.S. dollars.

- Payments shall be sent to the Lender’s address listed above.

DEFAULT:

If the Borrower fails to make a payment within ____ days after it is due, the Lender may consider the loan in default. In such a case, the Lender may demand full repayment of the remaining balance.

GOVERNING LAW:

This Agreement shall be governed by the laws of the State of California.

SIGNATURES:

By signing below, both parties agree to the terms and conditions outlined in this Loan Agreement.

- Lender's Signature: ___________________________ Date: ________________

- Borrower's Signature: _________________________ Date: ________________

More About California Loan Agreement

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement details important information such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities throughout the loan process.

Who should use a California Loan Agreement form?

This form is useful for anyone involved in lending or borrowing money in California. Individuals, businesses, and financial institutions can all benefit from using this agreement. Whether you’re lending money to a friend or entering into a business loan, having a written agreement helps ensure that everyone is on the same page regarding the terms of the loan.

What are the key components of a California Loan Agreement?

A comprehensive California Loan Agreement typically includes several key components. These include the names and addresses of the lender and borrower, the principal loan amount, the interest rate, the repayment schedule, and any fees or penalties for late payments. Additionally, the agreement may specify any collateral securing the loan and what happens in case of default. Clarity in these areas is crucial to avoid misunderstandings.

Is it necessary to have a lawyer review my California Loan Agreement?

What happens if one party defaults on the loan?

If a borrower defaults on the loan, the lender has several options, which should be outlined in the Loan Agreement. These may include charging late fees, initiating collection efforts, or taking legal action to recover the owed amount. In some cases, if collateral was involved, the lender may have the right to seize it. Understanding the consequences of default is essential for both parties and should be clearly stated in the agreement.

Key takeaways

When filling out and using the California Loan Agreement form, it’s important to keep several key points in mind to ensure clarity and legality. Below are some essential takeaways:

- Understand the Parties Involved: Clearly identify the lender and borrower. Include full names and contact information to avoid confusion.

- Specify Loan Amount: Clearly state the total amount being loaned. This helps both parties understand the financial commitment involved.

- Outline Repayment Terms: Detail how and when the borrower will repay the loan. This may include payment schedules, interest rates, and any late fees.

- Include Default Clauses: Specify what happens if the borrower fails to repay the loan as agreed. This protects the lender’s interests.

- Consider Legal Advice: While the form can be filled out independently, consulting with a legal expert can ensure that all terms are fair and enforceable.

- Keep Copies: Both parties should retain signed copies of the agreement. This serves as a reference and can help resolve any disputes in the future.

By following these guidelines, both lenders and borrowers can create a clear, effective loan agreement that protects their interests and fosters a positive lending relationship.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The California Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California, specifically under the California Civil Code. |

| Essential Components | The form typically includes the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms outlined in the document. |

Consider Some Other Loan Agreement Forms for US States

Promissory Note Illinois - The Loan Agreement may specify under what circumstances the loan can be modified.

Understanding the importance of the IRS 2553 form is essential for small businesses, as it not only facilitates the election to be treated as an S corporation but also ensures that corporate income, losses, deductions, and credits can flow through to shareholders for tax purposes. Filing this form with the Internal Revenue Service is a pivotal step in the process, and for more detailed guidance, you can visit OnlineLawDocs.com.

Texas Promissory Note Requirements - Personal loans may have simpler agreements compared to commercial loans.

Dos and Don'ts

When filling out the California Loan Agreement form, it's essential to approach the task with care and attention to detail. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do read the entire agreement thoroughly before starting.

- Do provide accurate and complete information.

- Do check for any specific requirements related to your loan type.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed otherwise.

- Don't use abbreviations or unclear language that might confuse the lender.

- Don't forget to review the agreement for any discrepancies before submitting.

By following these guidelines, you can help ensure that your Loan Agreement is filled out correctly and efficiently. This attention to detail can save you time and potential issues down the line.