Valid Horse Bill of Sale Form for California

In the vibrant world of equine transactions, the California Horse Bill of Sale form serves as a vital document that facilitates the transfer of ownership for horses within the state. This form not only outlines the essential details of the horse being sold, such as its breed, age, and registration number, but also provides a clear record of the sale transaction, including the purchase price and the date of sale. Importantly, it includes sections that address the responsibilities of both the seller and the buyer, ensuring that both parties are aware of their rights and obligations. By incorporating necessary disclosures about the horse's health and any potential liens, this form aims to protect all involved parties and promote transparency in the sale process. Additionally, the form can be customized to meet specific needs, allowing for the inclusion of any special agreements or conditions that may be relevant to the transaction. Understanding the nuances of this document is essential for anyone looking to navigate the complexities of buying or selling a horse in California.

Common mistakes

-

Failing to provide complete buyer and seller information. Ensure that names, addresses, and contact details are accurate and fully filled out.

-

Not including a detailed description of the horse. Include the horse's name, breed, age, color, and any identifying marks.

-

Omitting the sale price. Clearly state the amount for which the horse is being sold to avoid confusion.

-

Neglecting to sign and date the form. Both parties must sign and date the document to make it legally binding.

-

Not providing a bill of sale copy to both parties. Each party should retain a copy for their records.

-

Failing to include any warranties or guarantees. If there are specific conditions regarding the horse's health or performance, they should be documented.

-

Using vague or unclear language. Be specific about the terms of the sale to prevent misunderstandings.

-

Ignoring local regulations. Some areas may have specific requirements for horse sales that must be followed.

-

Not verifying the horse's registration status. Ensure that the horse's registration papers are in order and that the seller has the right to sell.

Example - California Horse Bill of Sale Form

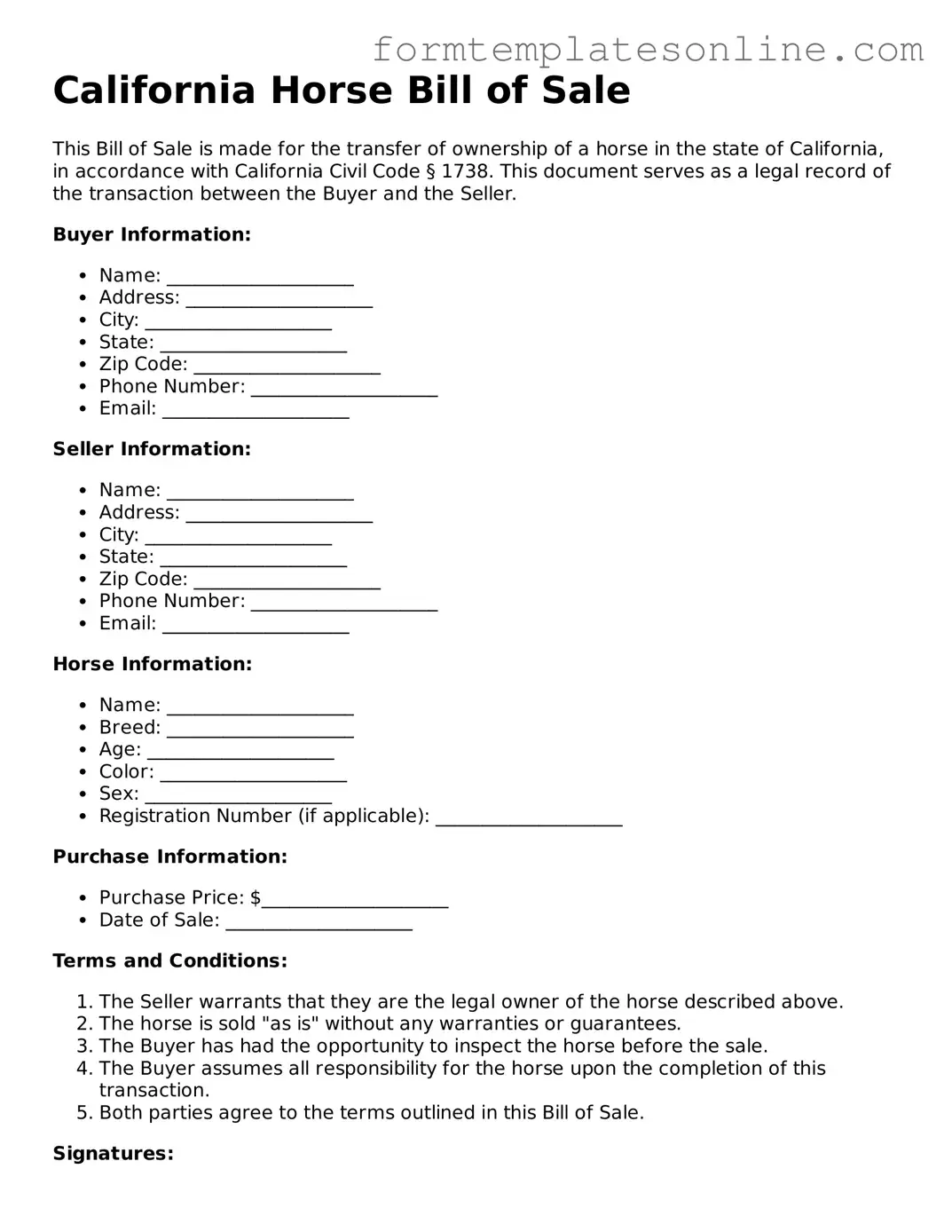

California Horse Bill of Sale

This Bill of Sale is made for the transfer of ownership of a horse in the state of California, in accordance with California Civil Code § 1738. This document serves as a legal record of the transaction between the Buyer and the Seller.

Buyer Information:

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: ____________________

- Zip Code: ____________________

- Phone Number: ____________________

- Email: ____________________

Seller Information:

- Name: ____________________

- Address: ____________________

- City: ____________________

- State: ____________________

- Zip Code: ____________________

- Phone Number: ____________________

- Email: ____________________

Horse Information:

- Name: ____________________

- Breed: ____________________

- Age: ____________________

- Color: ____________________

- Sex: ____________________

- Registration Number (if applicable): ____________________

Purchase Information:

- Purchase Price: $____________________

- Date of Sale: ____________________

Terms and Conditions:

- The Seller warrants that they are the legal owner of the horse described above.

- The horse is sold "as is" without any warranties or guarantees.

- The Buyer has had the opportunity to inspect the horse before the sale.

- The Buyer assumes all responsibility for the horse upon the completion of this transaction.

- Both parties agree to the terms outlined in this Bill of Sale.

Signatures:

Seller Signature: ____________________ Date: ____________________

Buyer Signature: ____________________ Date: ____________________

This Bill of Sale constitutes the entire agreement between the parties and supersedes any prior agreements or understandings.

More About California Horse Bill of Sale

What is a California Horse Bill of Sale?

A California Horse Bill of Sale is a legal document that records the transfer of ownership of a horse from one party to another. This form serves as proof that the buyer has purchased the horse and that the seller has relinquished their rights to it. It typically includes essential information such as the names and addresses of both the buyer and seller, a description of the horse, the sale price, and the date of the transaction. Having this document can help protect both parties in case of disputes regarding ownership or condition of the horse in the future.

Is a Horse Bill of Sale required in California?

While a Horse Bill of Sale is not legally required in California, it is highly recommended. This document provides a clear record of the transaction, which can be crucial if any issues arise later on. Without it, proving ownership or the terms of the sale can become complicated. Additionally, some buyers may request a bill of sale for their records or to register the horse with certain organizations, so having one prepared can facilitate the process.

What information should be included in the Horse Bill of Sale?

When drafting a Horse Bill of Sale, it is important to include specific details to ensure clarity and legality. Key elements should encompass the full names and contact information of both the seller and buyer, a detailed description of the horse (including breed, age, color, and any identifying marks), the sale price, and the date of sale. It is also wise to note any warranties or guarantees about the horse's health or behavior, if applicable. Finally, both parties should sign and date the document to validate the agreement.

Can a Horse Bill of Sale be used for other animals?

While a Horse Bill of Sale is specifically tailored for the sale of horses, the concept can be adapted for other animals as well. However, it is advisable to use a form designed for the specific type of animal being sold. Each species may have unique considerations regarding health, registration, and care, which should be addressed in the sale document. Customizing the bill of sale ensures that all necessary information is captured and that both parties understand their rights and responsibilities.

What happens if there are disputes after the sale?

If a dispute arises after the sale of a horse, the Horse Bill of Sale can serve as a vital piece of evidence. This document outlines the agreed-upon terms of the sale and can clarify issues such as ownership, payment, and any warranties made by the seller. In cases where disagreements cannot be resolved amicably, having a well-drafted bill of sale may help in legal proceedings, as it provides a formal record of the transaction and the intentions of both parties at the time of sale.

Is it advisable to have the Horse Bill of Sale notarized?

While notarization is not a requirement for a Horse Bill of Sale in California, it can add an extra layer of authenticity and protection. Notarizing the document ensures that both parties' identities are verified, which can help prevent fraud. Additionally, a notarized bill of sale may be viewed more favorably in a legal context, should any disputes arise. Therefore, while it is not mandatory, having the document notarized is a prudent step for both buyers and sellers.

Key takeaways

When it comes to buying or selling a horse in California, the Horse Bill of Sale form is an important document. Here are some key takeaways to keep in mind when filling out and using this form:

- Identify the Parties: Clearly state the names and contact information of both the seller and the buyer. This ensures that both parties can be easily reached if needed.

- Describe the Horse: Provide a detailed description of the horse, including its name, breed, age, color, and any identifying marks. This helps prevent any confusion about which horse is being sold.

- Include Sale Price: Clearly indicate the sale price of the horse. This is essential for both parties to understand the financial aspect of the transaction.

- Disclose Health and History: Sellers should provide any known health issues or history related to the horse. This transparency builds trust and protects both parties.

- Signatures Required: Both the seller and the buyer must sign the document. This signifies that both parties agree to the terms outlined in the bill of sale.

- Keep Copies: Each party should keep a copy of the signed bill of sale. This serves as proof of the transaction and can be important for future reference.

- Consult Legal Advice if Necessary: If either party has concerns about the transaction or the form itself, seeking legal advice can provide clarity and peace of mind.

Using the California Horse Bill of Sale form correctly can help ensure a smooth transaction, protecting the interests of both the buyer and the seller.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The California Horse Bill of Sale form is used to document the sale and transfer of ownership of a horse in California. |

| Legal Requirement | While not legally required, having a bill of sale provides legal protection for both the buyer and seller. |

| Governing Law | The sale of horses in California is governed by the California Commercial Code, particularly sections related to the sale of goods. |

| Information Included | The form typically includes details such as the horse's description, sale price, and the names and signatures of both parties. |

| Payment Details | It’s important to specify payment terms, including whether the transaction is a cash sale or involves financing. |

| Condition of Sale | The form may include statements regarding the horse’s health, training, and any warranties or guarantees. |

| Record Keeping | Both parties should keep a signed copy of the bill of sale for their records, as it may be needed for future reference. |

Consider Some Other Horse Bill of Sale Forms for US States

Equine Bill of Sale - Records the sale of a horse between a seller and a buyer.

Equine Bill of Sale Pdf - Includes provisions for liability during the sale process.

In addition to the fundamental functions of a Michigan Non-disclosure Agreement, it is essential for individuals and companies to understand the resources available to them for drafting such documents. For comprehensive templates and legal advice, you can visit OnlineLawDocs.com, which offers valuable insights and templates for creating effective non-disclosure agreements tailored to your needs.

What Does a Bill of Sale Need to Say - Must be signed by both parties to be valid.

Dos and Don'ts

When filling out the California Horse Bill of Sale form, it’s essential to be thorough and accurate. Here are some important dos and don’ts to consider:

- Do ensure that all information is complete and accurate. This includes the horse's description, the seller's and buyer's details, and the sale price.

- Do sign and date the form. Both parties should provide their signatures to validate the sale.

- Do keep a copy of the completed form for your records. This can be useful for future reference or in case of disputes.

- Don't leave any sections blank. If a particular section does not apply, indicate that clearly instead of omitting it.

- Don't use vague language when describing the horse. Provide specific details such as breed, age, color, and any identifying marks.

- Don't rush the process. Take your time to review the form thoroughly before submitting it.