Valid Deed in Lieu of Foreclosure Form for California

In the complex landscape of real estate transactions, particularly in California, the Deed in Lieu of Foreclosure serves as a significant tool for homeowners facing financial distress. This legal instrument allows a borrower to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often costly process of foreclosure. By executing this deed, homeowners can mitigate the damage to their credit scores, as it generally reflects more favorably than a foreclosure on their financial history. The process requires careful consideration, as both parties must agree to the terms, and the lender typically conducts a thorough review of the borrower’s financial situation before acceptance. Furthermore, the deed may include stipulations regarding any remaining debt, as it does not always absolve the borrower of all financial obligations tied to the property. Understanding the implications of this form is crucial for homeowners seeking to navigate their options during challenging economic times, making it a relevant topic for those looking to safeguard their financial future.

Common mistakes

-

Failing to provide accurate property information. Ensuring that the property address and legal description are correct is crucial. Errors can lead to delays or complications.

-

Not including all necessary parties. All individuals or entities with an ownership interest in the property must sign the deed. Omitting a co-owner can invalidate the document.

-

Neglecting to obtain necessary approvals. If the property is part of an HOA or has other encumbrances, obtaining their consent before proceeding is essential.

-

Overlooking tax implications. A deed in lieu of foreclosure may have tax consequences. Consulting a tax professional before signing is advisable.

-

Not understanding the impact on credit. A deed in lieu can affect credit scores, similar to a foreclosure. It's important to be aware of the long-term effects.

-

Failing to consult with a legal professional. Legal guidance can help navigate the complexities of the process and ensure that all documents are properly executed.

-

Not documenting communications with the lender. Keeping records of all interactions can be helpful in case disputes arise later.

-

Ignoring potential deficiencies. If the property has a mortgage balance higher than its market value, the lender may pursue a deficiency judgment. Understanding this risk is important.

-

Rushing through the process. Taking the time to review all terms and conditions is essential. Hasty decisions can lead to unfavorable outcomes.

-

Not considering alternatives. Exploring other options, such as loan modifications or short sales, may be more beneficial in some cases.

Example - California Deed in Lieu of Foreclosure Form

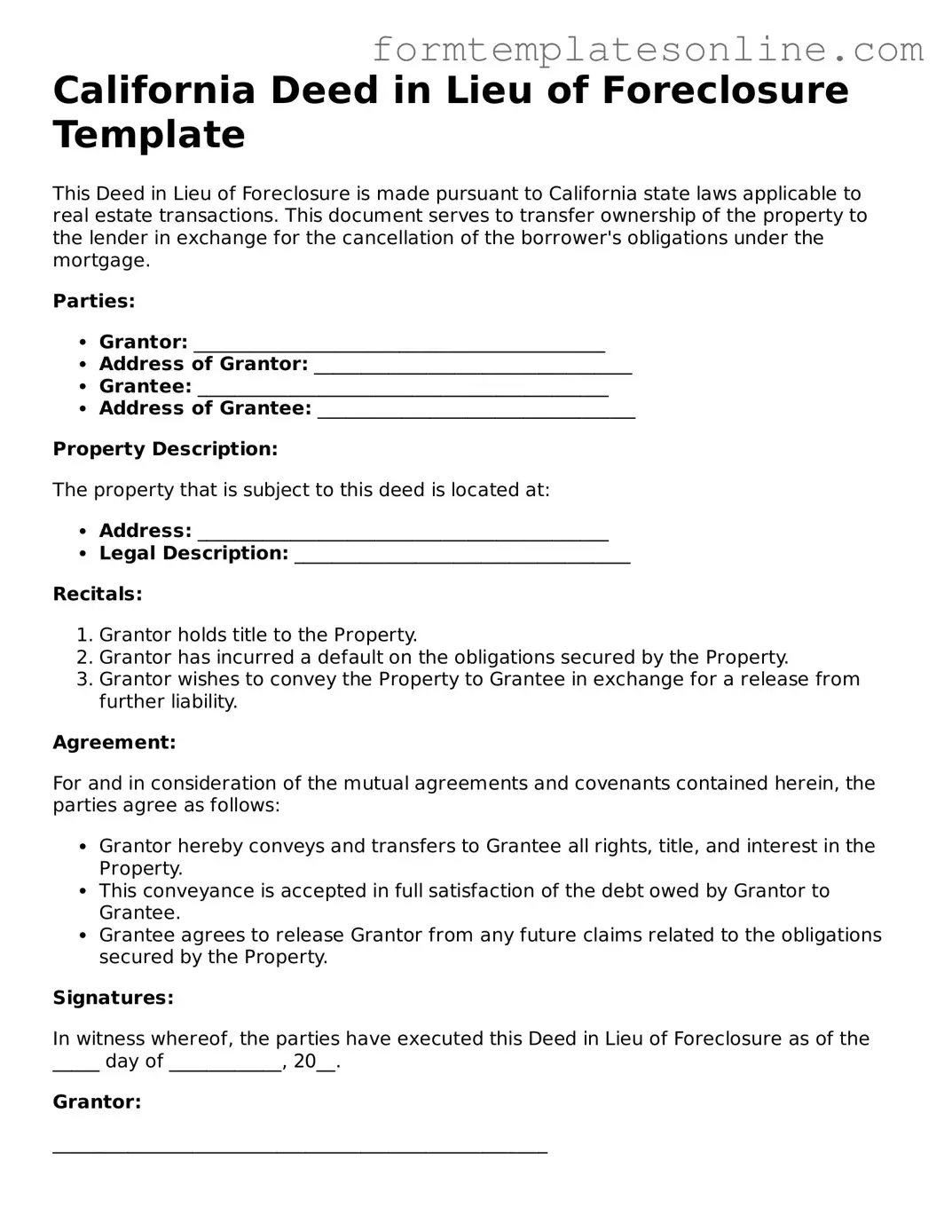

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made pursuant to California state laws applicable to real estate transactions. This document serves to transfer ownership of the property to the lender in exchange for the cancellation of the borrower's obligations under the mortgage.

Parties:

- Grantor: ____________________________________________

- Address of Grantor: __________________________________

- Grantee: ____________________________________________

- Address of Grantee: __________________________________

Property Description:

The property that is subject to this deed is located at:

- Address: ____________________________________________

- Legal Description: ____________________________________

Recitals:

- Grantor holds title to the Property.

- Grantor has incurred a default on the obligations secured by the Property.

- Grantor wishes to convey the Property to Grantee in exchange for a release from further liability.

Agreement:

For and in consideration of the mutual agreements and covenants contained herein, the parties agree as follows:

- Grantor hereby conveys and transfers to Grantee all rights, title, and interest in the Property.

- This conveyance is accepted in full satisfaction of the debt owed by Grantor to Grantee.

- Grantee agrees to release Grantor from any future claims related to the obligations secured by the Property.

Signatures:

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure as of the _____ day of ____________, 20__.

Grantor:

_____________________________________________________

Grantee:

_____________________________________________________

State of California, County of _______________

On this _____ day of ____________, 20__, before me, ________________, a Notary Public for the State of California, personally appeared __________, who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument, and acknowledged to me that they executed the same in their capacity as ________________.

Witness my hand and official seal.

___________________________

Notary Public

More About California Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option is often considered when a homeowner can no longer keep up with mortgage payments and wants to mitigate the negative impact of foreclosure on their credit score.

How does a Deed in Lieu of Foreclosure work?

The homeowner contacts the lender to express their interest in a Deed in Lieu of Foreclosure. If the lender agrees, both parties will sign the necessary documents, and the homeowner will hand over the property title to the lender. This process typically requires the homeowner to be current on property taxes and to vacate the property.

What are the benefits of a Deed in Lieu of Foreclosure?

One major benefit is that it can be less damaging to a homeowner's credit score compared to a foreclosure. Additionally, it allows for a quicker resolution and may relieve the homeowner from any further financial obligations related to the mortgage. It can also save time and money compared to a lengthy foreclosure process.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are potential drawbacks. The homeowner may still face tax implications, as forgiven mortgage debt can be considered taxable income. Furthermore, not all lenders accept Deeds in Lieu of Foreclosure, and the process may not relieve the homeowner from all financial responsibilities, especially if there are second mortgages or liens on the property.

Can I get cash for my property with a Deed in Lieu of Foreclosure?

Generally, homeowners do not receive cash for their property in a Deed in Lieu of Foreclosure. Instead, they surrender the property to the lender in exchange for the cancellation of the mortgage debt. However, some lenders may offer relocation assistance or incentives to help homeowners transition to new housing.

How do I know if I qualify for a Deed in Lieu of Foreclosure?

Qualification typically depends on your financial situation and the lender's policies. Most lenders require that you are unable to make mortgage payments and that you have attempted to sell the property without success. It's best to speak directly with your lender to understand their specific criteria.

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure will impact your credit score, but usually less severely than a foreclosure. It may still be reported as a negative event, but the overall effect on your credit history may be less damaging, depending on your previous credit standing.

What steps should I take to initiate a Deed in Lieu of Foreclosure?

First, contact your lender to discuss your situation and express your interest in this option. Gather all necessary documentation, including financial statements and proof of hardship. Next, complete any required forms and submit them to your lender for review.

Can I change my mind after signing a Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is signed and recorded, it typically cannot be reversed. It is crucial to fully understand the implications before proceeding. Consulting with a legal or financial advisor is recommended to ensure you are making the best decision for your situation.

What happens to my mortgage after a Deed in Lieu of Foreclosure?

After the Deed in Lieu of Foreclosure is completed, the mortgage is effectively canceled, and you are no longer responsible for the debt. However, any remaining liens or second mortgages may still need to be addressed, depending on the specific circumstances surrounding your property.

Key takeaways

When dealing with a California Deed in Lieu of Foreclosure, it is essential to understand several key aspects to ensure a smooth process. Below are important takeaways regarding the form and its usage:

- Voluntary Agreement: A Deed in Lieu of Foreclosure is a voluntary agreement between the borrower and the lender. The borrower agrees to transfer the property title to the lender to avoid foreclosure.

- Eligibility Requirements: Not all borrowers qualify for this option. Lenders typically evaluate the borrower's financial situation and the property's condition before accepting the deed.

- Impact on Credit Score: While a Deed in Lieu of Foreclosure may be less damaging than a foreclosure, it can still negatively impact the borrower's credit score.

- Release from Debt: Upon acceptance of the deed, the borrower may be released from the mortgage debt, although this depends on the terms agreed upon with the lender.

- Property Condition: The property must be in good condition. Lenders may require an inspection to ensure there are no significant issues that could affect the property's value.

- Tax Implications: Borrowers should be aware of potential tax consequences. The IRS may consider forgiven debt as taxable income, so consulting a tax professional is advisable.

- Legal Assistance: It is often beneficial for borrowers to seek legal advice when filling out the form. A legal professional can help navigate the complexities of the process and ensure all documents are completed correctly.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Laws | In California, the relevant laws include the California Civil Code Sections 2941 and 580d, which outline the procedures and implications of such transfers. |

| Process | The process typically involves the borrower and lender negotiating terms, signing the deed, and recording it with the county recorder's office. |

| Benefits | One major benefit is that it can be less damaging to the borrower's credit score compared to a foreclosure. It can also provide a quicker resolution. |

| Potential Drawbacks | Borrowers may still face tax implications, as the IRS may consider the forgiven debt as taxable income. Additionally, not all lenders accept this option. |

| Eligibility | To qualify, borrowers generally must be facing financial hardship and have a mortgage that is greater than the property’s current market value. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Deed in Lieu Vs Foreclosure - This form can be a beneficial avenue for homeowners to mitigate financial losses associated with property abandonment.

Foreclosure Deed - By signing this deed, the homeowner gives up their rights to the property to settle the mortgage debt.

To facilitate the transfer of ownership, it is important to utilize the New York Boat Bill of Sale form, which can be found at documentonline.org/blank-new-york-boat-bill-of-sale/. This form provides essential details about the vessel, including its make, model, and hull identification number, ensuring a smooth transaction and establishing clear ownership records.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu may open doors to new housing opportunities without the stain of foreclosure.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are five essential do's and don'ts to keep in mind:

- Do: Ensure all personal information is accurate and up to date.

- Do: Review the form carefully before submitting it to avoid mistakes.

- Do: Seek advice from a legal professional if you have questions about the process.

- Don't: Rush through the form; take your time to understand each section.

- Don't: Ignore any required signatures or documentation that must accompany the form.