Adp Pay Stub PDF Form

The ADP Pay Stub form is an essential document for employees, providing a clear and concise summary of their earnings and deductions for each pay period. This form includes critical information such as gross pay, net pay, and various deductions for taxes, retirement contributions, and health insurance premiums. Understanding the details on your pay stub is crucial, as it allows you to verify that you are being compensated accurately and that all deductions are correct. Additionally, the form often includes year-to-date totals, which help you track your overall earnings and tax contributions throughout the year. Familiarity with the ADP Pay Stub form can empower you to make informed financial decisions, ensuring that you are aware of your financial standing and obligations. Whether you are reviewing your pay stub for personal budgeting or for tax preparation, knowing how to read and interpret this document is vital.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to accurately fill out their personal details, such as their name, address, or Social Security number. This can lead to issues with tax reporting and identification.

-

Miscalculating Hours Worked: Employees often misreport the number of hours they have worked. This mistake can result in underpayment or overpayment, causing confusion and potential disputes with employers.

-

Neglecting to Update Tax Withholdings: Changes in marital status or dependents can affect tax withholdings. Failing to update this information can lead to incorrect deductions, impacting take-home pay.

-

Ignoring Deductions and Benefits: Some people overlook the deductions for health insurance, retirement contributions, or other benefits. Not understanding these deductions can lead to surprises when reviewing net pay.

-

Forgetting to Review Pay Stubs Regularly: Many individuals do not regularly check their pay stubs for accuracy. This oversight can result in missed errors that could have been corrected in a timely manner.

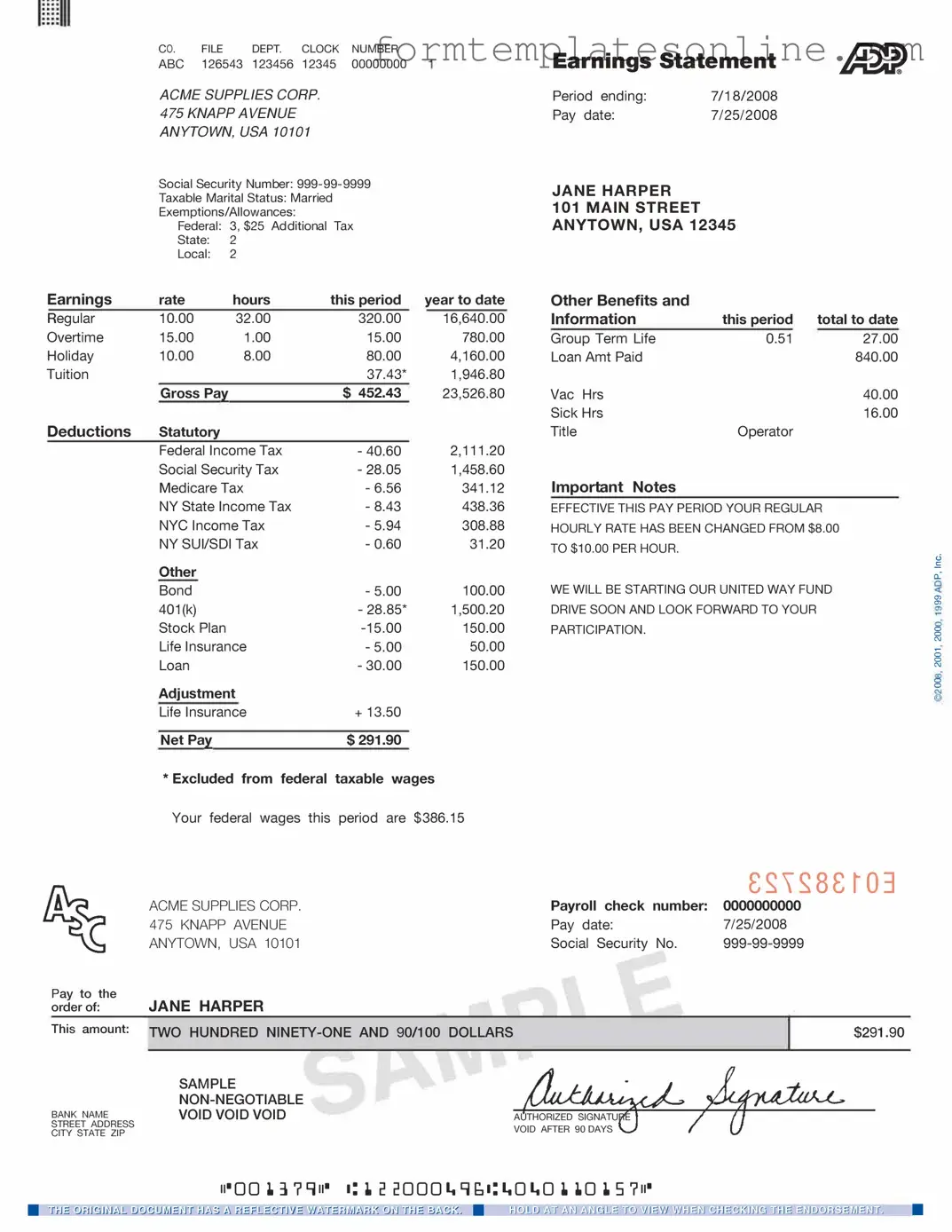

Example - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

More About Adp Pay Stub

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It typically includes details such as gross pay, deductions, and net pay, allowing employees to understand how their paycheck is calculated.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. If your employer uses ADP for payroll, you should have received login credentials. Simply visit the ADP website, enter your information, and navigate to the pay stub section to view or download your pay stubs.

What information is included on my ADP Pay Stub?

Your ADP Pay Stub will typically include your name, employee ID, pay period dates, gross earnings, various deductions (such as taxes and benefits), and your net pay. It may also show year-to-date totals for earnings and deductions, giving you a comprehensive overview of your financial status throughout the year.

Why is it important to review my ADP Pay Stub?

Reviewing your ADP Pay Stub is crucial for several reasons. It helps you verify that you are being paid correctly, ensures that all deductions are accurate, and allows you to track your earnings over time. If you notice any discrepancies, addressing them promptly can prevent larger issues down the line.

What should I do if I find an error on my ADP Pay Stub?

If you find an error, the first step is to contact your employer's payroll department. They can assist you in correcting the mistake. It's helpful to have specific details about the error ready when you reach out, such as the pay period in question and the exact nature of the discrepancy.

Can I receive my ADP Pay Stub electronically?

Yes, many employers offer electronic delivery of pay stubs through the ADP portal. This option is not only convenient but also environmentally friendly. You can choose to receive notifications via email when your pay stub is available, ensuring you never miss an update.

How long are ADP Pay Stubs available online?

Typically, ADP Pay Stubs remain accessible online for a specific period, often up to several years. However, this duration can vary based on your employer's policies. It's a good idea to download and save your pay stubs regularly for your records, especially for tax purposes.

What should I do if I forget my ADP login information?

If you forget your ADP login information, you can reset your password through the ADP portal. Look for the "Forgot Password" link on the login page. Follow the prompts to verify your identity and create a new password. If you encounter difficulties, your employer's HR department can assist you.

Is my ADP Pay Stub confidential?

Yes, your ADP Pay Stub contains sensitive information, including your earnings and personal details. It is essential to keep it confidential. Be cautious about sharing your login information and always log out of the ADP portal when you are finished to protect your data.

Key takeaways

Here are some key takeaways about filling out and using the ADP Pay Stub form:

- Ensure all personal information is accurate, including your name, address, and Social Security number.

- Review the pay period dates carefully to confirm that they match your work schedule.

- Understand the breakdown of earnings, including regular hours, overtime, and any bonuses.

- Check deductions for taxes, benefits, and any other withholdings to ensure they are correct.

- Keep a copy of your pay stub for your records, as it can be useful for tax purposes or loan applications.

- If discrepancies arise, contact your payroll department promptly to resolve any issues.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for a specific pay period. |

| Components | The form typically includes gross pay, net pay, tax withholdings, and deductions for benefits. |

| Frequency | Pay stubs are issued on a regular schedule, such as weekly, bi-weekly, or monthly, depending on the employer's payroll cycle. |

| Access | Employees can access their pay stubs electronically through the ADP portal or receive them in paper format, depending on company policy. |

| State-Specific Requirements | Some states require employers to provide specific information on pay stubs, such as hours worked or the pay rate. Check local laws for details. |

| Tax Information | The pay stub includes information on federal, state, and local taxes withheld from the employee's paycheck. |

| Record Keeping | Employees should keep their pay stubs for personal records and tax purposes, as they provide proof of income. |

| Errors | If there is an error on a pay stub, employees should report it to their HR or payroll department promptly for correction. |

| Legal Compliance | Employers must comply with federal and state laws regarding pay stub issuance and content. Non-compliance may result in penalties. |

Other PDF Forms

Intent to Lien Letter Template Free - Reinforces the professionalism of the service provider in communication.

Da - The form serves as an official record of the property distributed to each individual or unit.

Dos and Don'ts

When filling out the ADP Pay Stub form, it's important to approach the task with care. Here are some helpful guidelines to ensure accuracy and clarity.

- Do double-check your personal information for accuracy.

- Don't leave any required fields blank.

- Do use clear and legible handwriting if filling out the form by hand.

- Don't use any abbreviations that may confuse the reader.

- Do ensure that your pay period dates are correct.

- Don't forget to include any deductions or additional earnings.

- Do review the form for any errors before submission.

- Don't submit the form without a final check for completeness.

- Do keep a copy of the completed form for your records.

- Don't hesitate to ask for help if you're unsure about any part of the form.

Following these guidelines can help ensure that your ADP Pay Stub form is completed correctly and efficiently. Taking the time to do it right can prevent potential issues down the line.