Valid Gift Deed Form for California

The California Gift Deed form serves as a vital tool for individuals looking to transfer property ownership without the exchange of money. This legal document allows a property owner, known as the grantor, to gift real estate to another person, called the grantee, with minimal complications. One of the key features of this form is that it must be executed in writing and signed by the grantor, ensuring that the intent to gift is clear and documented. Additionally, the Gift Deed must be notarized to enhance its validity and prevent potential disputes in the future. Importantly, this form can also provide tax benefits, as gifts may be excluded from the taxable estate, making it an attractive option for those wishing to pass on their property to loved ones. Understanding the nuances of the California Gift Deed form is essential for anyone considering this type of property transfer, as it not only simplifies the process but also ensures compliance with state laws.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details when filling out the Gift Deed form. This can include missing names, addresses, or property descriptions. Each piece of information is crucial to ensure the deed is valid and enforceable.

-

Incorrect Property Description: Another common mistake involves inaccurately describing the property being gifted. It is essential to include the correct legal description of the property, which can usually be found in previous deeds or property tax statements. Without this, the deed may be challenged later.

-

Failure to Sign and Date: A Gift Deed must be signed and dated by the donor. Omitting this step can render the deed ineffective. Some individuals mistakenly believe that verbal agreements are sufficient, but the law requires written documentation for such transfers.

-

Not Notarizing the Document: Many people overlook the importance of having the Gift Deed notarized. Notarization adds a layer of authenticity and helps prevent disputes about the validity of the document. Without it, the deed may not hold up in court if challenged.

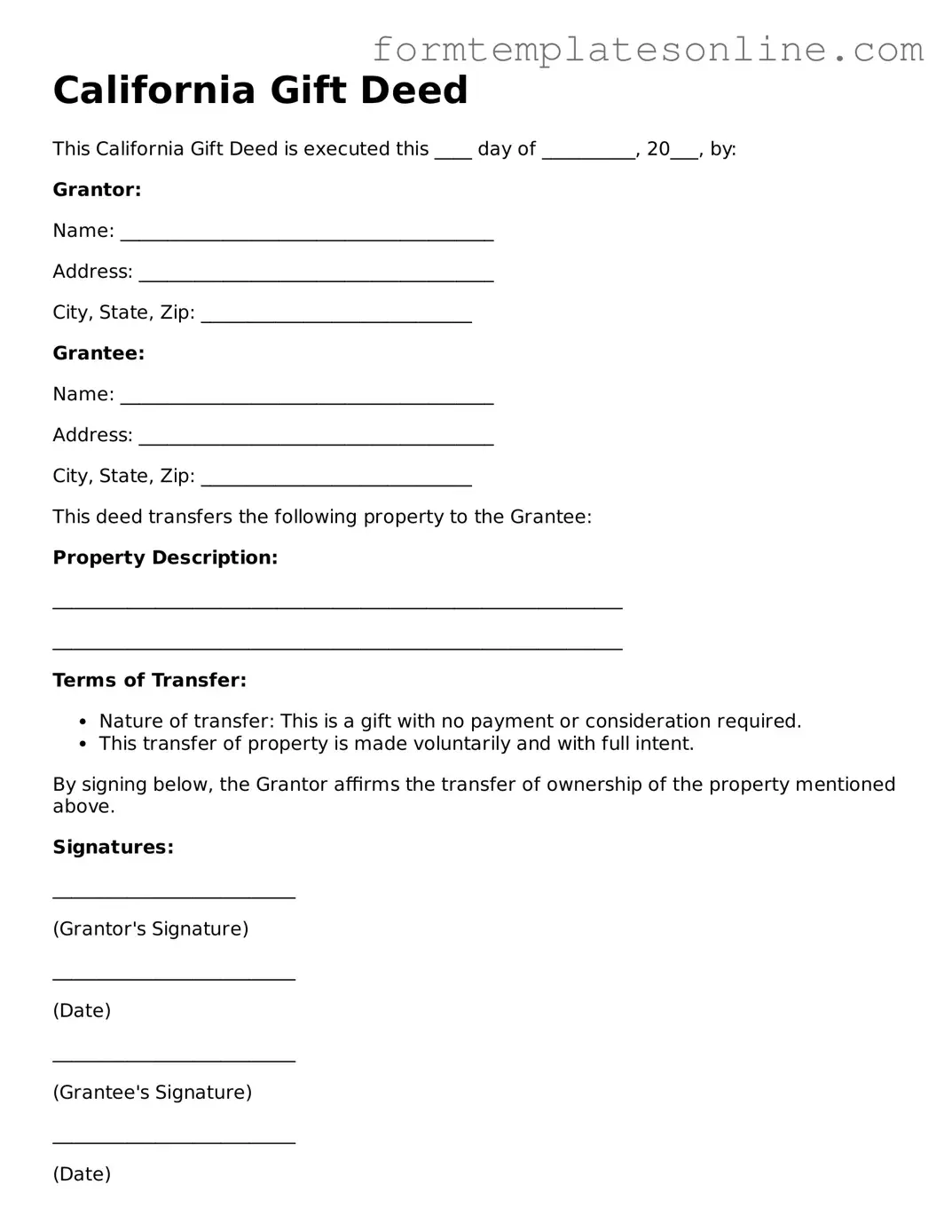

Example - California Gift Deed Form

California Gift Deed

This California Gift Deed is executed this ____ day of __________, 20___, by:

Grantor:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

Grantee:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: _____________________________

This deed transfers the following property to the Grantee:

Property Description:

_____________________________________________________________

_____________________________________________________________

Terms of Transfer:

- Nature of transfer: This is a gift with no payment or consideration required.

- This transfer of property is made voluntarily and with full intent.

By signing below, the Grantor affirms the transfer of ownership of the property mentioned above.

Signatures:

__________________________

(Grantor's Signature)

__________________________

(Date)

__________________________

(Grantee's Signature)

__________________________

(Date)

Notary Public:

State of California

County of ____________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared:

__________________________ (Grantor)

__________________________ (Grantee)

They are known to me to be the persons whose names are subscribed to this instrument and acknowledged that they executed the same.

_____________________________

Signature of Notary Public

_____________________________

(Notary Seal)

This Gift Deed is executed in accordance with the laws of the State of California.

More About California Gift Deed

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer property ownership from one person to another without any exchange of money. This deed is typically utilized when a property owner wishes to give their property as a gift to a family member or friend. It is important to note that the transfer must be voluntary and made without any expectation of receiving something in return.

What are the requirements for a valid Gift Deed in California?

For a Gift Deed to be valid in California, it must be in writing and signed by the donor (the person giving the gift). The deed should clearly identify the property being transferred and include the names of both the donor and the recipient (the person receiving the gift). Additionally, the deed must be notarized and recorded with the county recorder’s office where the property is located to ensure it is legally recognized.

Are there any tax implications associated with a Gift Deed?

Yes, there may be tax implications when executing a Gift Deed. The IRS allows individuals to gift up to a certain amount each year without incurring gift tax. However, if the value of the property exceeds this limit, the donor may need to file a gift tax return. It is advisable to consult with a tax professional to understand the specific tax consequences and ensure compliance with federal and state tax laws.

Can a Gift Deed be revoked once it is executed?

Once a Gift Deed is executed and recorded, it generally cannot be revoked unilaterally. The donor relinquishes ownership of the property, and the recipient becomes the legal owner. However, if the donor and recipient agree, they may execute a new deed to reverse the transfer. Legal advice may be necessary to navigate this process effectively.

Key takeaways

When considering the California Gift Deed form, it's essential to understand its purpose and implications. Here are some key takeaways to guide you through the process:

- Purpose of the Gift Deed: The Gift Deed is a legal document used to transfer property from one individual to another without any exchange of money. It signifies a voluntary gift.

- Eligibility: Anyone who owns property can gift it to another person. However, both the donor (the person giving the gift) and the recipient (the person receiving the gift) must be identified in the deed.

- Property Description: Clearly describe the property being gifted. This includes the address and legal description, ensuring there is no ambiguity about what is being transferred.

- Signatures Required: The deed must be signed by the donor. In California, notarization is also required to validate the document, ensuring that the donor’s identity is verified.

- Tax Implications: Gifting property may have tax consequences. It’s advisable to consult with a tax professional to understand potential gift tax liabilities and implications for the recipient.

- Record Keeping: After the Gift Deed is completed and notarized, it should be recorded with the county recorder’s office where the property is located. This step is crucial for establishing legal ownership.

- Revocation of Gift: Once the deed is executed and recorded, the gift is generally irrevocable. Donors should be certain of their decision before proceeding.

- Legal Assistance: While it is possible to fill out the form independently, seeking legal advice can help avoid mistakes and ensure compliance with all relevant laws.

Understanding these points can help ensure a smooth process when using the California Gift Deed form. Proper attention to detail can prevent future disputes and clarify intentions between the parties involved.

File Details

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership without any exchange of money. |

| Governing Law | The Gift Deed is governed by California Civil Code Section 11911. |

| Requirements | The deed must be signed by the donor (the person giving the gift) and must be notarized. |

| Property Types | Real property, such as land or buildings, can be transferred using a Gift Deed. |

| Tax Implications | Gift tax may apply if the value of the property exceeds the annual exclusion limit set by the IRS. |

| Recording | To ensure the transfer is legally recognized, the Gift Deed should be recorded with the county recorder’s office. |

| Revocation | A Gift Deed cannot be revoked after it has been executed and delivered, unless specified conditions exist. |

Consider Some Other Gift Deed Forms for US States

What Is a Gift Deed - This legal tool can help document non-cash gifts of significant value, protecting both parties involved.

Obtaining a Georgia Power of Attorney form can simplify the process of delegating responsibilities, ensuring your affairs are managed according to your wishes. For those in need of assistance or more information about this important document, you can visit OnlineLawDocs.com, which provides valuable resources and insights.

How to Transfer Deed - This document can facilitate charitable gifting while providing tax benefits.

Dos and Don'ts

When filling out the California Gift Deed form, attention to detail is crucial. Here are five important dos and don'ts to consider:

- Do ensure that all names and addresses are accurate. Mistakes can lead to complications later.

- Don't leave any sections blank. Every part of the form must be completed to avoid delays in processing.

- Do include a clear description of the property being gifted. This helps establish what is being transferred.

- Don't forget to have the deed notarized. A signature without notarization may not hold up in legal situations.

- Do consult with a legal professional if you have any questions. Getting it right the first time saves time and effort.