Valid Bill of Sale Form for California

The California Bill of Sale form serves as an essential document in the transfer of ownership for various types of personal property, including vehicles, boats, and other valuable items. This form not only provides a written record of the transaction but also outlines important details such as the names and addresses of both the buyer and seller, a description of the item being sold, and the purchase price. Additionally, it may include information about the condition of the item and any warranties or guarantees made by the seller. By clearly documenting these aspects, the Bill of Sale helps protect both parties in the event of disputes or misunderstandings. Understanding the nuances of this form is crucial for anyone engaging in a sale, as it ensures that the transaction is legally recognized and that both parties fulfill their obligations. Whether you are a seasoned seller or a first-time buyer, knowing how to properly complete and utilize a Bill of Sale can provide peace of mind and clarity in your dealings.

Common mistakes

-

Incorrect Information About the Buyer or Seller: People often make mistakes by entering the wrong names, addresses, or contact information. Double-checking these details is essential to ensure accuracy.

-

Missing Signatures: Both the buyer and seller must sign the form. Forgetting to include a signature can render the document invalid.

-

Failure to Include the Date: Not writing the date of the transaction can lead to confusion. Always include the date to establish when the sale took place.

-

Omitting Vehicle Information: For vehicle sales, it's crucial to provide complete details such as the make, model, year, and VIN. Missing this information can cause issues with registration.

-

Not Indicating the Purchase Price: The bill of sale should clearly state the purchase price. Leaving this blank can lead to misunderstandings later on.

-

Using Incorrect or Incomplete Descriptions: When describing the item being sold, be as detailed as possible. Vague descriptions can lead to disputes about what was actually sold.

-

Not Keeping a Copy: After completing the bill of sale, it's important to keep a copy for personal records. Failing to do so can make it difficult to prove ownership in the future.

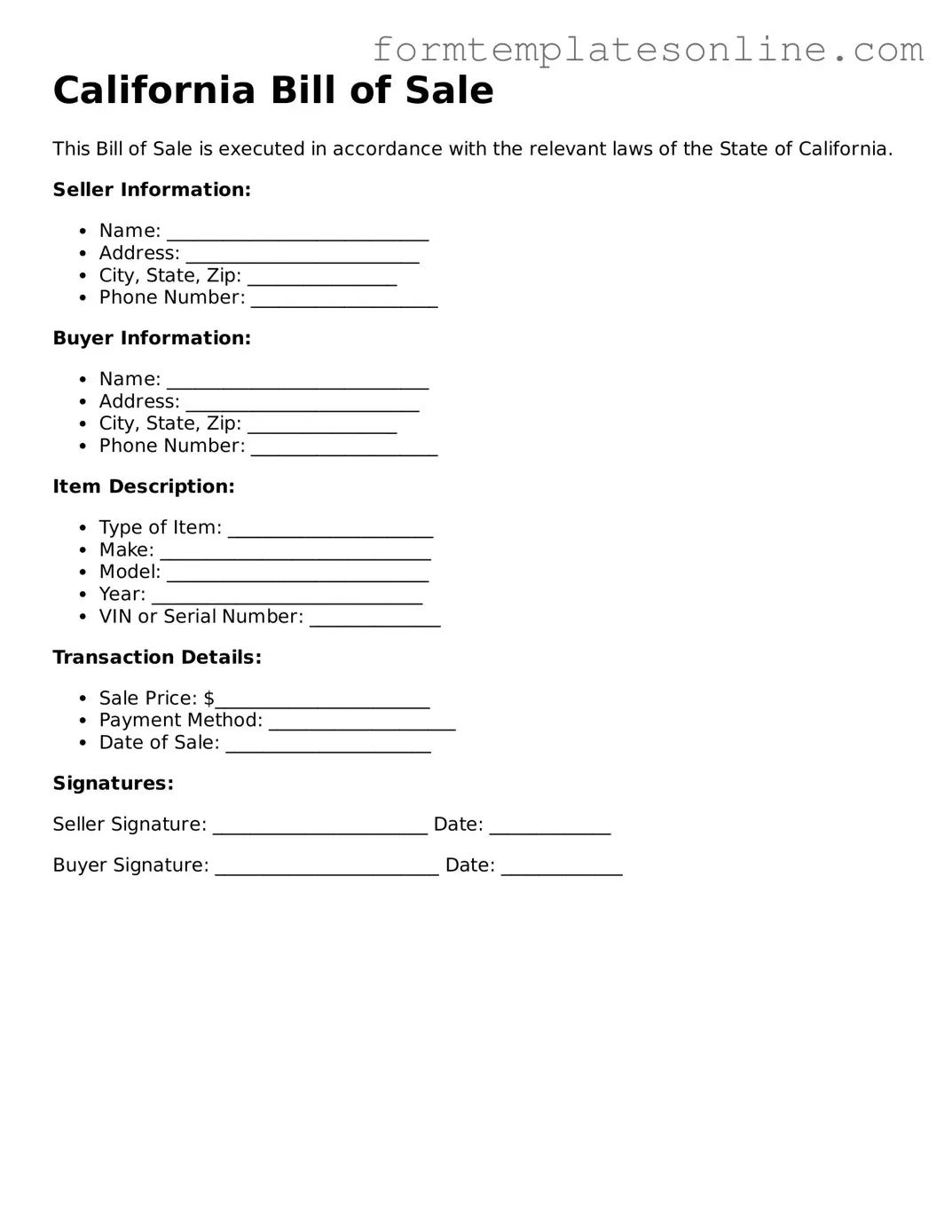

Example - California Bill of Sale Form

California Bill of Sale

This Bill of Sale is executed in accordance with the relevant laws of the State of California.

Seller Information:

- Name: ____________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ____________________

Buyer Information:

- Name: ____________________________

- Address: _________________________

- City, State, Zip: ________________

- Phone Number: ____________________

Item Description:

- Type of Item: ______________________

- Make: _____________________________

- Model: ____________________________

- Year: _____________________________

- VIN or Serial Number: ______________

Transaction Details:

- Sale Price: $_______________________

- Payment Method: ____________________

- Date of Sale: ______________________

Signatures:

Seller Signature: _______________________ Date: _____________

Buyer Signature: ________________________ Date: _____________

More About California Bill of Sale

What is a California Bill of Sale form?

A California Bill of Sale form is a legal document that records the transfer of ownership of personal property from one party to another. This form is commonly used for the sale of vehicles, boats, and other tangible items. It serves as proof of the transaction and includes details such as the buyer's and seller's names, the description of the item being sold, the sale price, and the date of the transaction. Having a Bill of Sale can help protect both parties in case of disputes or legal issues in the future.

Is a Bill of Sale required in California?

While a Bill of Sale is not legally required for every transaction in California, it is highly recommended, especially for significant purchases like vehicles or boats. Certain transactions, such as the sale of a vehicle, do require a Bill of Sale for registration purposes. For example, when transferring ownership of a car, the California Department of Motor Vehicles (DMV) requires a Bill of Sale to document the sale and facilitate the transfer of title.

What information should be included in a California Bill of Sale?

A comprehensive California Bill of Sale should include several key pieces of information. This includes the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and identification numbers if applicable), the sale price, and the date of the transaction. Additionally, both parties should sign the document to acknowledge their agreement to the terms of the sale. Including this information helps ensure clarity and can prevent misunderstandings later on.

Can a Bill of Sale be used as a receipt?

Yes, a Bill of Sale can serve as a receipt for the transaction. When both parties sign the document, it confirms that the buyer has paid the agreed-upon price and that the seller has transferred ownership of the item. This receipt-like function provides evidence of the transaction, which can be useful for record-keeping or if any disputes arise in the future. It is advisable for both parties to keep a copy of the Bill of Sale for their records.

Key takeaways

Filling out and using the California Bill of Sale form can be a straightforward process, but understanding its key components is essential. Here are some important takeaways to keep in mind:

- Purpose: The Bill of Sale serves as a legal document that records the transfer of ownership of an item, typically a vehicle or personal property.

- Required Information: The form requires details such as the names and addresses of both the buyer and seller, a description of the item, and the sale price.

- Item Description: Be specific when describing the item. Include details like make, model, year, and Vehicle Identification Number (VIN) for vehicles.

- Signatures: Both the buyer and seller must sign the document. This confirms that both parties agree to the terms of the sale.

- Notarization: While notarization is not always required, it can add an extra layer of security and legitimacy to the transaction.

- As-Is Condition: The Bill of Sale often includes a statement that the item is sold "as-is," meaning the buyer accepts it without warranties or guarantees.

- Record Keeping: Keep a copy of the Bill of Sale for your records. It serves as proof of the transaction and can be important for future reference.

- Local Laws: Be aware of any local regulations or requirements that may apply to your specific transaction, especially if it involves a vehicle.

- Tax Implications: Understand that sales tax may apply to the transaction, and ensure that it is calculated and paid accordingly.

By keeping these key points in mind, you can navigate the process of completing and using the California Bill of Sale form with confidence.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The California Bill of Sale form serves as a legal document to transfer ownership of personal property from one individual to another. |

| Governing Law | The form is governed by California Civil Code Section 1738, which outlines the requirements for the sale of personal property. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and other tangible items. |

| Signatures Required | Both the seller and the buyer must sign the Bill of Sale for it to be legally binding, ensuring mutual agreement on the transaction. |

| Notarization | While notarization is not required, it is recommended for added authenticity and to prevent potential disputes in the future. |

Consider Some Other Bill of Sale Forms for US States

Bill of Sale Pdf - Even minor transactions can benefit from the formal documentation provided by a Bill of Sale.

Automobile Bill of Sale - A Bill of Sale is often utilized in garage sales and flea markets for easy documentation.

Dmv Family Transfer - This form can also help with estate planning by documenting asset ownership.

Dos and Don'ts

When filling out the California Bill of Sale form, there are certain practices that can help ensure the document is completed correctly. Below is a list of things you should and shouldn't do.

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do specify the purchase price clearly.

- Do sign and date the form before submitting it.

- Don't leave any required fields blank.

- Don't use vague language when describing the item.

- Don't forget to keep a copy of the completed Bill of Sale for your records.

- Don't rush through the process; take your time to ensure accuracy.