Attorney-Approved Business Purchase and Sale Agreement Template

The Business Purchase and Sale Agreement form serves as a crucial document in the process of transferring ownership of a business. This agreement outlines the terms and conditions under which the buyer agrees to purchase the business from the seller. Key components of the form include the purchase price, payment terms, and the effective date of the transaction. Additionally, it addresses the assets being sold, such as inventory, equipment, and intellectual property, ensuring clarity on what is included in the sale. The form also covers representations and warranties made by both parties, which can protect the buyer from undisclosed liabilities. Furthermore, it may outline any contingencies that must be met before the sale is finalized, such as financing approvals or regulatory compliance. By detailing these aspects, the Business Purchase and Sale Agreement helps to facilitate a smooth transition of ownership and minimizes potential disputes between the involved parties.

Common mistakes

-

Failing to include accurate business information. Buyers and sellers often overlook the need for precise details about the business, including its legal name, address, and structure.

-

Neglecting to specify the purchase price. Omitting this crucial detail can lead to misunderstandings and disputes later in the process.

-

Not detailing the assets included in the sale. This can result in confusion regarding what is being transferred, such as equipment, inventory, or intellectual property.

-

Overlooking contingencies. Buyers should consider including contingencies related to financing, inspections, or regulatory approvals to protect their interests.

-

Using vague language. Ambiguities in the agreement can lead to different interpretations, which may complicate enforcement.

-

Failing to outline payment terms clearly. This includes the timing of payments, methods of payment, and any installment arrangements.

-

Ignoring the importance of representations and warranties. Both parties should provide assurances about the business's condition and legal standing.

-

Not addressing post-sale obligations. This includes any agreements regarding the seller's involvement in the business after the sale.

-

Neglecting to consult legal or financial advisors. Relying solely on personal judgment can lead to oversights that may have significant consequences.

-

Failing to review the document thoroughly before signing. Rushing through the final stages can result in overlooked errors or omissions.

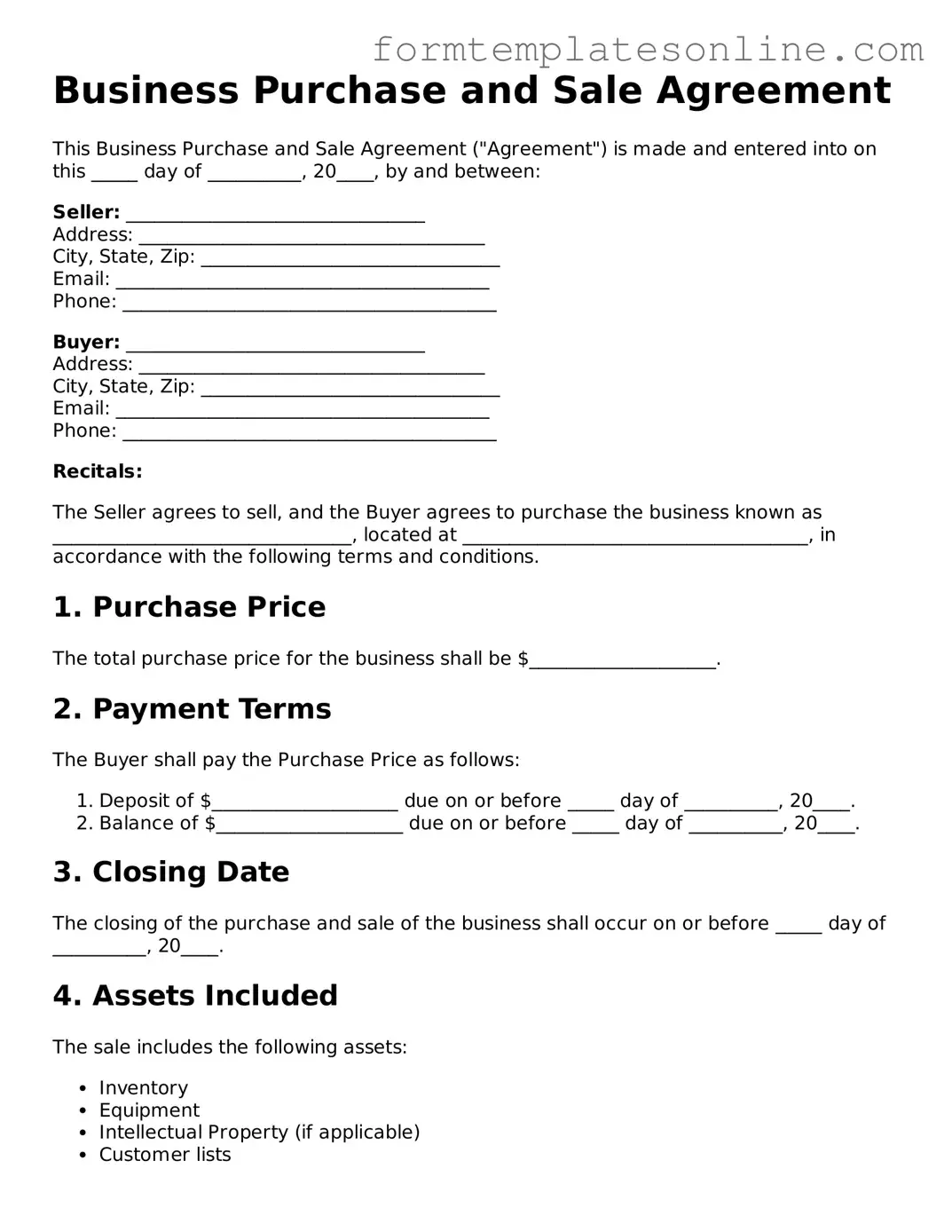

Example - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made and entered into on this _____ day of __________, 20____, by and between:

Seller: ________________________________

Address: _____________________________________

City, State, Zip: ________________________________

Email: ________________________________________

Phone: ________________________________________

Buyer: ________________________________

Address: _____________________________________

City, State, Zip: ________________________________

Email: ________________________________________

Phone: ________________________________________

Recitals:

The Seller agrees to sell, and the Buyer agrees to purchase the business known as ________________________________, located at _____________________________________, in accordance with the following terms and conditions.

1. Purchase Price

The total purchase price for the business shall be $____________________.

2. Payment Terms

The Buyer shall pay the Purchase Price as follows:

- Deposit of $____________________ due on or before _____ day of __________, 20____.

- Balance of $____________________ due on or before _____ day of __________, 20____.

3. Closing Date

The closing of the purchase and sale of the business shall occur on or before _____ day of __________, 20____.

4. Assets Included

The sale includes the following assets:

- Inventory

- Equipment

- Intellectual Property (if applicable)

- Customer lists

5. Representations and Warranties

The Seller represents and warrants that:

- The business is in good standing under the laws of the state of __________.

- All financial records are accurate and available for inspection.

- There are no outstanding legal claims against the business.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

7. Signatures

By signing below, both parties agree to the terms outlined in this Business Purchase and Sale Agreement.

Seller Signature: ________________________________

Date: ________________________________

Buyer Signature: ________________________________

Date: ________________________________

More About Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is sold. It serves to protect both the buyer and the seller by detailing the specifics of the transaction, including the purchase price, payment terms, and any contingencies that must be met before the sale is finalized. This agreement is crucial in ensuring that both parties understand their rights and obligations throughout the sale process.

Why is a Business Purchase and Sale Agreement important?

This agreement is important because it provides a clear framework for the transaction. It helps prevent misunderstandings by explicitly stating the responsibilities of both the buyer and seller. Additionally, it can address potential issues such as liabilities, warranties, and representations, which can protect both parties from future disputes. Having a well-drafted agreement can also facilitate a smoother closing process.

What key elements should be included in the agreement?

Key elements of a Business Purchase and Sale Agreement typically include the purchase price, payment structure, description of the business being sold, assets included in the sale, and any liabilities that the buyer will assume. It should also outline any conditions that need to be satisfied before the sale can be completed, such as financing or regulatory approvals. Lastly, the agreement should address any warranties or representations made by either party.

Can the agreement be modified after it is signed?

What happens if one party breaches the agreement?

If one party breaches the Business Purchase and Sale Agreement, the other party may have legal recourse. This could involve seeking damages or specific performance, which means asking the court to enforce the terms of the agreement. The specific consequences will depend on the nature of the breach and the terms outlined in the agreement. It is essential to include a dispute resolution clause in the agreement to address how conflicts will be handled.

Is it necessary to have legal assistance when drafting this agreement?

Key takeaways

When engaging in a business transaction, the Business Purchase and Sale Agreement is a crucial document that outlines the terms of the sale. Here are some key takeaways to consider when filling out and using this form:

- Understand the Purpose: The agreement serves as a legal contract between the buyer and seller, detailing the terms of the business transfer.

- Identify the Parties: Clearly state the names and addresses of both the buyer and the seller. This ensures that all parties are properly recognized in the agreement.

- Describe the Business: Include a detailed description of the business being sold. This should encompass its operations, assets, and any liabilities.

- Specify the Purchase Price: Clearly outline the total purchase price and any payment terms. This could include down payments, financing arrangements, or installment plans.

- Outline Contingencies: Address any conditions that must be met before the sale can be finalized. This may include financing approvals or inspections.

- Include Representations and Warranties: Both parties should make certain promises about the business's condition and operations, which adds a layer of protection for the buyer.

- Define Closing Procedures: Clearly outline how and when the sale will be finalized, including the transfer of ownership and any necessary documentation.

- Consider Confidentiality: If sensitive information is involved, include a confidentiality clause to protect proprietary information during and after the transaction.

- Seek Legal Review: Before finalizing the agreement, it is advisable to have a legal professional review the document to ensure compliance with state laws and regulations.

Using the Business Purchase and Sale Agreement effectively can help facilitate a smooth transaction, protecting the interests of both the buyer and the seller.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document outlining the terms of a transaction involving the sale of a business. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Governing Law | The agreement is subject to the laws of the state where the business operates. For example, in California, it follows California Business and Professions Code. |

| Key Components | Essential elements include purchase price, payment terms, and the description of assets being sold. |

| Confidentiality Clause | Often, the agreement includes a confidentiality clause to protect sensitive business information during and after the sale. |

| Due Diligence | The buyer usually conducts due diligence to verify the business's financial and operational status before finalizing the purchase. |

| Contingencies | Common contingencies may include financing approval and satisfactory completion of due diligence. |

| Closing Date | The agreement specifies a closing date, which is when the transaction is officially completed. |

| Dispute Resolution | Many agreements include clauses on how disputes will be resolved, such as mediation or arbitration. |

| Amendments | Any changes to the agreement must be made in writing and signed by both parties to be enforceable. |

Other Templates:

Which of These Items Is Checked in a Pre-trip Inspection? - Inspect tires for proper inflation and tread wear before driving.

For those exploring the intricacies of investment transactions, a thorough understanding of the initial Investment Letter of Intent process can be crucial before engaging fully in negotiations and agreements.

Rental Letter of Intent - A Letter of Intent can help clarify the intentions of both parties in the leasing process.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, it is important to approach the task with care and attention to detail. Here are ten guidelines to help ensure a smooth process.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information in all sections.

- Do double-check all calculations and figures for accuracy.

- Do consult with a professional if you have questions or concerns.

- Do keep a copy of the completed agreement for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't use vague language; be specific in your descriptions.

- Don't rush through the process; take your time to ensure clarity.

- Don't ignore deadlines; submit the agreement on time.

- Don't hesitate to ask for clarification on any terms you do not understand.

By following these guidelines, you can help ensure that your Business Purchase and Sale Agreement is completed correctly and effectively. Each step taken with care contributes to a successful transaction.