Valid Articles of Incorporation Form for California

In the vibrant landscape of California's business environment, the Articles of Incorporation form serves as a crucial stepping stone for entrepreneurs looking to establish a corporation. This essential document not only marks the official birth of a corporation but also outlines key details that define its structure and purpose. Among the major aspects covered in the form are the corporation's name, which must be unique and compliant with state regulations, and its principal address, providing a physical location for official correspondence. Additionally, the form requires the identification of the corporation's initial agent for service of process, a designated individual or entity responsible for receiving legal documents. Furthermore, the Articles of Incorporation must specify the type of corporation—be it a general stock corporation or a nonprofit—and outline the purpose for which the corporation is formed, ensuring clarity in its intended operations. By carefully completing this form, business owners lay the groundwork for their corporate governance, setting the stage for future growth and compliance with California's regulatory framework.

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is failing to ensure that the business name is unique and not already in use. California requires that the name be distinguishable from existing entities.

-

Missing Purpose Statement: The Articles of Incorporation must include a clear statement of the business purpose. Omitting this can lead to delays or rejections.

-

Inaccurate Address Information: Providing incorrect or incomplete addresses for the corporation's principal office can cause issues. It's essential to double-check this information.

-

Not Including the Agent for Service of Process: Every corporation must designate an agent who can receive legal documents. Failing to include this information can lead to complications.

-

Improper Number of Directors: California law requires a minimum of one director. Some people mistakenly think they need to list more than the minimum, leading to confusion.

-

Failure to Sign the Document: A common oversight is neglecting to sign the Articles of Incorporation. Without a signature, the document is not valid.

-

Choosing the Wrong Corporation Type: Not all businesses fit into the same category. Misclassifying the type of corporation can have legal and tax implications.

-

Ignoring Filing Fees: Each submission requires a fee. Some individuals forget to include payment, which can result in processing delays.

-

Not Keeping Copies: Failing to retain a copy of the submitted Articles of Incorporation can lead to difficulties in the future when proof of incorporation is needed.

-

Overlooking State-Specific Requirements: California has specific requirements that differ from other states. Ignoring these can lead to rejection of the application.

Example - California Articles of Incorporation Form

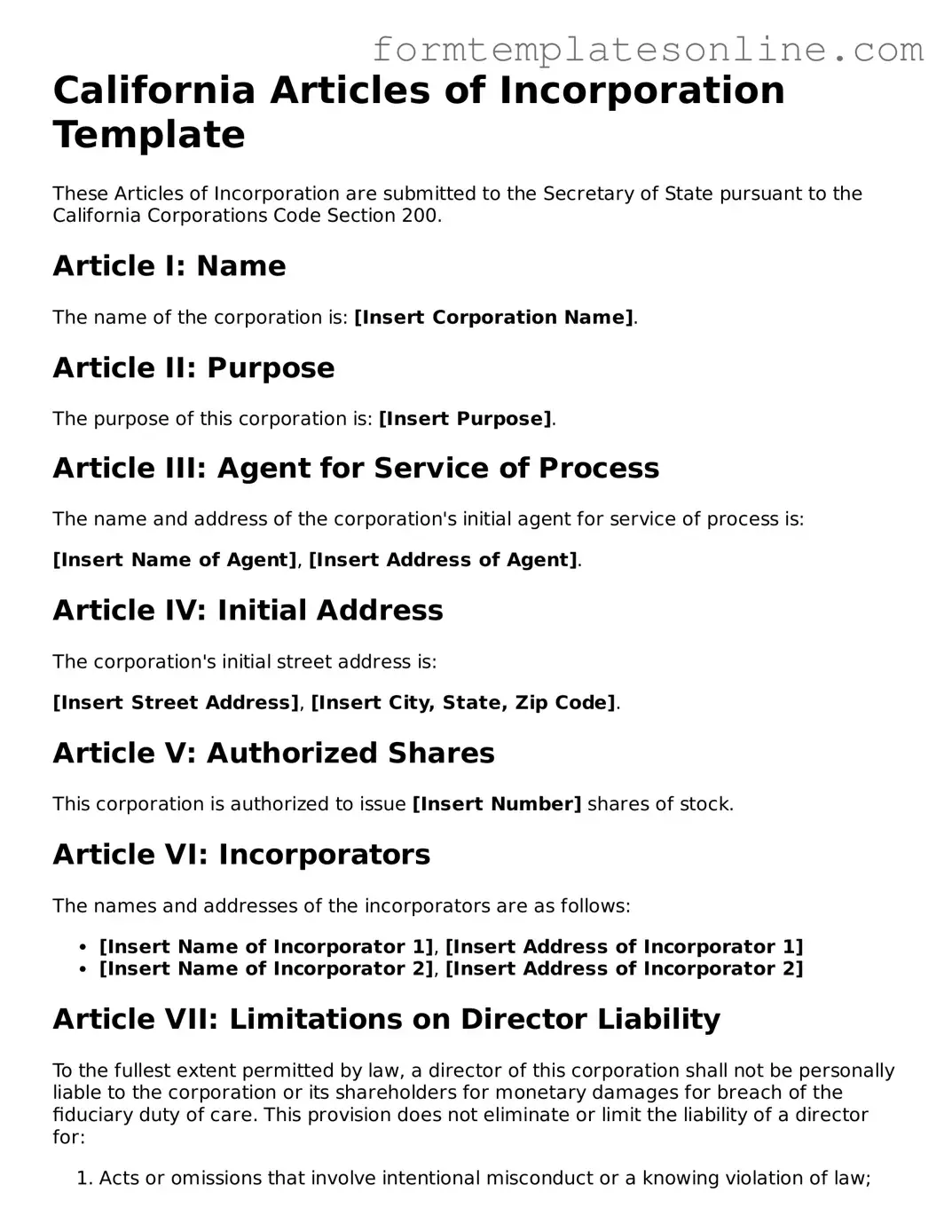

California Articles of Incorporation Template

These Articles of Incorporation are submitted to the Secretary of State pursuant to the California Corporations Code Section 200.

Article I: Name

The name of the corporation is: [Insert Corporation Name].

Article II: Purpose

The purpose of this corporation is: [Insert Purpose].

Article III: Agent for Service of Process

The name and address of the corporation's initial agent for service of process is:

[Insert Name of Agent], [Insert Address of Agent].

Article IV: Initial Address

The corporation's initial street address is:

[Insert Street Address], [Insert City, State, Zip Code].

Article V: Authorized Shares

This corporation is authorized to issue [Insert Number] shares of stock.

Article VI: Incorporators

The names and addresses of the incorporators are as follows:

- [Insert Name of Incorporator 1], [Insert Address of Incorporator 1]

- [Insert Name of Incorporator 2], [Insert Address of Incorporator 2]

Article VII: Limitations on Director Liability

To the fullest extent permitted by law, a director of this corporation shall not be personally liable to the corporation or its shareholders for monetary damages for breach of the fiduciary duty of care. This provision does not eliminate or limit the liability of a director for:

- Acts or omissions that involve intentional misconduct or a knowing violation of law;

- Any unlawful distribution in violation of Section 500 of the California Corporations Code;

- Any transaction from which the director derived an improper personal benefit.

Article VIII: Duration

The duration of this corporation is perpetual.

Signature

The undersigned incorporator affirms to the best of their knowledge and belief that the statements made herein are true.

Executed on: [Insert Date]

By: [Insert Name of Incorporator]

Title: [Insert Title, e.g., Incorporator]

More About California Articles of Incorporation

What are Articles of Incorporation in California?

Articles of Incorporation are legal documents that establish a corporation in California. They outline essential information about the company, such as its name, purpose, and the address of its registered office. Filing these articles with the California Secretary of State is a crucial first step in forming a corporation.

What information is required to complete the Articles of Incorporation?

To fill out the Articles of Incorporation, you'll need to provide several key details. This includes the corporation's name, the purpose of the business, the address of the principal office, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. It's important to ensure that the name you choose is unique and complies with California naming rules.

How do I file the Articles of Incorporation?

Filing can be done online, by mail, or in person. If you choose to file online, visit the California Secretary of State's website. For mail-in submissions, download the form, fill it out, and send it to the appropriate address. If you prefer to file in person, you can visit the Secretary of State's office. Be sure to include the required filing fee, which can vary depending on the type of corporation.

What is the filing fee for the Articles of Incorporation?

The filing fee for Articles of Incorporation in California typically ranges from $100 to $150, depending on the type of corporation you are forming. Additional fees may apply if you choose expedited processing or if you file certain types of corporations. Always check the latest fee schedule on the Secretary of State's website for the most accurate information.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If you need to change the corporation's name, purpose, or other details, you will need to file an amendment form with the Secretary of State. This process usually involves submitting a new form and paying a fee. Keep in mind that certain changes may require additional documentation or approvals.

Do I need a lawyer to file Articles of Incorporation?

No, hiring a lawyer is not a requirement for filing Articles of Incorporation in California. Many individuals successfully file on their own using available resources and templates. However, if your corporation has complex needs or you have questions about legal compliance, consulting with a lawyer can provide valuable guidance.

How long does it take to process the Articles of Incorporation?

The processing time for Articles of Incorporation can vary. Typically, it takes about 2 to 4 weeks for the California Secretary of State to process your filing. If you opt for expedited service, you may receive a faster turnaround, often within 24 hours. Always check the current processing times on the Secretary of State's website for the most up-to-date information.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially recognized by the state. You will receive a stamped copy of the Articles, which serves as proof of incorporation. After this, you should focus on obtaining any necessary business licenses, setting up a corporate bank account, and adhering to ongoing compliance requirements, such as holding annual meetings and filing annual reports.

Key takeaways

Filling out the California Articles of Incorporation form is a crucial step for anyone looking to start a corporation in the state. Here are some key takeaways to keep in mind:

- Choose the right type of corporation: Decide whether you are forming a standard corporation or a nonprofit. Each type has different requirements and implications.

- Provide accurate information: Ensure that all details, such as the corporation's name, address, and purpose, are correct. Mistakes can lead to delays or rejections.

- Designate a registered agent: This person or business will receive legal documents on behalf of the corporation. It’s essential to choose someone reliable.

- File with the Secretary of State: Submit your completed form along with the required filing fee to the California Secretary of State. Keep a copy for your records.

- Understand ongoing requirements: After incorporation, be aware of annual filing requirements and other regulations to maintain good standing.

By keeping these points in mind, you can navigate the incorporation process more smoothly and set your business up for success.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The California Articles of Incorporation is used to create a corporation in California. |

| Governing Law | This form is governed by the California Corporations Code, specifically Sections 200-210. |

| Filing Requirement | To officially incorporate, the Articles must be filed with the California Secretary of State. |

| Contents | The form typically includes the corporation's name, purpose, agent for service of process, and number of shares authorized. |

| Filing Fee | A filing fee is required, which can vary based on the type of corporation being formed. |

| Online Filing | California allows for online submission of the Articles of Incorporation, making the process more accessible. |

| Amendments | Changes to the Articles can be made through an amendment process, which also requires filing with the Secretary of State. |

Consider Some Other Articles of Incorporation Forms for US States

Incorporating in Nc - The Articles serve as an important record for future governance and accountability.

Michigan Llc Application Online - Articles of Incorporation outline the basic information for creating a corporation.

Articles of Incorporation Georgia Template - A registered office address must be included in the Articles.

Llc Filing Ohio - The document may include statements regarding corporate governance practices.

Dos and Don'ts

When filling out the California Articles of Incorporation form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide the full legal name of the corporation as it will appear on official documents.

- Do include the purpose of the corporation clearly and concisely.

- Do ensure that the registered agent's name and address are correct and complete.

- Do specify the number of shares the corporation is authorized to issue.

- Do sign and date the form where required.

- Don't use abbreviations or informal names for the corporation.

- Don't leave any required fields blank; ensure all information is filled out.

- Don't submit the form without double-checking for errors or typos.

- Don't forget to include the filing fee with the submission.

- Don't ignore the instructions provided with the form; they are there for a reason.