Broker Price Opinion PDF Form

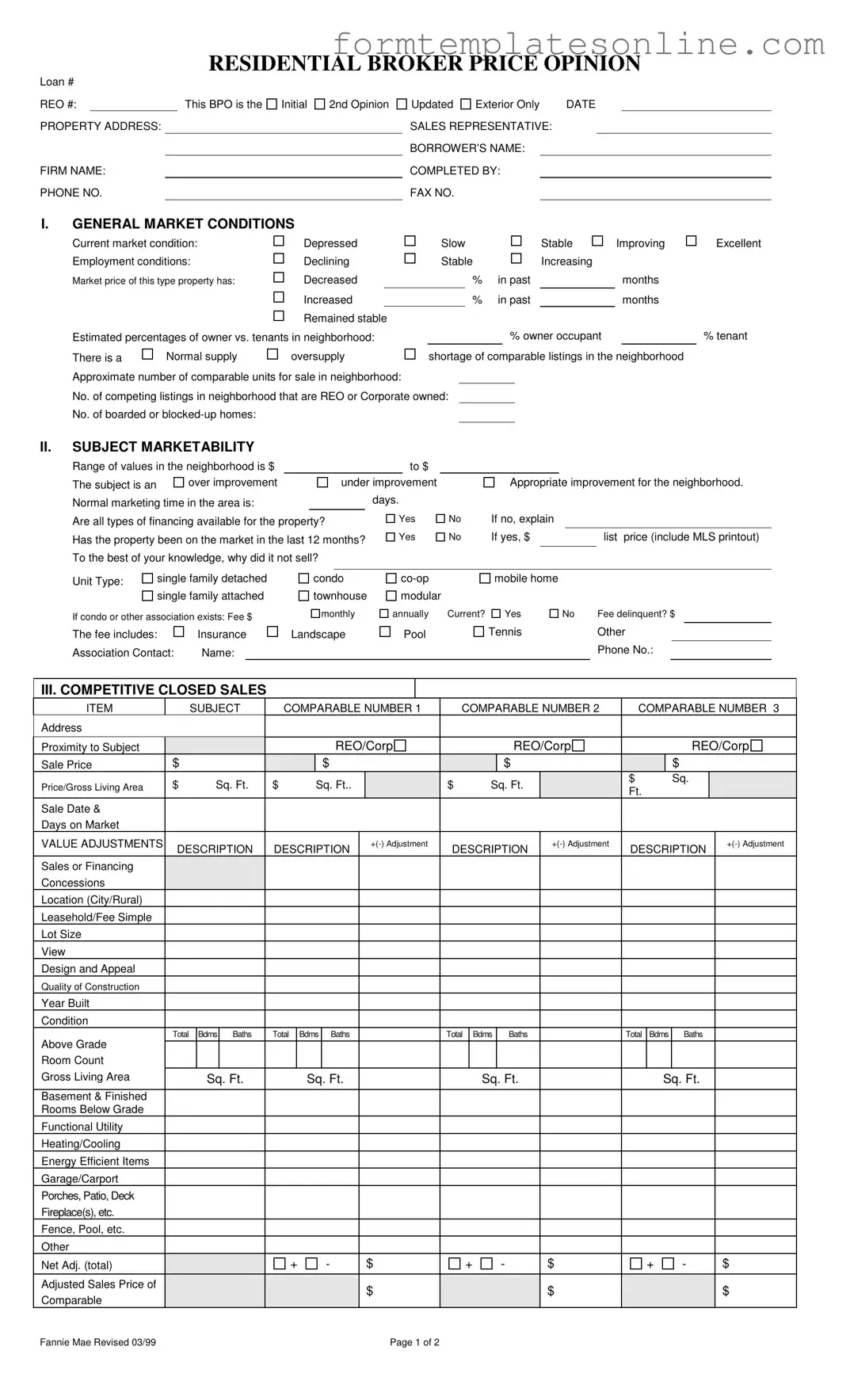

The Broker Price Opinion (BPO) form is a crucial tool used in the real estate industry to assess property values, particularly in situations involving distressed properties or foreclosures. This comprehensive document captures essential information about a property, including its address, current market conditions, and the status of the local economy. It outlines the marketability of the subject property, detailing factors such as the range of values in the neighborhood and the availability of financing options. Additionally, the BPO includes comparisons with similar properties that have recently sold, providing a clearer picture of competitive pricing. Key sections of the form address necessary repairs, occupancy status, and marketing strategies, all of which play a significant role in determining the best approach to selling the property. By examining comparable closed sales and active listings, the BPO helps establish a realistic market value, guiding lenders, investors, and real estate professionals in their decision-making processes. Understanding the nuances of this form can make a significant difference in achieving favorable outcomes in real estate transactions.

Common mistakes

-

Inaccurate Property Information: One of the most common mistakes is providing incorrect or incomplete details about the property. This includes missing the property address, failing to specify the type of unit, or neglecting to include the number of bedrooms and bathrooms. Accurate information is crucial for a reliable assessment.

-

Neglecting Market Conditions: Many individuals overlook the section regarding current market conditions. It is essential to assess whether the market is stable, improving, or declining. This context can significantly impact the valuation and should not be taken lightly.

-

Ignoring Comparable Sales: Failing to provide or inaccurately listing comparable sales can lead to an unrealistic property valuation. It is important to select properties that are truly comparable in terms of size, location, and condition to ensure a fair market price.

-

Overlooking Repairs: Some people forget to itemize necessary repairs that would enhance the property's marketability. Listing these repairs helps in providing a clearer picture of the property's condition and potential costs to buyers.

-

Inadequate Marketing Strategy: A vague or incomplete marketing strategy can hinder the property's appeal. Clearly stating whether the property is being sold "as-is" or with repairs can help set appropriate expectations for potential buyers.

-

Failure to Comment on Special Concerns: The comments section is often underutilized. Including specific positives, negatives, and any special concerns such as environmental issues or easements can provide valuable insights to potential buyers and lenders.

Example - Broker Price Opinion Form

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

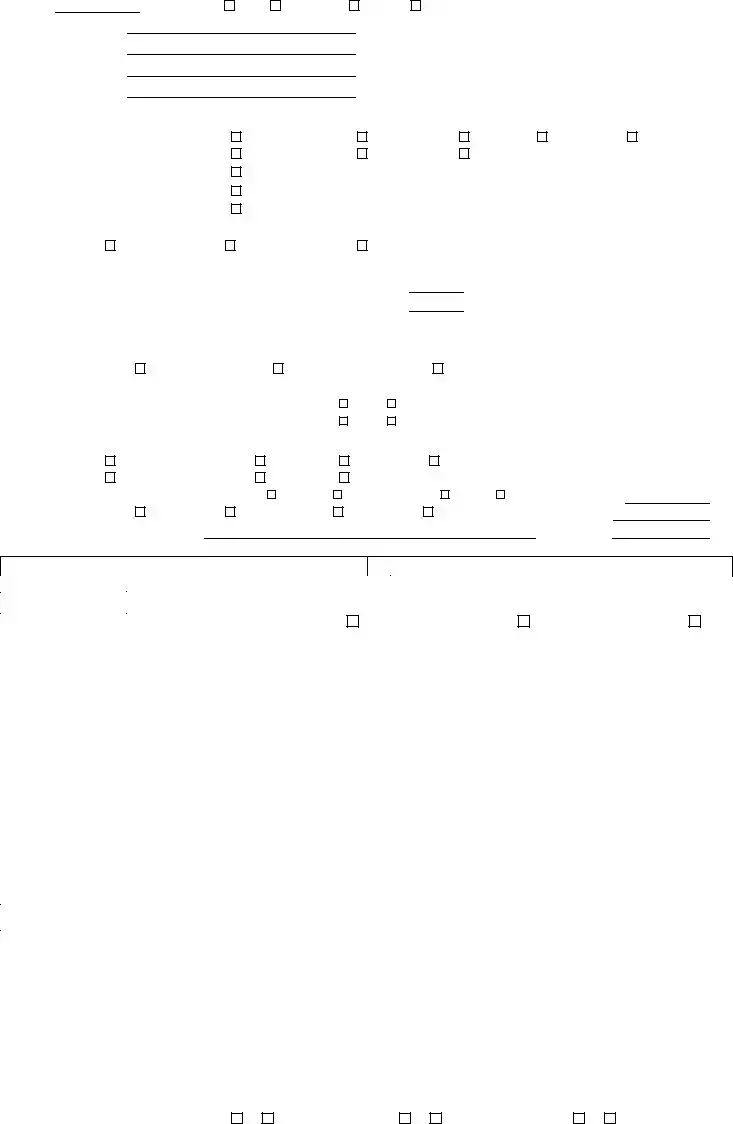

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

More About Broker Price Opinion

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is a professional opinion provided by a licensed real estate broker regarding the value of a property. It is often used by lenders, investors, and real estate agents to assess property value in situations like foreclosures, short sales, or when determining a listing price. The BPO considers current market conditions, comparable sales, and the property's condition.

What information is required to complete a BPO?

The BPO form requires various details including the property address, loan number, and the name of the borrower. It also includes sections on market conditions, subject marketability, competitive closed sales, marketing strategy, repairs needed, and competitive listings. Accurate data is essential for a reliable opinion.

How is the market condition assessed in a BPO?

The market condition is evaluated based on factors such as employment rates, the current supply and demand of properties, and overall economic trends. The BPO form includes specific indicators like whether the market is depressed, stable, or improving, which helps in determining the property's value.

What are comparable sales and why are they important?

Comparable sales, or "comps," refer to similar properties that have recently sold in the area. They are crucial for establishing a property's market value. The BPO form requires brokers to list and analyze these sales, considering factors like sale price, square footage, and condition to provide a well-rounded opinion on the subject property.

What is the difference between 'As-Is' and 'Repaired' values in a BPO?

The 'As-Is' value reflects the property's current condition without any repairs, while the 'Repaired' value estimates what the property would be worth after necessary repairs are completed. This distinction helps buyers and lenders understand the potential investment needed to bring the property to marketable condition.

What does the marketing strategy section entail?

This section outlines how the property will be marketed, whether it will be sold 'As-Is' or after minimal repairs. It helps to identify the best approach for attracting potential buyers and maximizing the property's sale price.

How does occupancy status affect a BPO?

The occupancy status—whether the property is occupied, vacant, or unknown—can significantly influence its marketability and value. Occupied properties may present challenges for showings, while vacant properties might indicate a need for repairs or security measures.

What types of repairs are typically noted in a BPO?

Repairs may include anything from minor cosmetic updates to major structural fixes. The BPO form prompts brokers to itemize necessary repairs that would bring the property to an average marketable condition, which can help set expectations for potential buyers and lenders.

What role do financing options play in a BPO?

The availability of financing options can affect a property's appeal and market value. The BPO form asks brokers to indicate if all types of financing are available for the property, as limited financing options can deter potential buyers and impact the sale price.

How is the final market value determined in a BPO?

The final market value is derived from the analysis of comparable sales, the condition of the property, and current market trends. The BPO form guides brokers to suggest a list price based on these factors, ensuring it aligns with the competitive landscape of the area.

Key takeaways

When filling out and using the Broker Price Opinion (BPO) form, there are several important considerations to keep in mind:

- Accurate Market Analysis: It is crucial to assess the current market conditions accurately. This includes evaluating whether the market is stable, improving, or depressed. Understanding local employment conditions and the percentage of owner-occupied versus rental properties will provide a clearer picture of the neighborhood.

- Comparable Sales: Gathering data on comparable closed sales is essential. You should document at least three comparable properties, noting their sale prices, conditions, and any adjustments that may affect their value. This information will help establish a fair market value for the subject property.

- Repairs and Improvements: Clearly itemize any repairs needed to bring the property to a marketable condition. This will not only help in determining the property's value but also guide potential buyers on what to expect.

- Marketing Strategy: Outline a clear marketing strategy. Indicate whether the property will be sold "as-is" or if minimal repairs will be made. This decision can significantly impact the property's appeal and the expected sale price.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the market value of a property. |

| Loan Information | The form includes sections for Loan # and REO # to identify the property. |

| Property Address | The form requires the complete address of the property being evaluated. |

| Market Conditions | It assesses current market conditions, including employment and pricing trends. |

| Subject Marketability | The form evaluates the subject property's marketability and potential financing options. |

| Competitive Sales | It compares the subject property to three similar properties that have recently sold. |

| Repairs Needed | The form lists necessary repairs to bring the property to marketable condition. |

| Competitive Listings | It includes information on three comparable properties currently listed for sale. |

| Market Value | The BPO form provides a suggested list price based on the analysis of comparable sales. |

| Governing Laws | Each state may have specific laws governing the use of BPOs; consult local regulations. |

Other PDF Forms

Roofing Inspection Checklist Template - Supports detailed communication of conditions to property managers.

The Georgia Lease Agreement form is a legally binding document that outlines the terms and conditions under which a rental property is leased by the landlord to the tenant. This detailed agreement serves to protect the interests of both parties involved in the rental transaction. For those seeking assistance with this process, resources such as OnlineLawDocs.com can provide valuable insights and guidance. Understanding the specifics of this form is crucial for anyone embarking on a lease arrangement in Georgia.

Fedex Indirect Signature - Utilizing this form fosters a better understanding between you and the FedEx delivery team.

Dos and Don'ts

When filling out a Broker Price Opinion (BPO) form, attention to detail is crucial. Here are five important do's and don'ts to keep in mind:

- Do ensure all information is accurate and complete. Double-check property details, including the address and loan number.

- Do provide a thorough analysis of the market conditions. Highlight trends that may affect the property's value.

- Do include recent comparable sales data. This will support your valuation and provide context for your opinion.

- Do be transparent about the condition of the property. Clearly list any repairs needed and their estimated costs.

- Do maintain professionalism throughout the form. Use clear language and avoid personal opinions.

- Don't leave sections blank. Every part of the form should be filled out to provide a complete picture.

- Don't exaggerate or understate the property's condition. Be honest to maintain credibility.

- Don't ignore the importance of current market trends. Failing to address these can mislead stakeholders.

- Don't forget to sign and date the form. An unsigned document may not be considered valid.

- Don't rush through the process. Take your time to ensure accuracy and thoroughness.