Auto Insurance Card PDF Form

When you get behind the wheel, having your auto insurance card readily available is essential. This card serves as proof of insurance and contains important details that can help you in case of an accident. It features your insurance identification number, the company number, and your policy number, ensuring you have the necessary information at hand. The effective and expiration dates are clearly marked, so you can easily keep track of your coverage. Additionally, the card includes specifics about your vehicle, such as the year, make, model, and vehicle identification number (VIN). It’s issued by your insurance agency, which is also listed on the card. Remember, this document must be kept in your vehicle and presented upon request. In the unfortunate event of an accident, it’s crucial to report the incident to your insurance agent or company as soon as possible. Make sure to gather important information from all parties involved, including names and addresses of drivers, passengers, and witnesses, along with the insurance details for each vehicle. For security, the front of the card features an artificial watermark that can be viewed by holding it at an angle. Keeping this card on hand ensures you are prepared and compliant while driving.

Common mistakes

Filling out the Auto Insurance Card form accurately is crucial for ensuring proper coverage and compliance. Here are seven common mistakes people make:

- Incorrect Company Number: Failing to enter the correct company number can lead to issues with policy verification. Always double-check this number against your insurance documents.

- Missing Policy Number: Omitting the policy number can create confusion during claims processing. Ensure this is filled out completely and correctly.

- Inaccurate Effective and Expiration Dates: Entering the wrong dates can result in coverage lapses. Verify these dates with your insurance provider before submission.

- Vehicle Identification Number (VIN) Errors: A single digit error in the VIN can invalidate your insurance. Cross-reference the VIN with your vehicle registration to avoid mistakes.

- Incomplete Vehicle Information: Failing to provide the year, make, and model of the vehicle can lead to complications in claims. Ensure all details are filled in accurately.

- Agency/Company Issuing Card Not Specified: Not indicating the issuing agency can cause delays in processing. Make sure to include this information clearly.

- Ignoring Important Notices: Overlooking the instructions on the reverse side can result in non-compliance. Always read and understand all notices provided.

Taking the time to carefully complete the Auto Insurance Card form can prevent unnecessary complications and ensure that you are properly covered in case of an accident. Review each section thoroughly before submitting the form.

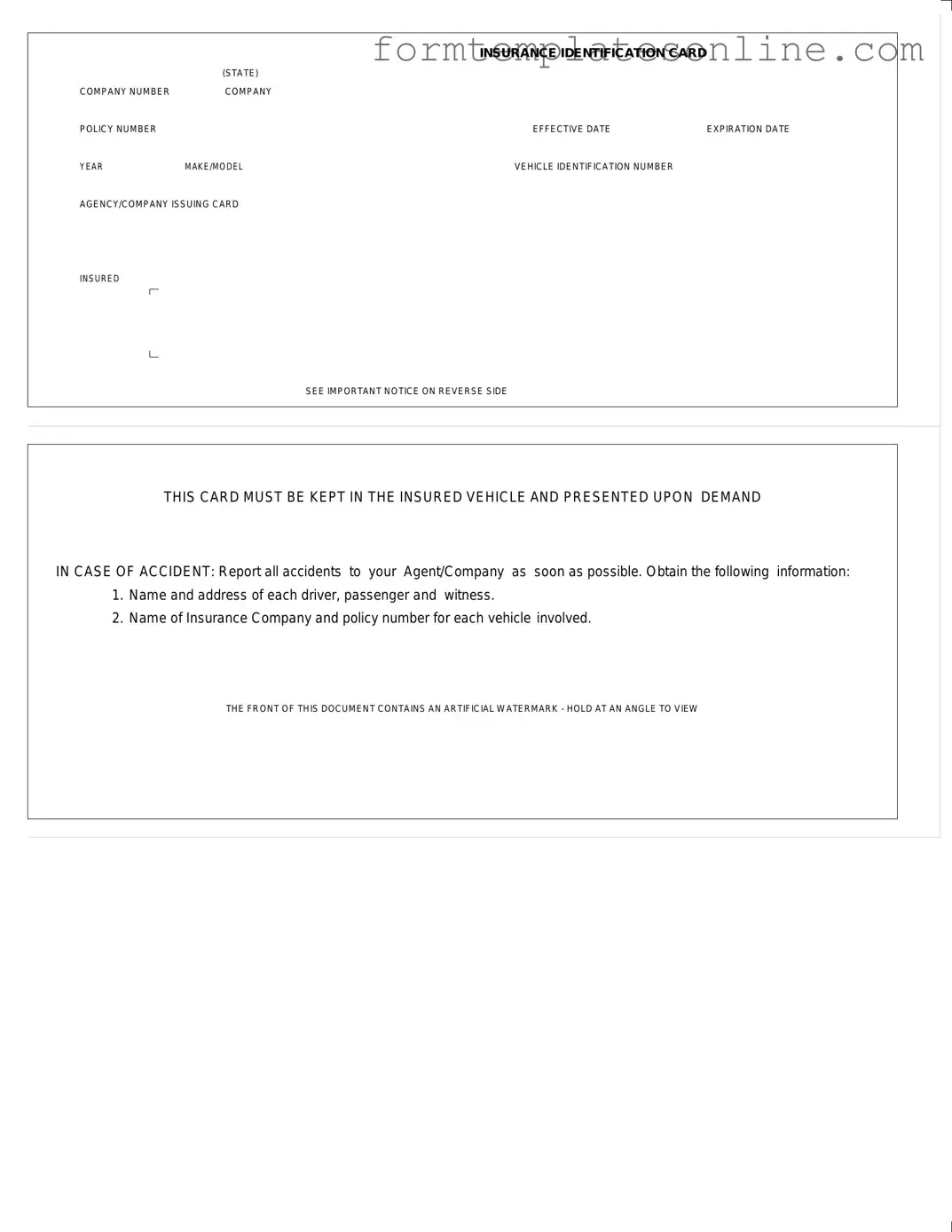

Example - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

More About Auto Insurance Card

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have valid car insurance. It includes essential information such as your insurance company’s name, your policy number, the effective and expiration dates of your coverage, and details about your vehicle, including its make, model, and Vehicle Identification Number (VIN). This card is crucial for legal compliance and must be kept in your vehicle at all times.

Why is it important to keep the Auto Insurance Card in the vehicle?

Keeping the Auto Insurance Card in your vehicle is important because it serves as proof of insurance when required. If you are involved in an accident or stopped by law enforcement, you must present this card upon demand. Failing to provide proof of insurance can lead to fines or other legal consequences. Therefore, having it readily accessible ensures you are prepared for any situation on the road.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, it is essential to contact your insurance company or agent as soon as possible. They can issue a replacement card, which you can often receive digitally or by mail. It is advisable to keep a digital copy on your phone as a backup while you wait for the new card to arrive. Always ensure that you have proof of insurance readily available to avoid potential issues while driving.

What information is required on the Auto Insurance Card?

The Auto Insurance Card must include several key pieces of information. This includes the name of the insurance company, your policy number, the effective and expiration dates of your coverage, and details about your vehicle, such as the make, model, and VIN. Additionally, the card may indicate the agency or company that issued it. This information is vital for verifying your insurance status.

What should I do if I get into an accident?

If you are involved in an accident, the first step is to ensure everyone's safety. After that, you must report the accident to your insurance agent or company as soon as possible. Collect relevant information, including the names and addresses of all drivers, passengers, and witnesses. Additionally, gather the insurance details of all vehicles involved. This information will be necessary for filing a claim and ensuring a smooth resolution to the incident.

Key takeaways

When filling out and using the Auto Insurance Card form, keep these key takeaways in mind:

- Accurate Information: Ensure all fields, such as the company number and policy number, are filled out correctly to avoid issues during claims.

- Effective Dates: Note the effective and expiration dates. This helps confirm that your coverage is active when needed.

- Vehicle Details: Include the year, make, model, and vehicle identification number (VIN) to clearly identify the insured vehicle.

- Keep It Accessible: This card must be kept in the insured vehicle at all times. Present it upon demand in case of an accident.

- Accident Protocol: Report all accidents to your agent or company immediately. Collect essential information from all parties involved.

Remember, the front of the document features an artificial watermark. Hold it at an angle to view it clearly.

Form Attributes

| Fact Name | Description |

|---|---|

| Insurance Identification Card | This document serves as proof of auto insurance coverage for the insured vehicle. |

| Company Number | A unique identifier assigned to the insurance company providing coverage. |

| Policy Number | The specific number associated with the insurance policy for the vehicle. |

| Effective Date | The date when the insurance coverage begins, as specified on the card. |

| Expiration Date | The date when the insurance coverage ends, requiring renewal to maintain validity. |

| Vehicle Information | Includes the year, make, model, and vehicle identification number (VIN) of the insured vehicle. |

| Issuing Agency/Company | The name of the agency or company that issued the insurance identification card. |

| Legal Requirement | Most states require that this card be kept in the vehicle and presented upon demand in case of an accident. |

Other PDF Forms

Fedex Indirect Signature - Your request specifies exactly where you want your package to be left when you aren't available.

What Is an I-9 - Provide background verification for prospective employers.

When engaging in the sale of a mobile home, it is essential to utilize a legally recognized document to facilitate the process, ensuring clarity and legality in the transaction. A Mobile Home Bill of Sale is a legal document that records the transfer of ownership of a mobile home from one party to another. This form serves as proof of the sale and outlines important details such as the purchase price, the date of sale, and the identities of both the buyer and seller. Completing this form accurately is crucial for ensuring a smooth transaction and protecting the rights of both parties involved. For your convenience, you can obtain a reliable Mobile Home Bill of Sale form that meets these requirements.

Pdf Printable Puppy Shot Record - Lists all vaccines administered including DHPP and Rabies.

Dos and Don'ts

When filling out the Auto Insurance Card form, it is essential to be careful and precise. Here are some important dos and don'ts to keep in mind:

- Do double-check all information for accuracy before submitting the form.

- Do include the vehicle identification number (VIN) to ensure proper identification of your vehicle.

- Don't leave any fields blank. Every section must be filled out completely.

- Don't forget to keep the card in your vehicle at all times, as it must be presented upon demand.