Business Credit Application PDF Form

When seeking to establish a line of credit for a business, the Business Credit Application form plays a crucial role in the process. This document serves as a gateway for lenders to assess the financial health and creditworthiness of a business. It typically requires essential information, including the business's legal name, address, and contact details, as well as the nature of the business and its structure, such as whether it is a sole proprietorship, partnership, or corporation. Additionally, the form often requests financial statements, tax identification numbers, and details about the owners or principals of the business. Credit history is another significant aspect; lenders will want to know about past borrowing experiences and payment histories. Furthermore, the application may include a section for authorizing credit checks, allowing lenders to verify the information provided. By gathering this information, the Business Credit Application form not only facilitates the lending process but also helps businesses prepare for future financial obligations.

Common mistakes

-

Incomplete Information: Many applicants fail to provide all the necessary details. Missing fields can delay the approval process. Ensure that every section is filled out completely.

-

Incorrect Business Structure: Selecting the wrong business type can lead to complications. Be sure to accurately identify whether your business is a sole proprietorship, LLC, corporation, or partnership.

-

Inaccurate Financial Information: Providing incorrect financial data can raise red flags. Double-check your figures to reflect your business's current financial status.

-

Neglecting to Review Terms: Skipping the fine print can result in misunderstandings. Always read the terms and conditions carefully before submitting the application.

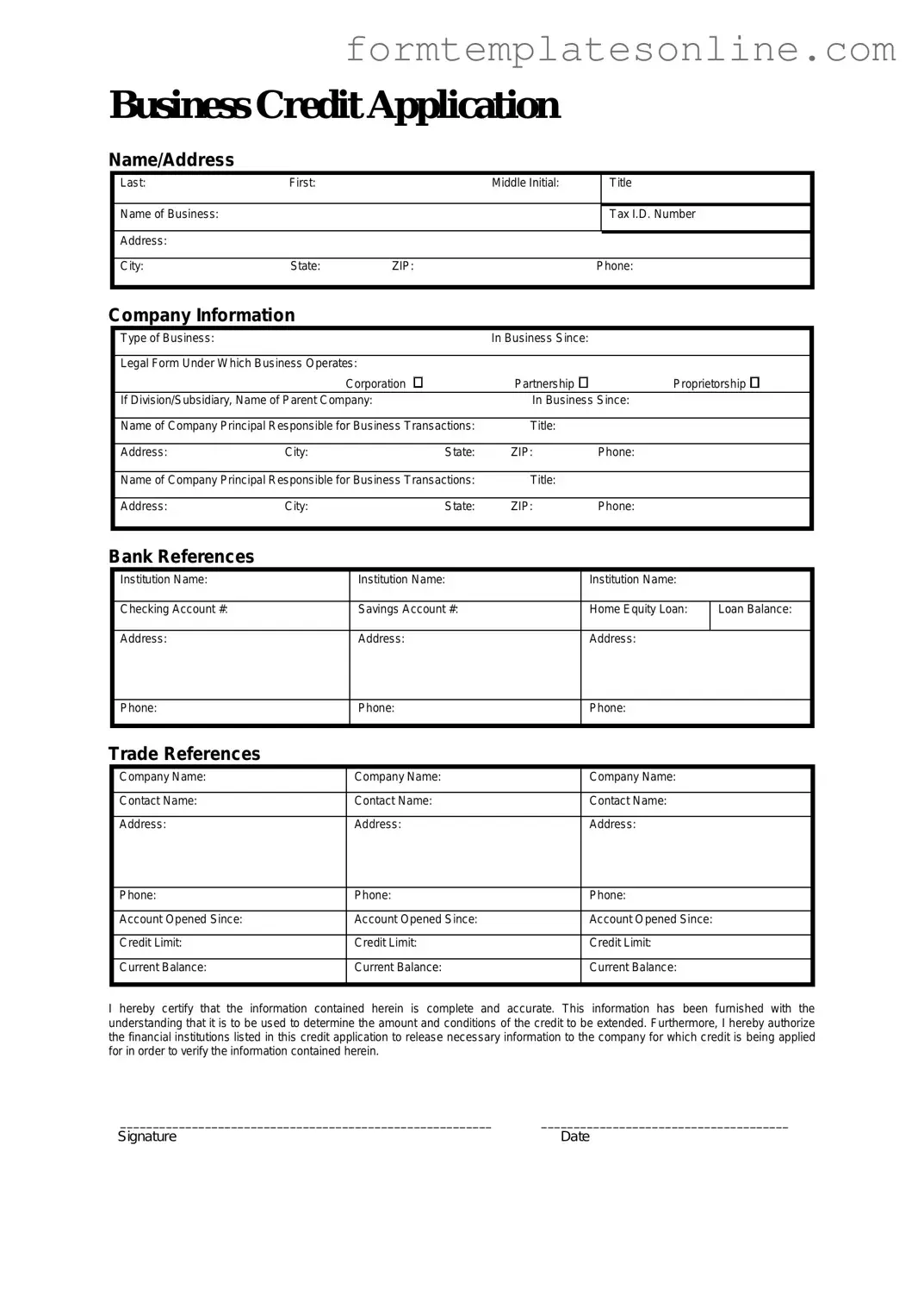

Example - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

More About Business Credit Application

What is a Business Credit Application form?

The Business Credit Application form is a document that businesses complete to apply for credit with a lender or supplier. This form typically collects essential information about the business, including its legal structure, financial history, and creditworthiness. By providing this information, the business allows the lender to assess its ability to repay borrowed funds or to meet payment terms for goods and services.

Why is it important to fill out the form accurately?

Accuracy is crucial when completing the Business Credit Application form. Inaccurate or incomplete information can lead to delays in processing the application or even a denial of credit. Lenders rely on the details provided to make informed decisions. Therefore, it is essential to double-check all entries, ensuring they reflect the current status of the business.

What information is typically required on the form?

The form usually requires basic information such as the business name, address, and contact details. Additionally, it may ask for the business's legal structure (e.g., LLC, corporation), tax identification number, and financial statements. Some forms also request details about the owners or principals, including their personal credit information, to assess overall creditworthiness.

How long does it take to process the application?

The processing time for a Business Credit Application can vary widely depending on the lender or supplier. Generally, it may take anywhere from a few days to a couple of weeks. Factors that influence this timeline include the complexity of the application, the lender's workload, and the thoroughness of the information provided. Keeping communication open with the lender can help clarify any questions and expedite the process.

What should I do if my application is denied?

If your Business Credit Application is denied, don’t panic. First, request a detailed explanation from the lender. Understanding the reasons behind the denial can help you address any issues. You may need to improve your credit score, provide additional documentation, or consider alternative financing options. Reapplying after addressing the concerns may also be a viable strategy.

Key takeaways

Filling out and using a Business Credit Application form is an essential step for any business seeking to establish credit. Here are some key takeaways to keep in mind:

- Accuracy is Crucial: Ensure that all information provided is accurate and up-to-date. Inaccurate details can lead to delays or denial of credit.

- Provide Comprehensive Information: Include all necessary details about your business, such as ownership structure, financial history, and business references. This helps lenders assess your creditworthiness.

- Understand the Terms: Carefully review the terms and conditions associated with the credit. Know your obligations and what is expected from you as a borrower.

- Be Prepared for Follow-Up: After submitting your application, be ready for potential follow-up questions from the lender. Quick responses can expedite the approval process.

- Keep Copies: Always keep a copy of the completed application for your records. This can be helpful for future reference or if any issues arise.

By following these guidelines, you can streamline the process of obtaining business credit and improve your chances of approval.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | Typically, the form requires information such as business name, address, ownership details, and financial information. |

| Credit Evaluation | The information provided is used to evaluate the creditworthiness of the business. |

| State-Specific Forms | Some states may have specific requirements or forms that comply with local laws. |

| Governing Laws | In the U.S., the governing laws may vary by state, including regulations related to credit transactions. |

| Confidentiality | Information submitted is generally kept confidential, but businesses should review privacy policies of the creditor. |

Other PDF Forms

Utility Bill Generator - Provide supplemental information if the account is in joint names.

Odometer Disclosure Texas - This disclosure is an important safeguard for all vehicle owners.

Yugioh Deck List Sheet - The form is essential for maintaining fairness in competitive play environments.

Dos and Don'ts

When filling out a Business Credit Application form, attention to detail is crucial. Here are some essential dos and don'ts to consider:

- Do provide accurate and complete information. Double-check your entries for any errors.

- Do include all necessary documentation, such as financial statements and business licenses.

- Do be honest about your business’s financial history. Transparency builds trust with lenders.

- Do read the application thoroughly before submission. Ensure you understand all terms and conditions.

- Don't leave any sections blank. If a question does not apply, indicate that clearly.

- Don't rush through the process. Take your time to ensure accuracy and completeness.