California Death of a Joint Tenant Affidavit PDF Form

The California Death of a Joint Tenant Affidavit form serves as a vital legal document in the realm of property ownership, particularly when it comes to the transfer of property interests upon the death of one joint tenant. This form is primarily utilized to facilitate the seamless transition of property rights to the surviving joint tenant, ensuring that the deceased's share is automatically transferred without the need for probate. It typically includes essential details such as the names of the deceased and surviving joint tenants, the description of the property in question, and the date of death. By providing a straightforward mechanism for property transfer, the affidavit helps to clarify ownership and prevent potential disputes among heirs or beneficiaries. Additionally, it requires the surviving tenant to affirm that they are indeed the rightful owner of the property following the death of their co-tenant. This affidavit not only simplifies the legal process but also provides peace of mind to those navigating the complexities of property inheritance in California.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This can include missing the decedent’s full name, date of death, or property details.

-

Incorrect Signatures: Signatures must be from the surviving joint tenant. Sometimes, people mistakenly have someone else sign the affidavit, which can invalidate the document.

-

Not Notarizing the Document: Many individuals forget to have the affidavit notarized. In California, notarization is often necessary for the affidavit to be legally binding.

-

Failing to Attach Required Documents: Supporting documents, such as the death certificate or proof of joint tenancy, are essential. Omitting these can delay the process or lead to rejection.

-

Using Outdated Forms: People sometimes use old versions of the affidavit form. It’s important to ensure that you have the most current version to avoid complications.

-

Misunderstanding the Purpose: Some individuals fill out the affidavit without fully understanding its purpose. This can lead to incomplete or incorrect information being provided.

-

Overlooking Filing Requirements: Each county may have specific filing requirements. Not checking these can result in additional steps or delays in processing.

-

Ignoring Legal Advice: Some people choose to fill out the affidavit without consulting a legal professional. This can lead to mistakes that could have been easily avoided with proper guidance.

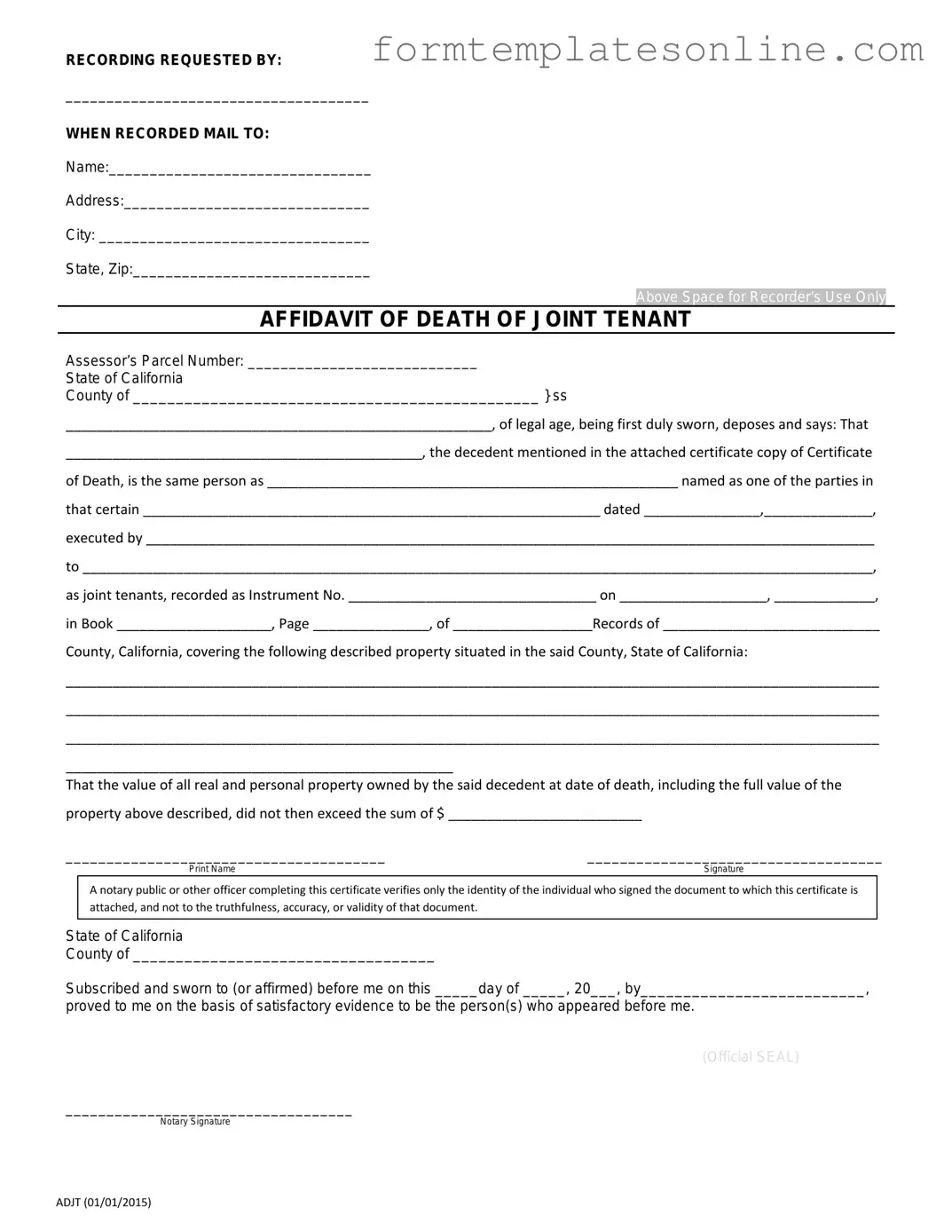

Example - California Death of a Joint Tenant Affidavit Form

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature

ADJT (01/01/2015)

More About California Death of a Joint Tenant Affidavit

What is the California Death of a Joint Tenant Affidavit?

The California Death of a Joint Tenant Affidavit is a legal document used to transfer the interest of a deceased joint tenant to the surviving joint tenant(s). This form helps establish that the deceased joint tenant's share of the property automatically passes to the surviving tenant(s) without the need for probate, simplifying the transfer process and ensuring a smooth transition of property ownership.

Who can file this affidavit?

Typically, the surviving joint tenant or tenants are responsible for filing the affidavit. They must have been joint tenants with the deceased at the time of death. It’s important that the surviving tenant(s) can provide the necessary information about the deceased, including their date of death and details of the property in question.

What information is required to complete the affidavit?

To complete the affidavit, you will need specific information such as the names of all joint tenants, the date of death of the deceased tenant, and a description of the property. Additionally, the affidavit must include a statement confirming that the property was held in joint tenancy and that no probate proceedings are necessary. Be prepared to provide any relevant documentation, such as a death certificate, to support your claims.

Is notarization required for the affidavit?

Yes, the affidavit must be notarized. This means that a notary public must witness the signing of the document to verify the identities of the individuals involved. Notarization adds a layer of authenticity and can help prevent potential disputes regarding the transfer of property ownership.

Where should the completed affidavit be filed?

The completed and notarized affidavit should be filed with the county recorder’s office in the county where the property is located. Filing the affidavit officially records the transfer of ownership and ensures that public records reflect the change in property title following the death of the joint tenant.

What happens if the affidavit is not filed?

If the affidavit is not filed, the property may remain in the name of the deceased joint tenant, which can lead to complications. Without the affidavit, the surviving tenant(s) may face challenges in proving their ownership, and the property may become subject to probate proceedings. This can result in delays, additional costs, and potential disputes among heirs or beneficiaries.

Key takeaways

When dealing with the California Death of a Joint Tenant Affidavit form, it is essential to approach the process with care and attention to detail. Here are some key takeaways to consider:

- The affidavit is used to establish the death of a joint tenant and facilitate the transfer of property ownership.

- It is important to confirm that the property was held in joint tenancy before proceeding with the affidavit.

- The form must be completed accurately, including the names of the deceased and surviving joint tenant(s).

- Gather necessary documents such as the death certificate and any existing property deeds to support the affidavit.

- Signatures from the surviving joint tenant(s) are required, affirming their status as the new owner(s) of the property.

- The affidavit should be filed with the county recorder's office where the property is located.

- Filing the affidavit helps clear the title to the property and makes it easier for the surviving tenant to manage the property.

- Be aware of any deadlines for filing the affidavit, as they may vary by county.

- Consulting with a legal professional can provide guidance and ensure that all steps are correctly followed.

- Keep copies of the completed affidavit and supporting documents for your records, as they may be needed in the future.

Taking these steps can help ease the transition during a difficult time and ensure that property matters are handled appropriately.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The California Death of a Joint Tenant Affidavit is used to establish the death of one joint tenant, allowing the surviving tenant to claim full ownership of the property. |

| Governing Law | This affidavit is governed by California Probate Code Section 5600, which outlines the rights of joint tenants upon the death of one tenant. |

| Requirements | The affidavit must be signed by the surviving joint tenant and may require notarization, depending on the county's regulations. |

| Filing | Once completed, the affidavit should be filed with the county recorder's office where the property is located to update the title records. |

| Effect on Property | Upon recording the affidavit, the surviving joint tenant becomes the sole owner of the property, eliminating the deceased tenant's interest. |

Other PDF Forms

Miscellaneous Information - The IRS may conduct audits if inconsistencies are found between 1099-MISC forms and tax returns.

Abn for Medicare - This form is important for managing healthcare costs and avoiding surprise bills for patients.

To simplify the process of transferring ownership, you can obtain the necessary documentation from OnlineLawDocs.com, where you'll find the Georgia Motor Vehicle Bill of Sale form designed to meet all legal requirements.

What's Advance Directive - It is recommended to discuss your values and choices with the person you appoint to make decisions for you.

Dos and Don'ts

When filling out the California Death of a Joint Tenant Affidavit form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are some key do's and don'ts to keep in mind:

- Do provide accurate information about the deceased joint tenant.

- Do include the date of death clearly on the form.

- Do ensure that all required signatures are present.

- Do check for any additional documents that may need to accompany the affidavit.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank unless instructed.

- Don't use white-out or erasers on the form.

- Don't submit the form without verifying all information is correct.

- Don't forget to file the affidavit with the appropriate county office.